The World Braces For Europe's July 22 "Doomsday"

Jul 13, 2022 0:34:55 GMT -5

Post by ShofarSoGood on Jul 13, 2022 0:34:55 GMT -5

The World Braces For Europe's July 22 "Doomsday"

BY TYLER DURDEN

TUESDAY, JUL 12, 2022 - 02:00 PM

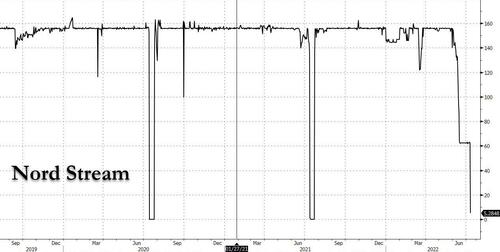

Two weeks ago, when previewing the scheduled 10-day shutdown of the Nord Stream 1 pipeline - which supplies the bulk of European nat gas usage courtesy of Russia - for maintenance, we quoted from DB FX strategist George Saravelos that if the gas shutoff is not resolved in coming weeks this would lead to a broadening out of energy disruption with material upfront effects on economic growth, and of course much higher inflation, or as he puts it, "beyond the market's worries about slower global growth in recent months, what is unfolding in Europe in recent days is a fresh big negative supply shock."

As such, DB's Jim Reid said that July 22, the day gas is supposed to come back online, could be the most important day of the year: "while we all spend most of our market time thinking about the Fed and a recession, I suspect what happens to Russian gas in H2 is potentially an even bigger story. Of course by July 22nd parts may have be found and the supply might start to normalize. Anyone who tells you they know what is going to happen here is guessing but as minimum it should be a huge focal point for everyone in markets."

Fast forward to today when, one day after the start of the scheduled 10-day shutdown period which has already sent flows through to NS 1 pipeline to basically zero...

... and the market is now focusing on the worst case scenario: what happens if Russia cuts off all gas on July 22, the day even Bloomberg has now dubbed Europe's "doomsday scenario."

Here is a sample of what Wall Street expects to happen then: European stocks plunging 20%. Junk credit spreads widening past 2020 crisis levels. The euro sinking to just 90 cents, before a full-blown recession slams the world's 2nd biggest economy.

And all this power in the palm of Putin's hand, almost as if he knew precisely how much leverage he had back in February while Europe was - as always - completely clueless.

So to help Europe's braindead bureaucrats, where energy policies have been dictated by a petulant Scandianvian teenager and a bunch of German "greens", strategists across Wall Street have tried to put numbers on a scenario that would be unthinkable in normal times. The caveat of course is that there are so many variables, such as the length of any shutdown, the extent of supply cuts, and how far countries would go to ration energy, that anyone’s prediction is a guess at best. Even so, the scenarios are catastrophic.

Continued at link