Why Food Inflation Is Only Getting Started

Jun 19, 2022 15:22:57 GMT -5

Post by J.J.Gibbs on Jun 19, 2022 15:22:57 GMT -5

Why Food Inflation Is Only Getting Started

BY CAPITALIST EXPLOITS

FRIDAY, JUN 17, 2022 - 13:49

Take a look at this:

Chart of Food Production vs Food Prices

The US has just experienced an 8.8% increase in food prices. The problem (and there are many, actually) is that this doesn’t take into account the spiraling costs farmers are now experiencing.

It’s worth remembering that because farmers pay upfront and only recoup their expenses at the point of sale/harvest months later, all the opex they’ve experienced has a lag.

This lag is dependent on produce but certainly, we’re looking at a tsunami of food inflation 12 to 18 months out.

Then there is the fuel and fertilizer. You’ll hopefully recall our bullish call on both fuel and fertilizer in order to play the entire food cost explosion that is now kicking off. Fuel and fertilizer together are the two largest input costs to farmers, typically exceeding in aggregate 50% of their total costs.

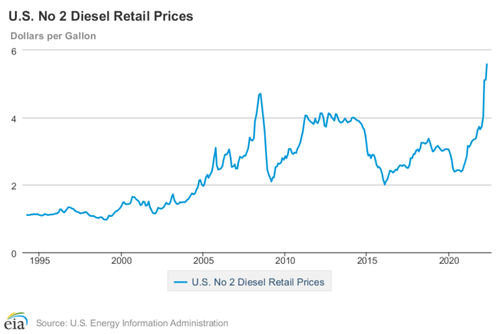

Here’s diesel:

U.S. No 2 Diesel Retail Prices 2022

Then we have fertilizer, itself a by-product of natural gas:

A chart of natural gas prices

Fertilizer has tripled and in some cases quadrupled. What are governments doing to “fix” this? Playing with interest rates. How cute!

Sticking with supply-side economics…

New Zealand to price sheep and cow burps to cut greenhouse gases

There is no question that we need to cut the amount of methane we are putting into the atmosphere, and an effective emissions pricing system for agriculture will play a key part in how we achieve that,” said James Shaw, climate change minister.

James, dear boy, you are either a complete abject moron or you are too cowardly to tell your handlers to go chew on thorns.

I won’t bore you with the details. It’s a tax. Surprise! A tax is administered to the most productive sector of the New Zealand economy.

When New Zealand can’t export the volumes of food it does, then it will quickly experience a widening trade deficit, weakening currency, and an explosion in the price of anything not domestically produced, which includes the coal it now imports (after shutting down natural gas facilities), diesel (which its farmers all use), and fertilizer (again, which its farmers use).

Quickly, New Zealand becomes less competitive on the global agricultural market. It’s just what’s going to happen. This isn’t some hypothetical situation. This is what happens. Watch!

What else?

If you price people out of the necessities of life, two things happen:

They become desperate, and

In desperation, they are susceptible and malleable to “solutions” which would have previously been out of the question.

When the World Economic Forum talks about eating bugs, they aren’t merely suggesting it in the sense that a company marketing a new product would. No. They are telling you.

There will be no choice since via a combination of supply destruction as New Zealand is showing, leading to higher costs and thus pricing more and more people out of the market so they can blame the price increases on the greedy farmers who are killing mother earth.

Think it makes no sense?

It doesn’t have to make any sense. What we learned over the last two years is that a never-ending stream of propaganda will lead the masses to demonize and ostracise those they are told to.

This time it isn’t 'the unvaccinated', though that will not go away. It is farmers. How dare they provide us with food?

And so it goes. Energy will be demonized. Hence the UK’s most recent 25% “windfall tax” on energy firms in the UK amidst the worst energy crisis of our lifetimes.

This just highlights the importance of why we spend so much energy and time attempting (not always getting it right, mind you) to invest not just in those sectors which benefit (energy and food), but doing so in jurisdictions where this murderous ideology isn’t gaining traction.

It also highlights the reason why we have a disproportionate amount of fertilizer stocks in our “ag” position.

Fertilizer companies can sell their product all over the world and are somewhat less constrained by local politics in any one place.

They are also, as we’ve pointed out many times before, like bloody firecrackers when they have a bull market.

link