The US Misery Index Worsens as Unchecked Bidenflation Grows

Jul 18, 2022 3:10:08 GMT -5

Post by ExquisiteGerbil on Jul 18, 2022 3:10:08 GMT -5

The U.S. Misery Index Worsens as Unchecked Bidenflation Grows

BY GWENDOLYN SIMS JUL 15, 2022 3:25 PM ET

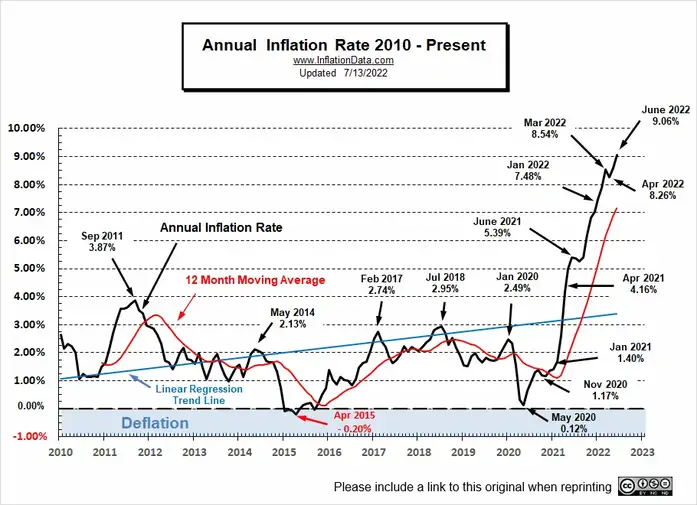

The U.S. government announced Wednesday that June’s federal inflation numbers increased to a staggering 9.06% — a 40-year high. According to the official Bureau of Labor Statistics (BLS) news release, inflation is being felt keenly and across the board:

The increase was broad-based, with the indexes for gasoline, shelter, and food being the largest contributors. The energy index rose 7.5 percent over the month and contributed nearly half of the all items increase, with the gasoline index rising 11.2 percent and the other major component indexes also

rising. The food index rose 1.0 percent in June, as did the food at home index.

The index for all items less food and energy rose 0.7 percent in June, after increasing 0.6 percent in the preceding two months. While almost all major component indexes increased over the month, the largest contributors were the indexes for shelter, used cars and trucks, medical care, motor vehicle insurance, and new vehicles. The indexes for motor vehicle repair, apparel, household furnishings and operations, and recreation also increased in June. Among the few major component indexes to decline in June were lodging away from home and airline fares.

From the updated BLS data, economists quantify the economic health of the country. To do so, they add the current U.S. unemployment rate, which is a stagnant 3.6%, to the current rate of U.S. inflation, which is a jarring 9.06%, to produce a snapshot of the country’s economy. The result is known as the U.S. Misery Index.

The current U.S. Misery Index stands at a very miserable 12.66%.

With inflation at record-high levels not seen since 1981, it follows that the Misery Index would also climb higher over last month’s levels, causing increases in basic necessities like food, shelter, and gasoline. In other words, American consumers are definitely feeling the pain of Bidenflation in their wallets with every purchase.

Current Inflation Chart

So what exactly does the Misery Index tell us? First, we know that as the rate of inflation grows, the cost of living increases. If the unemployment numbers also rise, more and more people fall into poverty. In theory, adding those two rates together gives us the Misery Index, which acts as a kind of snapshot in time gauging the health of the economy as a whole. In practice and since both unemployment and inflation significantly impact the average American wage earner’s spending power, the Misery Index also gauges how negatively impacted the quality of American life is by Bidenflation. To put it another way, as the Misery Index climbs, the quality of American life declines.

And, while not perfect, the Misery Index is a useful tool to gauge the ups and downs of the U.S. economy under the Biden-Harris administration’s ruinous economic policies. With the soaring cost of living, most Americans are being forced to tighten their belts by cutting back on everyday expenses like groceries, gasoline, and housing. Simply put, inflation decreases the purchasing power of consumers for all purchases, not just luxuries.

Continued at link

BY GWENDOLYN SIMS JUL 15, 2022 3:25 PM ET

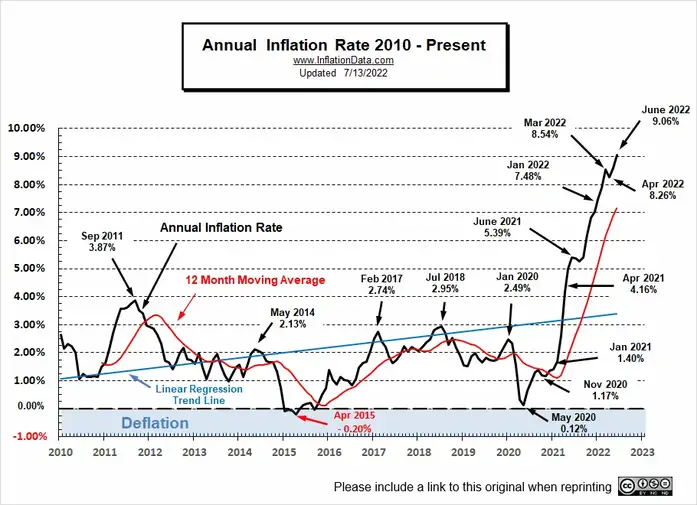

The U.S. government announced Wednesday that June’s federal inflation numbers increased to a staggering 9.06% — a 40-year high. According to the official Bureau of Labor Statistics (BLS) news release, inflation is being felt keenly and across the board:

The increase was broad-based, with the indexes for gasoline, shelter, and food being the largest contributors. The energy index rose 7.5 percent over the month and contributed nearly half of the all items increase, with the gasoline index rising 11.2 percent and the other major component indexes also

rising. The food index rose 1.0 percent in June, as did the food at home index.

The index for all items less food and energy rose 0.7 percent in June, after increasing 0.6 percent in the preceding two months. While almost all major component indexes increased over the month, the largest contributors were the indexes for shelter, used cars and trucks, medical care, motor vehicle insurance, and new vehicles. The indexes for motor vehicle repair, apparel, household furnishings and operations, and recreation also increased in June. Among the few major component indexes to decline in June were lodging away from home and airline fares.

From the updated BLS data, economists quantify the economic health of the country. To do so, they add the current U.S. unemployment rate, which is a stagnant 3.6%, to the current rate of U.S. inflation, which is a jarring 9.06%, to produce a snapshot of the country’s economy. The result is known as the U.S. Misery Index.

The current U.S. Misery Index stands at a very miserable 12.66%.

With inflation at record-high levels not seen since 1981, it follows that the Misery Index would also climb higher over last month’s levels, causing increases in basic necessities like food, shelter, and gasoline. In other words, American consumers are definitely feeling the pain of Bidenflation in their wallets with every purchase.

Current Inflation Chart

So what exactly does the Misery Index tell us? First, we know that as the rate of inflation grows, the cost of living increases. If the unemployment numbers also rise, more and more people fall into poverty. In theory, adding those two rates together gives us the Misery Index, which acts as a kind of snapshot in time gauging the health of the economy as a whole. In practice and since both unemployment and inflation significantly impact the average American wage earner’s spending power, the Misery Index also gauges how negatively impacted the quality of American life is by Bidenflation. To put it another way, as the Misery Index climbs, the quality of American life declines.

And, while not perfect, the Misery Index is a useful tool to gauge the ups and downs of the U.S. economy under the Biden-Harris administration’s ruinous economic policies. With the soaring cost of living, most Americans are being forced to tighten their belts by cutting back on everyday expenses like groceries, gasoline, and housing. Simply put, inflation decreases the purchasing power of consumers for all purchases, not just luxuries.

Continued at link