Avg American Needs Annual Wage Increase of $11,500 toKeep Up

Sept 23, 2022 2:17:06 GMT -5

Post by Midnight on Sept 23, 2022 2:17:06 GMT -5

BIDEN ECONOMY: Average American Needs Annual Wage Increase of $11,500 to Keep Up with Biden Inflation

By Joe Hoft

Published September 22, 2022 at 8:30pm

The Conservative Treehouse posted:

With most financial media being intentionally obtuse with the Biden economic impact upon Main Street, it is refreshing to see analysis that cuts to the heart of the matter. HatTip to ZeroHedge who provides a link to a great article outlining reality for blue and white-collar working families.

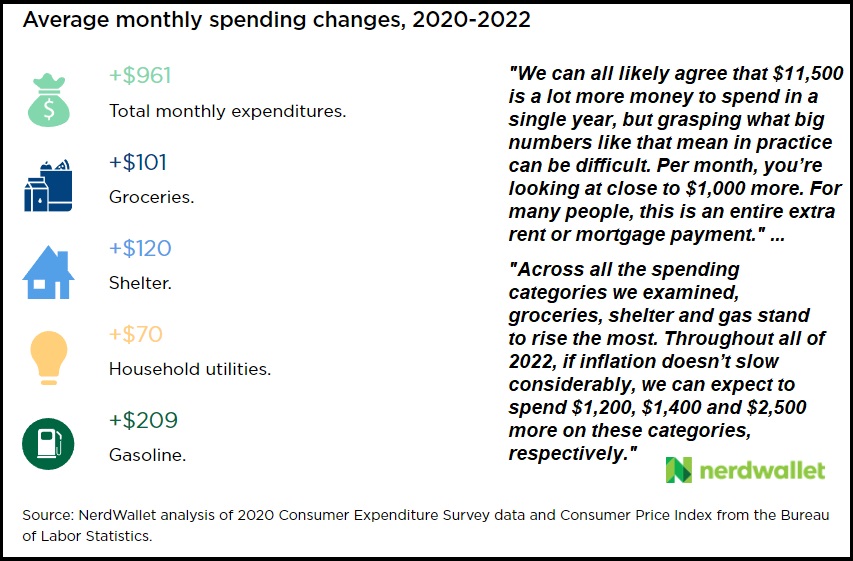

The folks at NerdWallet have taken the inflation date from the Bureau of Labor and Statistics (BLS) and applied the math to real life. The result is a good encapsulation of checkbook economics and how the Biden economy is painful for the working class.

TRENDING: HUGE: GOP Lawmaker Obtains New Documents that Show Joe and Hunter Biden Working to Sell US Natural Gas and Drilling Assets to China - HAS WHISTLEBLOWERS WHO WILL TESTIFY (VIDEO)

In total, Joe Biden’s energy policy driven inflation has added $961/month to preexisting expenses. That’s $11,532 a year just to retain the status quo standard of living.

We all see the massive inflation everywhere we go. Drive through any fast-food restaurant and you’ll find out that it will cost you your car for payment. Good luck walking home.

Nerdwallet shared this about the impact of inflation.

In all of 2020, American households spent $61,300, on average. This number includes everything we spend our money on: housing, food, entertainment, clothing, transportation and everything else. In 2022, it stands to reach $72,900, a difference of more than $11,500 if consumers want to maintain the same standard of living. Keep in mind, this is an average, a number that represents an approximation across all Americans, but one that’s exact to a very few. Those who earn (and therefore spend) more will see more dramatic dollar increases. Those who earn less may see less dramatic dollar jumps, but the impact of these rising prices could be more significantly felt.

It’s worth calling out — spending was a bit unusual in 2020. People spent less on commuting, child care and entertainment, for example, and more on home improvements. It’s a safe assumption that people will spend less in certain categories this year too, if for no other reason than avoiding high prices. This is primarily why we think spending in 2022 will be more similar to 2020 than 2019, for example, another year for which such spending data was available.

We can all likely agree that $11,500 is a lot more money to spend in a single year, but grasping what big numbers like that mean in practice can be difficult. Per month, you’re looking at close to $1,000 more. For many people, this is an entire extra rent or mortgage payment.

Americans are beginning to hate Biden if they don’t already.

link

By Joe Hoft

Published September 22, 2022 at 8:30pm

The Conservative Treehouse posted:

With most financial media being intentionally obtuse with the Biden economic impact upon Main Street, it is refreshing to see analysis that cuts to the heart of the matter. HatTip to ZeroHedge who provides a link to a great article outlining reality for blue and white-collar working families.

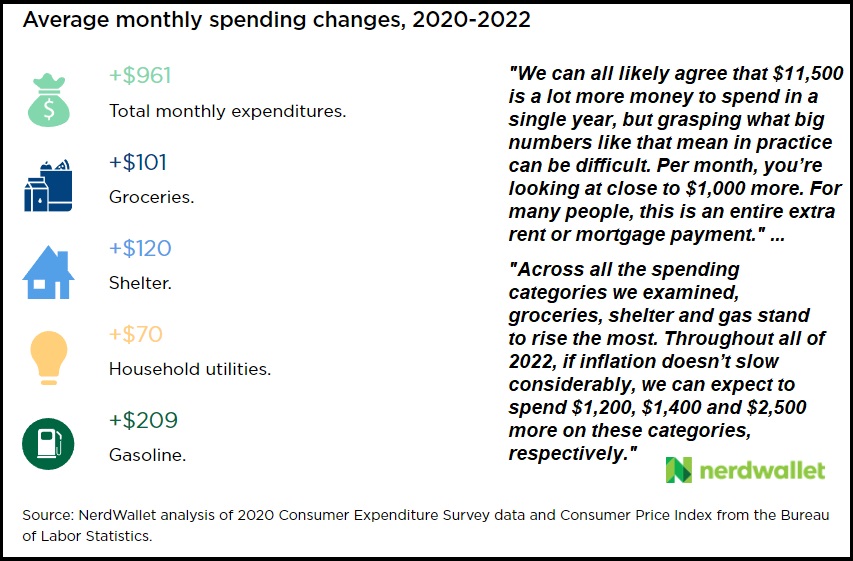

The folks at NerdWallet have taken the inflation date from the Bureau of Labor and Statistics (BLS) and applied the math to real life. The result is a good encapsulation of checkbook economics and how the Biden economy is painful for the working class.

TRENDING: HUGE: GOP Lawmaker Obtains New Documents that Show Joe and Hunter Biden Working to Sell US Natural Gas and Drilling Assets to China - HAS WHISTLEBLOWERS WHO WILL TESTIFY (VIDEO)

In total, Joe Biden’s energy policy driven inflation has added $961/month to preexisting expenses. That’s $11,532 a year just to retain the status quo standard of living.

We all see the massive inflation everywhere we go. Drive through any fast-food restaurant and you’ll find out that it will cost you your car for payment. Good luck walking home.

Nerdwallet shared this about the impact of inflation.

In all of 2020, American households spent $61,300, on average. This number includes everything we spend our money on: housing, food, entertainment, clothing, transportation and everything else. In 2022, it stands to reach $72,900, a difference of more than $11,500 if consumers want to maintain the same standard of living. Keep in mind, this is an average, a number that represents an approximation across all Americans, but one that’s exact to a very few. Those who earn (and therefore spend) more will see more dramatic dollar increases. Those who earn less may see less dramatic dollar jumps, but the impact of these rising prices could be more significantly felt.

It’s worth calling out — spending was a bit unusual in 2020. People spent less on commuting, child care and entertainment, for example, and more on home improvements. It’s a safe assumption that people will spend less in certain categories this year too, if for no other reason than avoiding high prices. This is primarily why we think spending in 2022 will be more similar to 2020 than 2019, for example, another year for which such spending data was available.

We can all likely agree that $11,500 is a lot more money to spend in a single year, but grasping what big numbers like that mean in practice can be difficult. Per month, you’re looking at close to $1,000 more. For many people, this is an entire extra rent or mortgage payment.

Americans are beginning to hate Biden if they don’t already.

link