EU To Impose Full Embargo On Russian Oil Next Week

Apr 19, 2022 15:27:18 GMT -5

Post by schwartzie on Apr 19, 2022 15:27:18 GMT -5

EU To Impose Full Embargo On Russian Oil Next Week, Will Send Price Above $185 According To JPMorgan

BY TYLER DURDEN

TUESDAY, APR 19, 2022 - 01:13 PM

Update (13:15 ET): What was largely a theoretical modeling exercise until moments ago, is set to go live because Reuters reports that the EU is set to declare a full embargo on Russian oil after this weekend's French election:

EU GAS PRICE TO SHOOT UP AS EU TO DECLARE EMBARGO ON RUSSIAN OIL AFTER FRENCH ELECTION NEXT WEEK - SOURCE

Why wait until after the election to launch the embargo? Simple: Europe's bureaucrats are correctly terrified that the coming oil price spike to push the vote in Le Pen's favor, which is why Europe will wait until after the election (when Macron will supposedly be the next president of France, as Belgium hopes) to announce it publicly.

More below (and in the full JPM report available to pro subs).

* * *

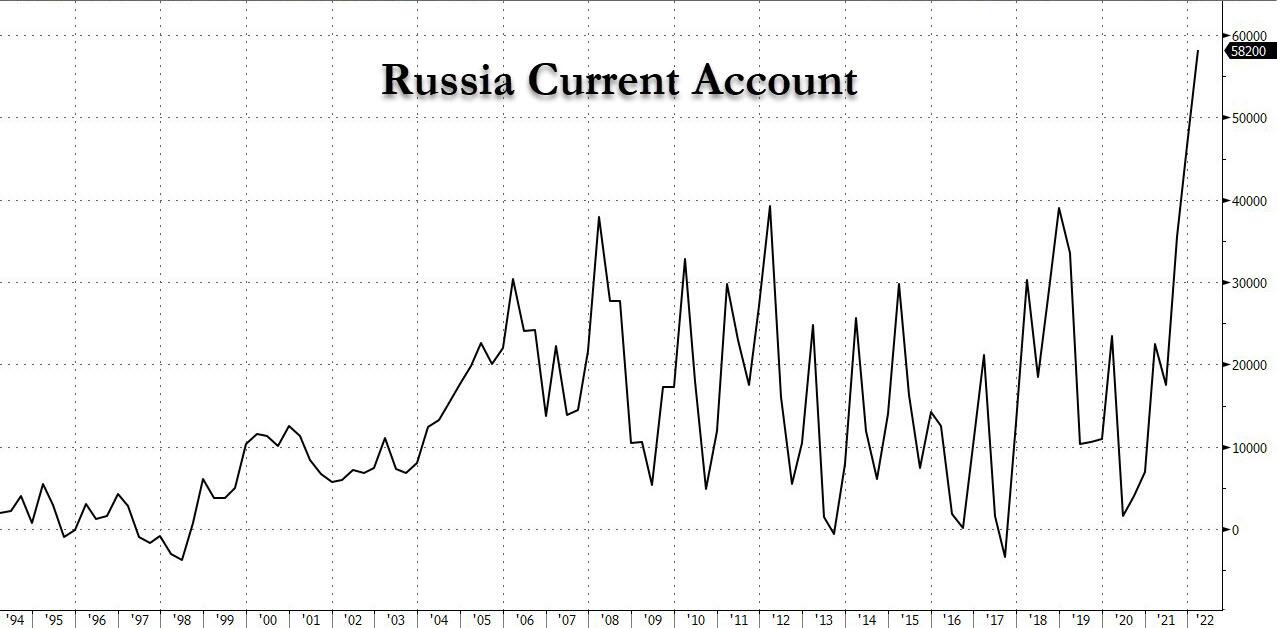

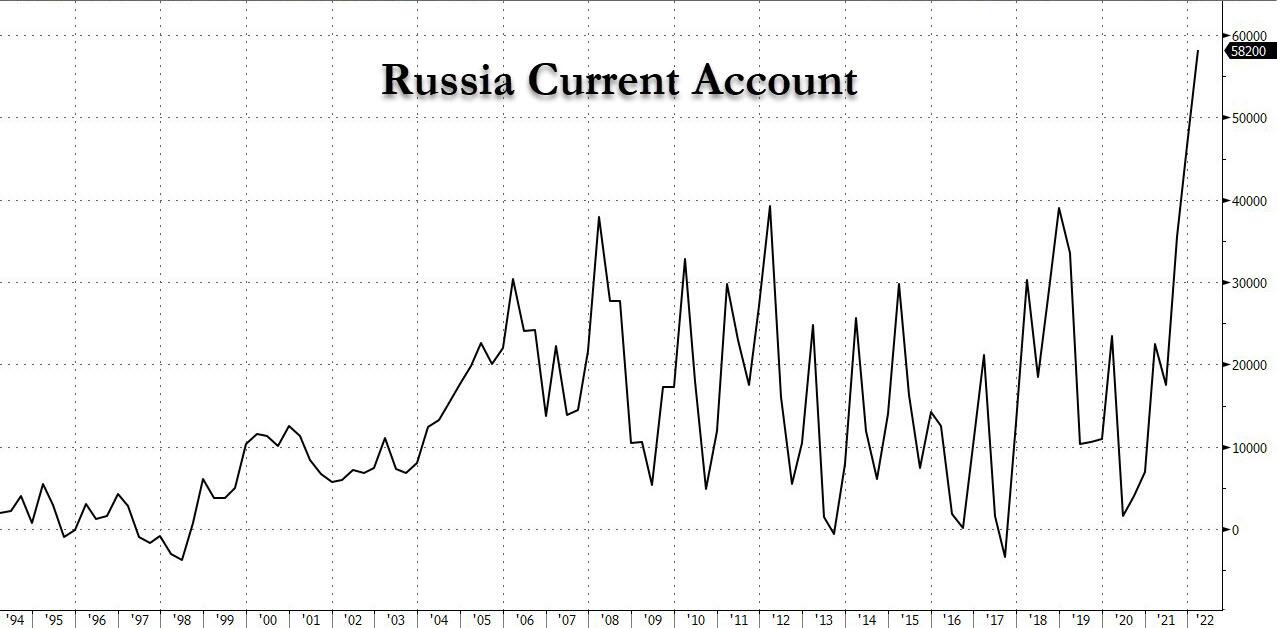

Despite the clear intentions of western government to cripple Russian energy production, loadings of Russian oil have so far been surprisingly resilient, so much so that Russia's current account balance is at all time highs.

According to JPMorgan, shipments in the seven days to April 16 hit 7.3 mbd, only 330 kbd below the 7.58 mbd averaged in

February before the start of the war. Remarkably, JPM calculates that Russian crude exports are averaging 360 kbd above pre-invasion volumes, while exports of oil products like fuel oil, naphtha, and VGO have declined by 700 kbd (full report available to pro subscribers in the usual place).

As previously observed, the decline in product exports combined with a 200 kbd drop in Russian domestic oil demand has resulted in Russian refineries cutting runs. The volume of refining cuts in April has risen to 1.3 mbd, almost 0.6 mbd above usual April maintenance. By late March, a sharp reduction in domestic refining throughput triggered production shut-ins.

With that in mind, JPM now estimates that Russian production shut-ins will amount to 1.5 mbd in April, vs its initial forecast of 2 mbd (the forecast of a 1 mbd loss of Russian exports for the rest of the year remains unchanged for now).

Underlying JPM's projection is the assumption that European buyers will cut their purchases of Russian oil by about 2.0-2.5 mbd by the end of the year and that Russia will be able to re-route only about 1 mbd out of that.

The three ways JPM gets to its 2.0-2.5 mbd estimate are:

Russian crude spot contracts account for about 1.8 mbd of total exports, while about 0.3 mbd of products are sold on spot terms, giving us a likely disruption of 2.1 mbd,

As of today, nine European countries plus the US, Canada and the UK have committed to cut their imports of Russian oil by ~2.1 mbd,

26 major European refiners and trading companies have suspended spot purchases or intend to phase out 2.1 mbd of Russian imports.

Continued at link

BY TYLER DURDEN

TUESDAY, APR 19, 2022 - 01:13 PM

Update (13:15 ET): What was largely a theoretical modeling exercise until moments ago, is set to go live because Reuters reports that the EU is set to declare a full embargo on Russian oil after this weekend's French election:

EU GAS PRICE TO SHOOT UP AS EU TO DECLARE EMBARGO ON RUSSIAN OIL AFTER FRENCH ELECTION NEXT WEEK - SOURCE

Why wait until after the election to launch the embargo? Simple: Europe's bureaucrats are correctly terrified that the coming oil price spike to push the vote in Le Pen's favor, which is why Europe will wait until after the election (when Macron will supposedly be the next president of France, as Belgium hopes) to announce it publicly.

More below (and in the full JPM report available to pro subs).

* * *

Despite the clear intentions of western government to cripple Russian energy production, loadings of Russian oil have so far been surprisingly resilient, so much so that Russia's current account balance is at all time highs.

According to JPMorgan, shipments in the seven days to April 16 hit 7.3 mbd, only 330 kbd below the 7.58 mbd averaged in

February before the start of the war. Remarkably, JPM calculates that Russian crude exports are averaging 360 kbd above pre-invasion volumes, while exports of oil products like fuel oil, naphtha, and VGO have declined by 700 kbd (full report available to pro subscribers in the usual place).

As previously observed, the decline in product exports combined with a 200 kbd drop in Russian domestic oil demand has resulted in Russian refineries cutting runs. The volume of refining cuts in April has risen to 1.3 mbd, almost 0.6 mbd above usual April maintenance. By late March, a sharp reduction in domestic refining throughput triggered production shut-ins.

With that in mind, JPM now estimates that Russian production shut-ins will amount to 1.5 mbd in April, vs its initial forecast of 2 mbd (the forecast of a 1 mbd loss of Russian exports for the rest of the year remains unchanged for now).

Underlying JPM's projection is the assumption that European buyers will cut their purchases of Russian oil by about 2.0-2.5 mbd by the end of the year and that Russia will be able to re-route only about 1 mbd out of that.

The three ways JPM gets to its 2.0-2.5 mbd estimate are:

Russian crude spot contracts account for about 1.8 mbd of total exports, while about 0.3 mbd of products are sold on spot terms, giving us a likely disruption of 2.1 mbd,

As of today, nine European countries plus the US, Canada and the UK have committed to cut their imports of Russian oil by ~2.1 mbd,

26 major European refiners and trading companies have suspended spot purchases or intend to phase out 2.1 mbd of Russian imports.

Continued at link