Chinese Banks Tumble, Swept Up In Mtg. Nonpayment Scandal

Jul 15, 2022 4:13:13 GMT -5

Post by Midnight on Jul 15, 2022 4:13:13 GMT -5

"The Damage Could Be Huge": Chinese Banks Tumble, Swept Up In Mortgage Nonpayment Scandal As Borrowers Revolt

BY TYLER DURDEN

THURSDAY, JUL 14, 2022 - 11:00 PM

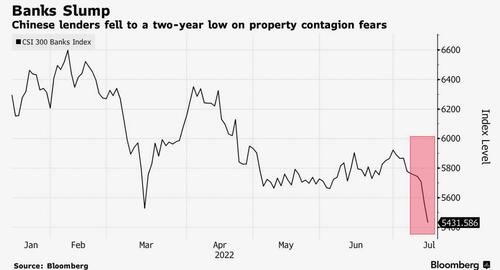

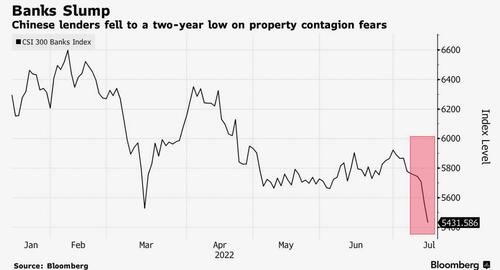

On Friday, shares of China’s banks extended their slide to a two-year low amid fears widespread mortgage non-payments would spark contagion within the banking sector (see "China On Verge Of Violent Debt Jubilee As "Disgruntled" Homebuyers Refuse To Pay Their Mortgages") even after the local banking and insurance regulator said it will maintain continuity and stability of financing policies for the real estate sector.

China Central Television said on its WeChat page that the regulator will guide financial institutions to participate in risk disposals based on market conditions, after researcher China Real Estate Information Corp. reported that home buyers had stopped mortgage payments on at least 100 projects in more than 50 cities as of Wednesday, spurring concerns that the quality of home loans is in rapid decline and could culminate in a 2007-like credit/housing bubble blow up.

Still, as Bloomberg Markets Live reporter Ye Xie writes, the grassroots movement of Chinese homebuyers boycotting mortgage payments isn’t exactly akin to the US subprime crisis of 2008. That said, no matter what Beijing does to address the latest chapter in China’s housing crisis drama, banks are likely to share the burden.

In the wake of a surging number of homebuyers who refuse to pay mortgages on construction projects that have stalled, China’s banking regulators said Thursday that they are coordinating with other agencies to support local governments in working to ensure the delivery of housing units. Separately, Bloomberg reported that policy makers held emergency meetings with banks to discuss the issue amid concern that it may worsen.

The boycotts raise the risk of mortgage defaults, a new set of troubles for banks that are already squeezed by exposure to ailing property developers. Mortgages make up almost 20% of total bank loans outstanding, amounting to about 39 trillion yuan ($5.8 trillion).

Continued at link

BY TYLER DURDEN

THURSDAY, JUL 14, 2022 - 11:00 PM

On Friday, shares of China’s banks extended their slide to a two-year low amid fears widespread mortgage non-payments would spark contagion within the banking sector (see "China On Verge Of Violent Debt Jubilee As "Disgruntled" Homebuyers Refuse To Pay Their Mortgages") even after the local banking and insurance regulator said it will maintain continuity and stability of financing policies for the real estate sector.

China Central Television said on its WeChat page that the regulator will guide financial institutions to participate in risk disposals based on market conditions, after researcher China Real Estate Information Corp. reported that home buyers had stopped mortgage payments on at least 100 projects in more than 50 cities as of Wednesday, spurring concerns that the quality of home loans is in rapid decline and could culminate in a 2007-like credit/housing bubble blow up.

Still, as Bloomberg Markets Live reporter Ye Xie writes, the grassroots movement of Chinese homebuyers boycotting mortgage payments isn’t exactly akin to the US subprime crisis of 2008. That said, no matter what Beijing does to address the latest chapter in China’s housing crisis drama, banks are likely to share the burden.

In the wake of a surging number of homebuyers who refuse to pay mortgages on construction projects that have stalled, China’s banking regulators said Thursday that they are coordinating with other agencies to support local governments in working to ensure the delivery of housing units. Separately, Bloomberg reported that policy makers held emergency meetings with banks to discuss the issue amid concern that it may worsen.

The boycotts raise the risk of mortgage defaults, a new set of troubles for banks that are already squeezed by exposure to ailing property developers. Mortgages make up almost 20% of total bank loans outstanding, amounting to about 39 trillion yuan ($5.8 trillion).

Continued at link