The US Is Still Vexed By High Inflation

Aug 13, 2023 17:18:30 GMT -5

Post by J.J.Gibbs on Aug 13, 2023 17:18:30 GMT -5

The US Is Still Vexed By High Inflation

SUNDAY, AUG 13, 2023 - 05:45 PM

Authored by Jeffrey Tucker via The Epoch Times,

The inflationary mess is lasting even longer than I or anyone thought. Even the headlines couldn’t spin this one. The Consumer Price Index came out this morning and it showed no improvement over last month. It is still rocking at 3.2 percent with new strength in food and medicine.

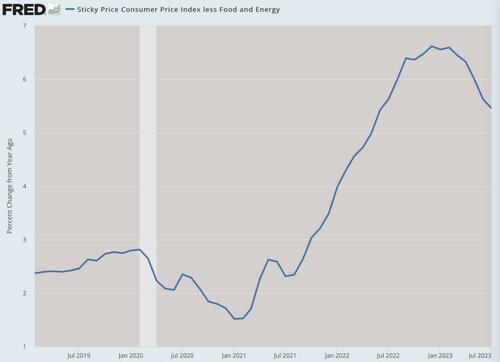

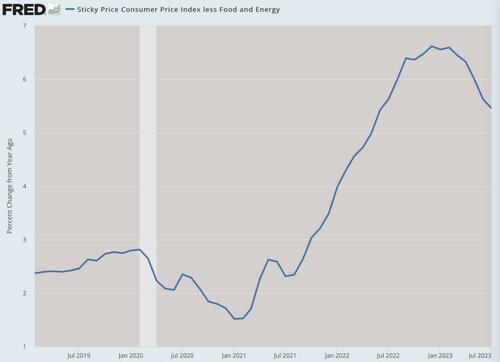

The sticky index is frustratingly high too at 5.4 percent.

(Data: Federal Reserve Economic Data [FRED], St. Louis Fed; Chart: Jeffrey A. Tucker)

Instead of following the script and reporting this as continued easing, the headlines were reduced to merely reporting the news: inflation is not improving. It’s the new normal.

It’s fascinating because this is now the 31st month after this “transitory” inflation began and nearly just as long since the Federal Reserve began its war on inflation by raising rates higher and faster than in the whole history of the institution. That said, in real terms, federal funds rates are still barely above zero. That’s because inflation is still rocking and eating away the dollar’s purchasing power.

The best you can say is that the dollar’s purchasing power is declining less rapidly than it was a year ago. But it is still declining, and missing the Fed’s target. Prices are nowhere near going back to 2019 levels but instead it all keeps getting worse. We have now lost 16 cents from its value at the start of Trump’s last year of his presidency. The mad money printing has taken a terrible toll. All of the value of the transfer payments from 2020 and 2021 have completely vanished.

(Data: Federal Reserve Economic Data [FRED], St. Louis Fed; Chart: Jeffrey A. Tucker)

This is all very interesting because the Fed has done everything it knows to do in order to bring this under control. Not that the Fed has ever admitted to having caused the problem in the first place by enabling an insane bout of Congressionally authorized spending. The Fed stood ready to sop up as much newly created debt as it could. In so doing, it triggered a complete mess.

The Fed’s clean-up operation has been fascinating to watch, like creating a fire in the kitchen and then demanding credit for one’s great clean-up skills. Worse, the clean-up has not really worked well. The money stock has indeed declined by 5.4 percent since the war on inflation commenced. But not even that has worked to tame the beast.

Let’s seek out an answer. There is always a lag between money and prices but it is 12 to 18 months, and we are really over that. We should be seeing a bigger impact. We should already have hit the target. But think about the old “equation of exchange” as pushed by monetary theorists for centuries. The impact of money on prices is mitigated by a concept called velocity.

Velocity is a measure of the pace at which money is spent. When people demand high dollar balances, the measure of velocity falls. This has always happened in a crisis. People get scared and hold on to cash. It happened at the start of the Great Depression. It happened in 2008. And it happened in 2020 but to the greatest extent we’ve ever seen. People were flush with cash and nothing on which to spend it, so we entered into a stage of negative velocity. The money truly ended up in metaphorical mattresses.

A decline in velocity provides room for the Fed to expand its open-market operations and expand credit through the banking system. A decline in velocity also allows the central bank to avoid the inflationary consequences of its policies.

The Fed, however, cannot control velocity. It is merely a measure of public psychology over risk and expectations. It neither causes high or low money-transmission rates but those rates profoundly affect the value of money.

As time has gone on, people and institutions have moved more money from cash balances into purchases. Velocity is on the move, exactly as one would expect. It’s inevitable.

The problem from the Fed’s point of view is that this pace at which money is spent is fueling price increases. And that change is blunting the impact of the pullback on money stocks.

(Data: Federal Reserve Economic Data [FRED], St. Louis Fed; Chart: Jeffrey A. Tucker)

There are of course a million other considerations to this big picture. But using a reductionist approach of a simple equation (in which money multiplied by velocity equals prices multiplied by output), you can see that there is plenty of room remaining for prices to go up and up.

In fact, if velocity continues to increase like this, we are looking at years of price increases at 3 percent and higher. And that is presuming no sudden surprises.

At the current pace of decline, we can expect the 2020 dollar to keep falling in value, so that it will be worth half its value by the time we reach the 2030s. Keep in mind that this is a tax that wrecks the standard of living of the middle class and the poor while enriching the people and institutions that can afford to endure the storm.

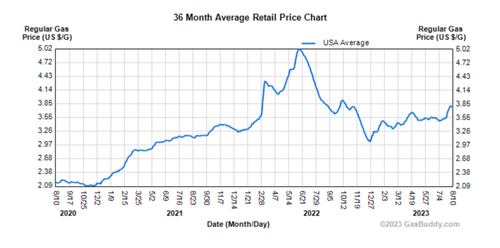

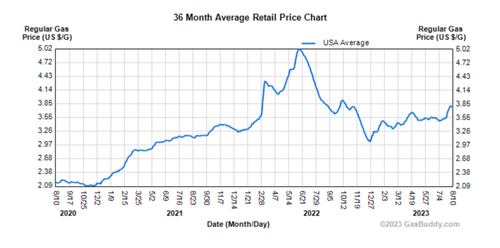

How used to all of this are you? Probably more than you should be. For example, are high gas prices making you as crazy now as they did two years ago? Probably not. That’s because you have been treated to the military concept of shock and awe. The idea is for the government to devastate you in one fell swoop and then let off a bit in order to make you grateful for the lessening of pain.

This is exactly what has happened to gas prices. In the long sweep, it has only increased in price but right now it feels not so bad. This is entirely in your head. The reality is that you are being pillaged.

Gas prices could eventually reach their old highs but by this time, you will have been so bruised and bloodied that you will be no longer screaming in pain. In short, our masters are trying to acculturate us to suffering so that we will no longer have the strength to protest.

This is how “transitory” became permanent and why an entire generation has already forgotten what it is like to live with falling prices in many sectors while incomes are steadily rising.

Those days seem to be gone. Our income is falling even as the thieves who took away our prosperity continue to masquerade as people we can trust to solve the problems that they created. It’s called monetary policy but it is an ancient ruse that still works in the 21st century.

link

SUNDAY, AUG 13, 2023 - 05:45 PM

Authored by Jeffrey Tucker via The Epoch Times,

The inflationary mess is lasting even longer than I or anyone thought. Even the headlines couldn’t spin this one. The Consumer Price Index came out this morning and it showed no improvement over last month. It is still rocking at 3.2 percent with new strength in food and medicine.

The sticky index is frustratingly high too at 5.4 percent.

(Data: Federal Reserve Economic Data [FRED], St. Louis Fed; Chart: Jeffrey A. Tucker)

Instead of following the script and reporting this as continued easing, the headlines were reduced to merely reporting the news: inflation is not improving. It’s the new normal.

It’s fascinating because this is now the 31st month after this “transitory” inflation began and nearly just as long since the Federal Reserve began its war on inflation by raising rates higher and faster than in the whole history of the institution. That said, in real terms, federal funds rates are still barely above zero. That’s because inflation is still rocking and eating away the dollar’s purchasing power.

The best you can say is that the dollar’s purchasing power is declining less rapidly than it was a year ago. But it is still declining, and missing the Fed’s target. Prices are nowhere near going back to 2019 levels but instead it all keeps getting worse. We have now lost 16 cents from its value at the start of Trump’s last year of his presidency. The mad money printing has taken a terrible toll. All of the value of the transfer payments from 2020 and 2021 have completely vanished.

(Data: Federal Reserve Economic Data [FRED], St. Louis Fed; Chart: Jeffrey A. Tucker)

This is all very interesting because the Fed has done everything it knows to do in order to bring this under control. Not that the Fed has ever admitted to having caused the problem in the first place by enabling an insane bout of Congressionally authorized spending. The Fed stood ready to sop up as much newly created debt as it could. In so doing, it triggered a complete mess.

The Fed’s clean-up operation has been fascinating to watch, like creating a fire in the kitchen and then demanding credit for one’s great clean-up skills. Worse, the clean-up has not really worked well. The money stock has indeed declined by 5.4 percent since the war on inflation commenced. But not even that has worked to tame the beast.

Let’s seek out an answer. There is always a lag between money and prices but it is 12 to 18 months, and we are really over that. We should be seeing a bigger impact. We should already have hit the target. But think about the old “equation of exchange” as pushed by monetary theorists for centuries. The impact of money on prices is mitigated by a concept called velocity.

Velocity is a measure of the pace at which money is spent. When people demand high dollar balances, the measure of velocity falls. This has always happened in a crisis. People get scared and hold on to cash. It happened at the start of the Great Depression. It happened in 2008. And it happened in 2020 but to the greatest extent we’ve ever seen. People were flush with cash and nothing on which to spend it, so we entered into a stage of negative velocity. The money truly ended up in metaphorical mattresses.

A decline in velocity provides room for the Fed to expand its open-market operations and expand credit through the banking system. A decline in velocity also allows the central bank to avoid the inflationary consequences of its policies.

The Fed, however, cannot control velocity. It is merely a measure of public psychology over risk and expectations. It neither causes high or low money-transmission rates but those rates profoundly affect the value of money.

As time has gone on, people and institutions have moved more money from cash balances into purchases. Velocity is on the move, exactly as one would expect. It’s inevitable.

The problem from the Fed’s point of view is that this pace at which money is spent is fueling price increases. And that change is blunting the impact of the pullback on money stocks.

(Data: Federal Reserve Economic Data [FRED], St. Louis Fed; Chart: Jeffrey A. Tucker)

There are of course a million other considerations to this big picture. But using a reductionist approach of a simple equation (in which money multiplied by velocity equals prices multiplied by output), you can see that there is plenty of room remaining for prices to go up and up.

In fact, if velocity continues to increase like this, we are looking at years of price increases at 3 percent and higher. And that is presuming no sudden surprises.

At the current pace of decline, we can expect the 2020 dollar to keep falling in value, so that it will be worth half its value by the time we reach the 2030s. Keep in mind that this is a tax that wrecks the standard of living of the middle class and the poor while enriching the people and institutions that can afford to endure the storm.

How used to all of this are you? Probably more than you should be. For example, are high gas prices making you as crazy now as they did two years ago? Probably not. That’s because you have been treated to the military concept of shock and awe. The idea is for the government to devastate you in one fell swoop and then let off a bit in order to make you grateful for the lessening of pain.

This is exactly what has happened to gas prices. In the long sweep, it has only increased in price but right now it feels not so bad. This is entirely in your head. The reality is that you are being pillaged.

Gas prices could eventually reach their old highs but by this time, you will have been so bruised and bloodied that you will be no longer screaming in pain. In short, our masters are trying to acculturate us to suffering so that we will no longer have the strength to protest.

This is how “transitory” became permanent and why an entire generation has already forgotten what it is like to live with falling prices in many sectors while incomes are steadily rising.

Those days seem to be gone. Our income is falling even as the thieves who took away our prosperity continue to masquerade as people we can trust to solve the problems that they created. It’s called monetary policy but it is an ancient ruse that still works in the 21st century.

link