The Strangest Recession Of Our Lifetimes

Jul 16, 2022 17:11:07 GMT -5

Post by schwartzie on Jul 16, 2022 17:11:07 GMT -5

The Strangest Recession Of Our Lifetimes

SATURDAY, JUL 16, 2022 - 05:30 PM

Authored by Jeffrey Tucker via The Epoch Times,

The evidence of economic weakness and decline fill the headlines day by day, with major banks reporting lower earnings, big box stores with excess inventories, home sales skidding, and consumer sentiment crashing.

Meanwhile, inflation in all sectors is raging so high and hot that it has overtaken every other issue that polls say matter in the lives of average Americans.

This inflationary recession—also called stagflation—is an odd beast in any case. The combination of both purchasing power declines and falling productivity violates not only every modeling presumption made since the Keynesian revolution of the 1930s but also just plain intuition. Higher prices are supposed to signal higher demand and/or tighter supply, not lower demand and higher supply.

So yes, this is strange. We are going to have to get used to it. It’s what happens when the money itself loses its integrity. The whole point of money in the first place—the essence of its economic utility—is to provide a common tool of measurement to facilitate trade and enable accounting. Its emergence permits investors, producers, and capital owners to assess the economic rationality of their actions.

When money blows up and no longer serves as a reliable guide to economic realities, various degrees of chaos ensue. You can feel like you are getting richer when you are really getting poorer. What can seem like profits are really losses. What seems like a hopeful environment can quickly switch to the other direction and become despair.

This is why inflation induces such fear in every sector of life.

We learned this in the 1970s as stagflation gradually took over in successive waves until it was stopped in 1981 by two major shifts: tighter money and a policy emphasis on strong economic growth. Today we are getting the former but not the latter, virtually guaranteeing a serious quagmire that will last at least two more years. The economic damage of this period will be too enormous to contemplate.

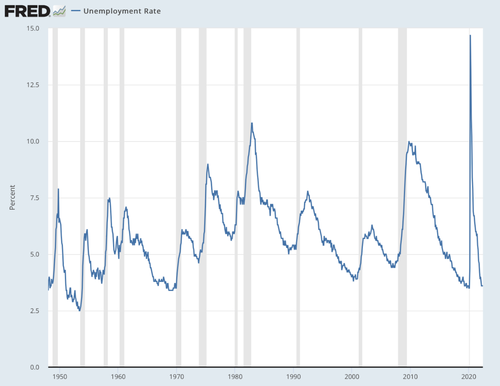

But let’s take a careful look at the strangest anomaly of all: the unemployment rate. It is historically low right now, at 3.6 percent. That is far lower than it has ever been during any impending recession. In fact, it is as low as any period since the end of World War II.

(Data: Federal Reserve Economic Data [FRED], St. Louis Fed; Chart: Jeffrey A. Tucker)

And yet, everyone knows that this is not a reason for hope: the labor participation rate is about where it was forty years ago, as if the whole experience of a more inclusive workforce never happened. It is also currently falling. There are reasons both demographic and cultural for this but it is impossible to understand without reference to the egregious and devastating effects of lockdowns.

Continued at link