All Roads Lead To Stagflation

Jun 9, 2024 20:04:16 GMT -5

Post by OmegaMan on Jun 9, 2024 20:04:16 GMT -5

All Roads Lead To Stagflation

BY THE MACRO BUTLER

SATURDAY, JUN 08, 2024 - 21:14

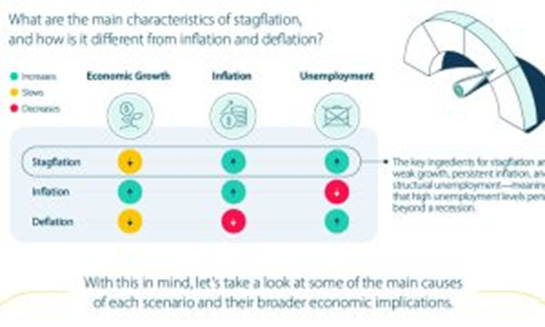

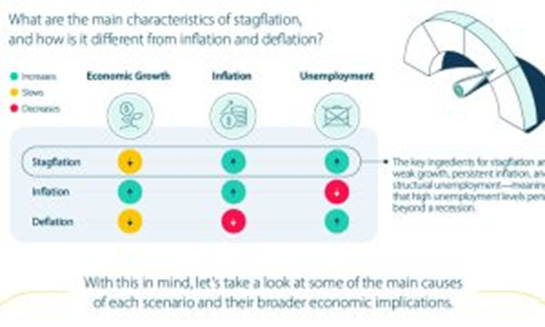

Most investors have a very hard time understanding the concept of inflation and often mistake stagflation for deflation, wondering why people are spending more on less. They only see prices of their daily grocery spending, not disposable income, and certainly not economic growth and unemployment. Looking back at the 1970s, prices rose sharply following the OPEC oil price hikes, but the sharp rise in energy costs crowded out other forms of spending. This resulted in rising prices that had nothing to do with a speculative economic expansion but rather a deflationary contraction. This phenomenon, called stagflation, occurred with rising prices and declining economic growth.

Stagflation explained:

On the campaign trail, Biden said that he will press corporations to raise wages and lower prices. It's a great plan in theory, but as always, it means absolutely nothing and illustrates that he has nothing to offer. Biden revealed his position that the government is never the problem. If you want to raise net disposable income, lower taxes! Raising wages, as he argues corporations should do, will push people into higher tax brackets, and soon, all the benefits will be countered by these socialistic programs. As always, nobody in government ever talks about reducing the size of government waste and corruption.

Deflation is not merely the lowering of prices; it is the reduction of economic activity that can also include stagflation, which occurs when prices rise but there is no economic growth. Stagflation is different from deflation, where the price of goods and services does decline. For example, prior to World War II, the US experienced a massive deflationary environment where GDP fell 30% between the crash of 1929 and 1933. A quarter of Americans were unemployed. Prices plummeted, and consumers were not spending because they had very little, if anything, to spend. Panics erupted, and people hoarded; the Second World War brought America out of that economic downfall. During periods of stagflation, the prices of goods and services increase while buying power decreases. Consumers end up spending more on less. As we are seeing now, retail sales on items such as clothing have declined, but people are spending more on gas and groceries. People feel as if they are earning less despite earning more because their buying power has been drastically reduced. Companies will suffer as consumers spend less, leading to workforce reductions. For example, during the OPEC crisis of the 1970s, unemployment rose to 7.2% by 1980. Inflation went from around 1% in 1964 to 14% in 1980, and GDP growth dropped from 5.8% to -0.3% during that same period. So, be very careful. As a consumer, if you only look at rising prices and ignore the fact that your disposable income is declining, you will be in for a very rude awakening.

Continued at link

BY THE MACRO BUTLER

SATURDAY, JUN 08, 2024 - 21:14

Most investors have a very hard time understanding the concept of inflation and often mistake stagflation for deflation, wondering why people are spending more on less. They only see prices of their daily grocery spending, not disposable income, and certainly not economic growth and unemployment. Looking back at the 1970s, prices rose sharply following the OPEC oil price hikes, but the sharp rise in energy costs crowded out other forms of spending. This resulted in rising prices that had nothing to do with a speculative economic expansion but rather a deflationary contraction. This phenomenon, called stagflation, occurred with rising prices and declining economic growth.

Stagflation explained:

On the campaign trail, Biden said that he will press corporations to raise wages and lower prices. It's a great plan in theory, but as always, it means absolutely nothing and illustrates that he has nothing to offer. Biden revealed his position that the government is never the problem. If you want to raise net disposable income, lower taxes! Raising wages, as he argues corporations should do, will push people into higher tax brackets, and soon, all the benefits will be countered by these socialistic programs. As always, nobody in government ever talks about reducing the size of government waste and corruption.

Deflation is not merely the lowering of prices; it is the reduction of economic activity that can also include stagflation, which occurs when prices rise but there is no economic growth. Stagflation is different from deflation, where the price of goods and services does decline. For example, prior to World War II, the US experienced a massive deflationary environment where GDP fell 30% between the crash of 1929 and 1933. A quarter of Americans were unemployed. Prices plummeted, and consumers were not spending because they had very little, if anything, to spend. Panics erupted, and people hoarded; the Second World War brought America out of that economic downfall. During periods of stagflation, the prices of goods and services increase while buying power decreases. Consumers end up spending more on less. As we are seeing now, retail sales on items such as clothing have declined, but people are spending more on gas and groceries. People feel as if they are earning less despite earning more because their buying power has been drastically reduced. Companies will suffer as consumers spend less, leading to workforce reductions. For example, during the OPEC crisis of the 1970s, unemployment rose to 7.2% by 1980. Inflation went from around 1% in 1964 to 14% in 1980, and GDP growth dropped from 5.8% to -0.3% during that same period. So, be very careful. As a consumer, if you only look at rising prices and ignore the fact that your disposable income is declining, you will be in for a very rude awakening.

Continued at link