|

|

Post by J.J.Gibbs on Nov 13, 2022 20:50:46 GMT -5

FTX CEO Sam Bankman-Fried Admits FTX Was a Crypto Laudromat for Ukrainian Government

The CEO of now-bankrupt FTX admitted that FTX was nothing more than a laundromat for the Ukrainian government.

Yesterday TGP reported that the now-bankrupt FTX was transferring money to Ukraine and then laundering money back from Ukraine to the Democrat party.

We’ve identified an interview where Bankman-Fried admitted that FTX was laundering money for the Ukrainian government.

All the money that the US sent to Ukraine over the past two decades needs to be audited and investigated.

How many billions of US dollars sent to Ukraine ended up back in the pockets of US politicians?FTX

|

|

|

|

Post by ExquisiteGerbil on Nov 13, 2022 23:47:14 GMT -5

"FTX Isn't The Canary In The Coal-Mine, FTX Is The Coal-Mine... & It Just Collapsed"

SUNDAY, NOV 13, 2022 - 11:00 PM Via SchiffGold.com, Bitcoin Hodlers: Time is Running Out to Convert Nothing into Something Three key takeaways: For weeks, the Bitcoin market has looked propped up by the whales, especially after the recent FTX disaster. Bitcoin hodlers should strongly consider moving into gold, silver, or at least Ether. Full disclosure, I have a complicated relationship with Crypto. An Artificial Market I have specifically avoided writing about Bitcoin despite having strong opinions on the subject. Bitcoin is a very hot topic, and most people have already made up their minds. In short, I think it has zero value but that argument has been made many times before so I couldn’t add anything new to the conversation. Full disclosure, I have been in the Crypto market since 2013 and am net positive. That said, given recent market events, I cannot sit by in good conscience without giving fair warning. This is not a Bitcoin is worthless analysis, this is a wake-up call to push people to ask what is keeping this market from imploding. FTX isn’t the canary in the coal mine (that was Celsius, or one of the other firms that crashed this year). FTX is the coal mine, and it just collapsed. I think the data shows that this market is being propped up by whales. If the dam breaks it could send markets crashing. Back on Oct 31, before anything happened with FTX, I texted a close friend: My new theory is that the whales are not trying to pump the price anymore. Instead, they are trying to stabilize the price to win back institutional investors. I have never seen bitcoin price volatility so low over a 6 month stretch in 10 years. It just totally stopped moving after an epic collapse back in June. No bounce, no continuation, no nothing. Just super tight price range even while the stock market has continued falling. I was led to this thinking after watching Bitcoin crash in June to ~19k and then just hold. It spent the next few months consolidating while the bond and stock markets went into turmoil. See the chart below with the simple price of SPY overlaid on top of Bitcoin since 2021. You may notice how steady the orange line has been since June 21, directly after the Bitcoin crash below $20k. Continued at link

|

|

|

|

Post by Midnight on Nov 14, 2022 4:02:20 GMT -5

Bahamas Police and Bahamas Securities Commission Looking into FTX Activities for Wrongdoing – Will They Find 10% to the Big Guy – Joe Biden?

By Joe Hoft Published November 13, 2022 at 7:30pm  Last night TGP reported that we have information that the tens of billions of dollars going to Ukraine were actually laundered back to the US to corrupt Democrats and elites using FTX cryptocurrency. Now the money is gone and FTX is bankrupt. As reported earlier, the FTX crypto company gave at least $40 million to Democrat candidates and causes in the midterms. Sam Bankman-Fried is Biden’s second biggest donor. The word is now out. The Democrats sent tens of billions to Ukraine and then laundered this money back to Democrat pockets and funds in the US. Now the company is bankrupt and the funds are nowhere to be found. Now it’s being reported that FTX is being investigated by the Bahamas police and the Bahamas Securities Commission for wrongdoing. Bloomberg shared: The Bahamian police said they’re working with the Bahamas Securities Commission to investigate whether there was any criminal misconduct in the collapse of the crypto exchange FTX. “In light of the collapse of FTX globally and the provisional liquidation of FTX Digital Markets Ltd., a team of financial investigators from the Financial Crimes Investigation Branch are working closely with the Bahamas Securities Commission to investigate if any criminal misconduct occurred,” a police spokesperson said in a statement Sunday. FTX is registered in the Bahamas. Will Joe or Hunter Biden be found to be connected? link

|

|

|

|

Post by maybetoday on Nov 14, 2022 21:28:40 GMT -5

Coincidence? Zelensky Calls for Peace Just Days After FTX Is Caught Funneling Millions of Ukrainian Aide Dollars to US Democrats

By Jim Hoft Published November 14, 2022 at 6:25pm The CEO of now-bankrupt FTX admitted that FTX was nothing more than a laundromat for the Ukrainian government. TGP previously reported that the now-bankrupt FTX was transferring international funding to FTX and then laundering money back from Ukraine to the Democrat Party. On Sunday The Gateway Pundit posted an interview where Bankman-Fried admitted that FTX was laundering money for the Ukrainian government. Bankman-Fried was the second largest donor for Democrats this last election cycle, only behind megadonor George Soros. Bankman Fried gave at least $38 million to $40 million to Democrats, leftist causes, PACs, and candidates, Fox News reported. Bankman-Fried floated the idea of spending upwards of $1 billion in the 2024 presidential election if Donald Trump is the Republican nominee. The billions of dollars that the US sent to Ukraine over the past two decades need to be audited and investigated. And, just like that… On Monday Ukrainian leader Volodymyr Zelensky called for peace with Russia. President Zelensky: “We are ready for peace, peace for our entire country.” Probably just a coincidence? It’s time for peace. link

|

|

|

|

Post by OmegaMan on Nov 15, 2022 23:50:07 GMT -5

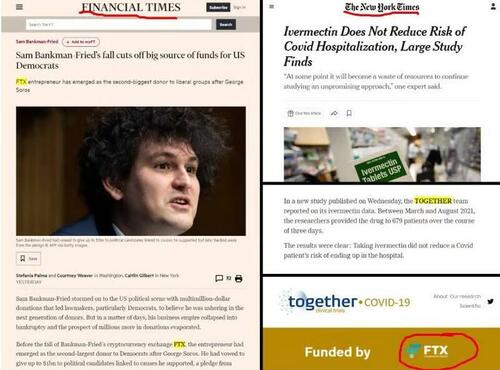

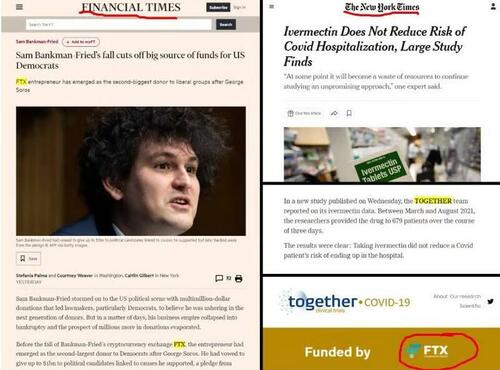

Deep state money supply: FTX, the collapsed crypto exchange, funded the “TOGETHER Trial” to discredit ivermectin

Tuesday, November 15, 2022 by: Ethan Huff Tags: conspiracy, corruption, COVID, crypto, cryptocurrency, deception, deep state, FTX, FTX Foundation, ivermectin, money supply, scamdemic, TOGETHER Trial This article may contain statements that reflect the opinion of the author (Natural News) Remember that infamous New England Journal of Medicine (NEJM) study that declared ivermectin to be an ineffective remedy against the Wuhan coronavirus (Covid-19)? It turns out that the now-defunct cryptocurrency exchange FTX helped pay for it. On May 16, the FTX Foundation issued a press release “proudly” announcing financial support for the “global expansion of the TOGETHER Trial,” as they called it, the lead investigators of which were awarded that very same day the prestigious Trial of the Year Award from the Society for Clinical Trials (SCT) in San Diego. “Each year the SCT presents one award for a randomized clinical trial published the previous year that best exemplifies five key criteria including improvements to humankind and provides a basis for substantial and beneficial changes to health care,” the press release states. “The TOGETHER Trial is the largest placebo-controlled COVID-19 trial and has, so far, evaluated 11 different treatments for COVID-19. On May 16, the TOGETHER trial receives the award and announces more than $18 million in funding and purchase commitments from the FTX Foundation that will enable the expansion of the trial from Brazil and Canada, to include experienced sites in South Africa, Rwanda, the Democratic Republic of the Congo, the Bahamas, Pakistan, Vietnam, and Ghana.” The press release goes on to feature quotes from several lead investigators as well as employees at the FTX Foundation, all of whom celebrated and praised each other for this “achievement”. (Related: Other research out of Brazil found that ivermectin helps reduce the risk of covid death by 92 percent.) Brighteon.TV Did FTX steal crypto investors’ money to fund corrupt studies like the TOGETHER Trial? David Henderson of EconLog critiqued the FTX-funded anti-ivermectin study and found that “it is not nearly as conclusive and persuasive as the two doctors’ quotes and other media coverage would lead us to believe.” It turns out trial participants actually did benefit from the use of ivermectin, which in many other countries is available as an over-the-counter medication similar to aspirin. Only in the United States and other heavily globalist-controlled countries is ivermectin prescription-only or not available at all due to political pressures. Henderson explains that the study’s methodology was flawed because prospective patients who were sick with covid and actually wanted ivermectin shied away from it because of the 50-50 chance that they would end up with a placebo instead. “Further, those who wanted ivermectin likely would have had a serious case of COVID; hence their desire for the drug,” he says. “Therefore, we can assume that the trial participants skewed toward those who considered themselves at low risk from the illness. This conflicts with the stated goal of the trial, which was to study high-risk patients.” None of this ended up mattering, though, as the globalists behind the TOGETHER Trial produced the results they wanted. And the FTX Foundation is a big reason why that happened, as the organization presumably stole crypto investors’ money to supply the cash needed to make it happen. Since we now know that FTX head Sam Bankman-Fried bilked investor cash to funnel it into Ukraine and ultimately the Biden regime and other Democrats, it is hardly a stretch to assume that the same criminality was used to fund this anti-ivermectin trial, and possibly other studies as well. “Criminal charges need to be brought to those responsible for shutting down doctors from helping their patients during the pandemic,” wrote a commenter about the anti-ivermectin agenda and everyone behind it, including Bankman-Fried and his FTX scam. More related news about the collapse of FTX and other criminality in the financial world can be found at Collapse.news. link

|

|

|

|

Post by schwartzie on Nov 16, 2022 14:00:38 GMT -5

BOMBSHELL REPORT: FTX Balance Sheet Contained Investment Called “TRUMPLOSE”

By Anthony Scott Published November 15, 2022 at 9:00am FTX’s collapse is one of the biggest financial scandals in the 21st century. As reported by the Gateway Pundit earlier, “tens of billions of dollars going to Ukraine were actually laundered back to the US to corrupt Democrats and elites using FTX cryptocurrency.” Now the Financial Times has been able to obtain a balance sheet of FTX and its contents are absolutely dark. The balance sheet revealed FTX had only “$900mn of assets it could easily sell, despite having $9bn of liabilities.” One of the most shocking revelations is that the balance sheet listed a $7 million dollar asset called “TRUMPLOSE”. CEO of Citadel Ken Griffin, has also taken a look at the FTX’s balance sheet and pointed out Sam Bankman-Fried’s “TRUMPLOSE” investment coupled with being the second largest Democrat donor was “ugly” WATCH: The Financial Times report called the TRUMPLOSE holding “obscure” and also noticed FTX had no bitcoin assets despite having Bitcoin liabilities of $1.4bn. The corporate media is ignoring these details but are instead commenting on Sam Bankman-Fried’s sleep schedule: link

|

|

|

|

Post by schwartzie on Nov 17, 2022 15:35:48 GMT -5

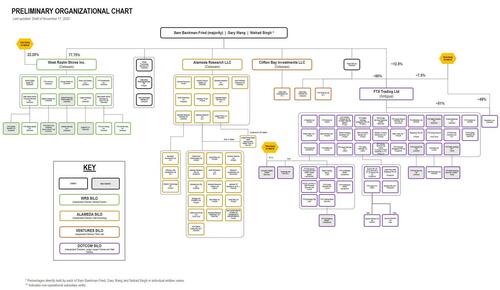

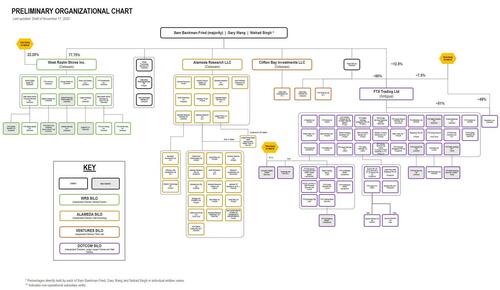

"This Is Unprecedented": Enron Liquidator Overseeing FTX Bankruptcy Speechless: "I Have Never Seen Anything Like This"

BY TYLER DURDEN THURSDAY, NOV 17, 2022 - 10:10 AM A few days ago we asked how much longer do we have to wait for the "first-day affidavit" in the FTX bankruptcy, traditionally the most detailed and comprehensive summary of how any given company collapsed into Chapter 11 (and in FTX's case, Chapter 7 soon, as this will soon become a full-blown liquidation)... ... and this morning we finally got our answer when it hit the docket (22-11068, U.S. Bankruptcy Court for the District of Delaware), almost a full week after FTX filed on Nov 11... and boy is it a doozy. Because how else would one describe it when FTX's new CEO and liquidator, John Ray III, who also oversaw the unwinding and liquidation of Enron, admits that "Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here." And just in case his shock at FTX's fraud of epic proportions was not quite clear enough, he adds that "from compromised systems integrity and faulty regulatory oversight abroad, to the concentration of control in the hands of a very small group of inexperienced, unsophisticated and potentially compromised individuals, this situation is unprecedented." Courtesy of the affidavit, here is what the company's org chart looks like as of Nov 17:  According to Ray, he has located “only a fraction” of the digital assets of the FTX Group that they hope recover during the Chapter 11 bankruptcy. They’ve so far secured about $740 million of cryptocurrency in offline cold wallets, a storage method designed to prevent hacks. This is just a fraction of the $10-$50 billion in liabilities the company disclosed in its bankruptcy filing. How do we know it's a fraud: as Ray writes on page 24, although the investigation has only begun and must run its course, it is my view based on the information obtained to date, "that many of the employees of the FTX Group, including some of its senior executives, were not aware of the shortfalls or potential commingling of digital assets." Many maybe not, but some - and certainly SBF himself - did. It gets better: Ray said that company’s audited financial statements should not be trusted, Ray said, adding that liquidators are working to rebuild balance sheets for FTX entities from the bottom up. FTX “did not maintain centralized control of its cash” and failed to keep an accurate list of bank accounts and account signatories, or pay sufficient attention to the creditworthiness of banking partners, according to Ray. Advisers don’t yet know how much cash FTX Group had when it filed for bankruptcy, but has found about $560 million attributable to various FTX entities so far. Although restructuring advisers have been in control of FTX for less than a week, they’ve seen enough to depict the crypto company as a deeply flawed enterprise. Lasting records of decision making are hard to come by: Bankman-Fried often communicated through applications that auto-deleted in short order and asked employees to do the same, according to Ray. Corporate funds of FTX Group were used to buy homes and other personal items for employees, Ray said. Corporate funds were also used to buy homes and other personal items for employees and advisers, sometimes in their personal names. "In the Bahamas, I understand that corporate funds of the FTX Group were used to purchase homes and other personal items for employees and advisors. I understand that there does not appear to be documentation for certain of these transactions as loans, and that certain real estate was recorded in the personal name of these employees and advisors on the records of the Bahamas," Ray said, who also noted that the company didn't have appropriate corporate governance and never held board meetings. There was no accurate list of bank accounts and account signatories, as well as insufficient attention paid to the creditworthiness of banking partners. Ray said the company did not have “an accurate list” of its own bank accounts, or even a complete record of the people who worked for FTX (see below). He added that FTX used “an unsecured group email account” to manage the security keys for its digital assets. The filing sheds light on the sloppy business practices, such as FTX employees asking to be paid through an online "chat" platform "where a disparate group of supervisors approved disbursements by responding with personalized emojis." Below we excerpt some of the most notable highlights from the affidavit, which we embed at the bottom of the post and which everyone should read to get a sense of just how massive Sam Bankman-Fried's fraud was. I have over 40 years of legal and restructuring experience. I have been the Chief Restructuring Officer or Chief Executive Officer in several of the largest corporate failures in history. I have supervised situations involving allegations of criminal activity and malfeasance (Enron). I have supervised situations involving novel financial structures (Enron and Residential Capital) and cross-border asset recovery and maximization (Nortel and Overseas Shipholding). Nearly every situation in which I have been involved has been characterized by defects of some sort in internal controls, regulatory compliance, human resources and systems integrity. Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here. From compromised systems integrity and faulty regulatory oversight abroad, to the concentration of control in the hands of a very small group of inexperienced, unsophisticated and potentially compromised individuals, this situation is unprecedented. For purposes of managing the Debtors’ affairs, I have identified four groups of businesses, which I refer to as “Silos.” These Silos include: (a) a group composed of Debtor West Realm Shires Inc. and its Debtor and non-Debtor subsidiaries (the “WRS Silo”), which includes the businesses known as “FTX US,” “LedgerX,” “FTX US Derivatives,” “FTX US Capital Markets,” and “Embed Clearing,” among other businesses; (b) a group composed of Debtor Alameda Research LLC and its Debtor subsidiaries (the “Alameda Silo”); (c) a group composed of Debtor Clifton Bay Investments LLC, Debtor Clifton Bay Investments Ltd., Debtor Island Bay Ventures Inc. and Debtor FTX Ventures Ltd. (the “Ventures Silo”); (d) a group composed of Debtor FTX Trading Ltd. and its Debtor and non-Debtor subsidiaries (the “Dotcom Silo”), including the exchanges doing business as “FTX.com” and similar exchanges in non-U.S. jurisdictions. These Silos together are referred to by me as the “FTX Group. Each of the Silos was controlled by Mr. Bankman-Fried.2 Minority equity interests in the Silos were held by Zixiao “Gary” Wang and Nishad Singh, the co-founders of the business along with Mr. Bankman-Fried. The WRS Silo and Dotcom Silo also have third party equity investors, including investment funds, endowments, sovereign wealth funds and families. To my knowledge, no single investor other than the co-founders owns more than 2% of the equity of any Silo. The diagram attached as Exhibit A provides a visual summary of the Silos and the indicative assets in each Silo. Exhibit B contains a preliminary corporate structure chart. These materials were prepared at my direction based on information available at this time and are subject to revision as our investigation into the affairs of the FTX Group continues. Continued at link

|

|

|

|

Post by shalom on Nov 17, 2022 18:26:09 GMT -5

Bombshell court filing claims Bahamas GOVERNMENT ordered fallen crypto CEO Sam Bankman-Fried to hack FTX systems and transfer assets to the island nation AFTER he filed for bankruptcy

Sam Bankman-Fried was allegedly directed by Bahamas regulators to gain unauthorized access to his collapsed crypto platform after quitting as CEO FTX made the bombshell claims in an emergency legal filing in the US Bankruptcy Court in Delaware on Thursday Bankman-Fried was accused of 'hacking' FTX systems to transfer digital assets to Bahamas government while he was 'effectively in custody' SEC chair Gary Gensler is now under scrutiny over his failure to prevent the implosion of FTX The crypto platform's new CEO John J. Ray III, a veteran lawyer guiding the company through its bankruptcy, said the situation at FTX was 'unprecedented' By EMMA JAMES FOR DAILYMAIL.COM PUBLISHED: 15:52 EST, 17 November 2022 | UPDATED: 17:42 EST, 17 November 2022e-mail The collapsed cryptocurrency exchange platform FTX claims former CEO Sam Bankman-Fried 'hacked' its systems after filing for bankruptcy to transfer 'digital assets' to Bahamian regulators. FTX lodged the motion in the US Bankruptcy Court in Delaware on Thursday saying it had evidence to suggest the Bahamas government ordered Bankman-Fried, 30, to gain 'unauthorized access' while in custody. 'In connection with investigating a hack on Sunday, November 13, Mr. Bankman-Fried and [FTX co-founder Gary] Wang, stated in recorded and verified texts that 'Bahamas regulators' instructed that certain post-petition transfers of Debtor assets be made by Mr. Wang and Mr. Bankman-Fried (who the Debtors understand were both effectively in the custody of Bahamas authorities) and that such assets were 'custodied on FireBlocks under control of Bahamian gov't,' the filing states. 'The Debtors thus have credible evidence that the Bahamian government is responsible for directing unauthorized access to the Debtors' systems for the purpose of obtaining digital assets of the Debtors—that took place after the commencement of these cases.' FTX, which is based in the Bahamas due to is relaxed tax laws, collapsed on November 11 in a scandal that has cost its investors more than $11billion. Continued at link

|

|

|

|

Post by maybetoday on Nov 17, 2022 20:28:13 GMT -5

Disgraced FTX Founder Donated To Six RINOs Who Voted To Impeach Trump

By Anthony Scott Published November 17, 2022 at 4:55pm As most are well aware by now, the disgraced founder of FTX Sam Bankman-Fried was the Democrat party’s second-largest donor just behind George Soros. As reported by The Gateway Pundit, in the 2020 presidential election, Bankman-Fried dished millions to the Biden campaign and followed it up by handing out over $40 million dollars to democrats in the 2022 primaries and midterms. Forbes reported last year that Bankman-Fried also donated to six RINOs who voted to impeach President Trump. Forbes reported : Since July, Bankman-Fried has made $5,800 contributions, the maximum individuals can give directly to Congressional campaigns, to the committees of Bill Cassidy (R-La.), Susan Collins (R-Maine), Lisa Murkowski (R-Alaska), Ben Sasse (R-Neb.), Mitt Romney (R-Utah) and Richard Burr, the North Carolina Republican who announced plans to retire at the end of his term in 2023. As previously reported, Bankman-Fried’s balance sheet contained an asset worth over $7 million called “TrumpLose.” link

|

|

|

|

Post by OmegaMan on Nov 17, 2022 21:16:23 GMT -5

FTX founder Sam Bankman-Fried puts up Bahamas penthouse for sale at $40M

Thursday, November 17, 2022 by: Kevin Hughes Tags: Alameda Research, Bahamas, bankruptcy, Bubble, Caroline Ellison, Collapse, crypto exchange, cryptocurrency, debt bomb, debt collapse, FTX, liquidity, market crash, money supply, penthouse, property sale, Real Estate, risk, Sam Bankman-Fried This article may contain statements that reflect the opinion of the author (Natural News) Sam Bankman-Fried, the founder of beleaguered cryptocurrency exchange company FTX, has put up his penthouse in the Bahamas for sale with a $40 million price tag. According to a report by Semafor, the 12,000 square-foot residence located in the Albany luxury resort community was recently listed for sale. While the realtor in charge refused to name Bankman-Fried, insider sources verified that it was indeed the residence of the disgraced crypto bigwig. The property designed by Morris Ajmi Architects is priced at $39,950,000 with an extra $21,000 in maintenance fees. The new buyer is set to enjoy its five bedrooms and master suite with walk-in closets. The residence also comes adorned with Venetian plaster walls with corresponding Italian marble accents. Amenities that await the new buyer also include an LED lighting system, a private garage, a private balcony with a lounge and spa area, grand living room with an open dining area and outdoor pool and a family entertainment room. The new owner is also set to enjoy its kitchen with a distinct bar and an outdoor BBQ nook with seating. FTX insiders disclosed to the New York Post that all of the crypto firm’s executives own houses in the resort. These houses are all located in the Albany Club, the most private resort community in the Bahamas that includes Justin Timberlake and Tiger Woods as members. It remains unclear, however, if the other FTX executives will divest ownership of these properties in the coming days. Moreover, Bankman-Fried lived with eight housemates – most of them former classmates and former colleagues – at the $40 million penthouse. These housemates included his former girlfriend Caroline Ellison, and most probably FTX co-founder Gary Want and Nishad Singh, FTX’s director of engineering. Brighteon.TV Following FTX’s bankruptcy filing on Nov. 11, Bankman-Fried had been considering the liquidation of his other assets in the past days. The 30-year-old former FTX CEO stated he was at the Bahamas over the weekend, though he did not clarify if the trip was connected to the property’s eventual sale. Penthouse sale follows FTX liquidity turmoil FTX filed for bankruptcy amid traders hurriedly withdrawing $6 billion worth of crypto tokens from the platform in a span of three days, triggering a liquidity problem. Subsequent reports revealed that FTX’s issues with liquidity had been fueled by its unauthorized reallocation of customer assets to prop up Alameda Research, which was headed by Ellison. The trading company headed by Bankman-Fried’s former partner had incurred huge losses in mid-2022. (Related: CRYPTO CARNAGE: Bankman-Fried ‘lent’ billions in customer funds to his trading firm, setting the stage for implosion.) Customer assets sent by FTX to Alameda Research allegedly vanished, but it was able to conceal this loss as the assets it collected never affected its own balance sheet. One source put the missing money at about $1.7 billion. Another source seconded this estimate, putting the value between $1 billion and $2 billion. Damien Michelmore, Albany Club general manager, informed residents of FTX’s bankruptcy filing through an email. He also instructed residents not to speak to the media. “Out of respect we offer to all homeowners and members, we have instructed our employees to not speak to the press, and we respectfully ask fellow members and homeowners to also not provide any comments at this time,” Michelmore said. Follow MoneySupply.news for more news about FTX and other cryptocurrency platforms. Watch this video that explains what the media won’t talk about Sam Bankman-Fried and FTX. www.brighteon.com/1fcbeed7-e496-413c-b4af-a34b1cd2e3fblink

|

|

|

|

Post by Midnight on Nov 18, 2022 3:50:14 GMT -5

Disgraced FTX Founder Donated To Six RINOs Who Voted To Impeach Trump

By Anthony Scott Published November 17, 2022 at 4:55pm As most are well aware by now, the disgraced founder of FTX Sam Bankman-Fried was the Democrat party’s second-largest donor just behind George Soros. As reported by The Gateway Pundit, in the 2020 presidential election, Bankman-Fried dished millions to the Biden campaign and followed it up by handing out over $40 million dollars to democrats in the 2022 primaries and midterms. Forbes reported last year that Bankman-Fried also donated to six RINOs who voted to impeach President Trump. Forbes reported : Since July, Bankman-Fried has made $5,800 contributions, the maximum individuals can give directly to Congressional campaigns, to the committees of Bill Cassidy (R-La.), Susan Collins (R-Maine), Lisa Murkowski (R-Alaska), Ben Sasse (R-Neb.), Mitt Romney (R-Utah) and Richard Burr, the North Carolina Republican who announced plans to retire at the end of his term in 2023. As previously reported, Bankman-Fried’s balance sheet contained an asset worth over $7 million called “TrumpLose.” CEO of Citadel Ken Griffin, has also taken a look at the FTX’s balance sheet and pointed out Sam Bankman-Fried’s “TRUMPLOSE” investment coupled with being the second largest Democrat donor was “ugly.” link

|

|

|

|

Post by Midnight on Nov 18, 2022 3:52:59 GMT -5

Democrat Maxine Waters Blew FTX Founder A Kiss Last Year – Will Now Lead Investigation Into FTX’s Collapse

By Anthony Scott Published November 17, 2022 at 7:20pm A video from December 2021 resurfaced showing Democrat Rep. Maxine Waters (CA) blowing a kiss to FTX founder Sam Bankman-Fried. Last year FTX founder Sam Bankman-Fried and five other cryptocurrency exchange executives testified before The House Financial Services Committee which is chaired by Maxine Waters. While Bankman-Fried was leaving the hearing Maxine Waters blew a kiss to the mega-Democrat donor. WATCH: Rep. Maxine Waters this week announced a bipartisan investigation into FTX. “Today, the Chairwoman of the House Financial Services Committee, Congresswoman Maxine Waters (D-CA), and the Ranking Member of the House Financial Services Committee, Congressman Patrick McHenry (R-NC), announced a bipartisan hearing into the collapse of FTX and the broader consequences for the digital asset ecosystem. In December, the Committee expects to hear from the companies and individuals involved, including Sam Bankman-Fried, Alameda Research, Binance, FTX, and related entities, among others.” The House Committee on Financial Services announced this week. “The fall of FTX has posed tremendous harm to over one million users, many of whom were everyday people who invested their hard-earned savings into the FTX cryptocurrency exchange, only to watch it all disappear within a matter of seconds. Unfortunately, this event is just one out of many examples of cryptocurrency platforms that have collapsed just this past year. That’s why it is with great urgency that I, along with my colleague Ranking Member McHenry, announce the Committee’s intention to hold a hearing to investigate the collapse of FTX,” said Chairwoman Waters. “As Chairwoman of the Financial Services Committee, I have led the effort in examining and investigating the digital assets marketplace, and know that we need legislative action to ensure that digital assets entities cannot operate in the shadows outside of robust federal oversight and clear rules of the road. I look forward to holding this important hearing, and uncovering all that Congress must do to ensure this never happens again.” link

|

|

|

|

Post by schwartzie on Nov 18, 2022 14:37:10 GMT -5

Waters: ‘I Possibly Could’ Recommend Politicians Return FTX Donations

IAN HANCHETT 17 Nov 2022 On Thursday’s broadcast of CNBC’s “Closing Bell,” House Financial Services Committee Chair Rep. Maxine Waters (D-CA) said it’s up to individuals if they return campaign donations from former FTX CEO Sam Bankman-Fried and she “possibly could” advocate people return the money if they don’t “feel comfortable” keeping the money. Host Sara Eisen asked, “He gave $500,000 to the Democratic National Committee. And we just showed a number of your colleagues on the House Financial Services Committee that took donations from him. Should the DNC and your fellow lawmakers return that money?” Waters answered, “Well, usually, that’s up to individuals about whether or not they return contributions that have been made. We have seen instances in the past where many members return contributions that they discovered had some fault, that they didn’t want to be blamed for having taken that contribution. And so, we don’t know what is going to happen with the return of contributions by Democrats or Republicans. But as we move forward with the hearings, we’ll learn an awful lot more.” Eisen followed up, “They appear to be ill-gotten gains. So, it sounds like you would suggest that, if the investigations find that, you would advocate for returning that money?” Waters responded, “I possibly could do that. I could certainly say to members, if you thought that this was the kind of contribution that you would feel proud of, then fine. But if you know there’s new information that leads you to understand that perhaps you do not feel comfortable now that you know these cryptocurrency companies, particularly FTX, have given contributions in spite of the fact that they have undermined consumers in the way that they have committed fraud, I would say you might want to do that, you might want to give that back.” link

|

|

|

|

Post by ExquisiteGerbil on Nov 18, 2022 15:12:41 GMT -5

The Five Wildest Things in the FTX Bankruptcy Filing

ALANA MASTRANGELO 18 Nov 2022 The new CEO of FTX, John Ray, III, revealed several wild and shocking items found in the collapsed company’s bankruptcy filing, which include the founder and former CEO Sam Bankman-Fried lending himself $1 billion, and FTX corporate funds being used to buy personal homes, among other things. Here are five of the wildest things found in FTX’s bankruptcy filing, according to a report by Market Watch. 1. FTX lent billions of dollars in customer funds to Bankman-Fried’s hedge fund, Alameda Research. Alameda Research reportedly loaned just over $4 billion out to Bankman-Fried and his closest business partners. On Thursday Ray revealed that Alameda had made $4.1 billion of related-party loans, which remained outstanding at the end of September. Among these loans included a staggering $1 billion loan made to Bankman-Fried himself, as well as a $543 million loan made to FTX co-founder Nishad Singh, and $55 million to co-CEO Ryan Salame. 2. FTX corporate funds were used to buy homes and “personal items” for executives. Bankman-Fried was living in a penthouse located in a luxury resort in the Bahamas, where FTX was also based. There, corporate FTX funds “were used to purchase homes and other personal items for employees and advisors,” according to bankruptcy filings. Ray also noted that there is no documentation for transactions and loans regarding these real estate purchases, and that they were recorded in the personal name of employees and advisors. Bankman-Fried has since put his 12,000-square ft. penthouse in the Bahamas up for sale for nearly $40 million. 3. Expenses approved by emoji. Ray also said that FTX employees “submitted payment requests through an online ‘chat’ platform where a disparate group of supervisors approved disbursements by responding with personalized emojis.” 4. Auditors living in the metaverse. The new FTX CEO revealed that Bankman-Fried secured audit opinions for the company’s international trading platform from Prager Metis, a firm that Ray had never heard of before. When Ray went to Prager Metis’ website to learn more about the company, he found that it describes itself as the “first-ever CPA firm to officially open its Metaverse headquarters in the metaverse platform Decentraland,” he said. 5. Most digital assets “owned” by FTX have not been secured Ray said that as of Thursday, he has only been able to locate and secure just “a fraction of the digital assets” he hoped to recover from the various FTX trading and exchange platforms and Alameda Research. The new FTX CEO added that only some $740 million of cryptocurrency has been secured in new cold wallets. He also cited at least $372 million of unauthorized transfers that had taken place on the day FTX and Alameda filed for bankruptcy. Ray said there was also “dilutive ‘minting’ of approximately $300 million in FTT tokens by an unauthorized source” in the days following the bankruptcy filing. “FTT tokens were created by FTX to facilitate trading on its exchange and made up a big chunk of Alameda’s assets,” Market Watch notes. The company collapsed last week, shortly after Bankman-Fried told investors that FTX was facing a major shortfall of up to $8 billion from withdrawal requests and needed emergency funding. After that, FTX filed for bankruptcy, and then Bankman-Fried announced his resignation, and said that Alameda Research would be shutting down. The disgraced FTX founder has since put his 12,000-square ft. penthouse in the Bahamas up for sale for nearly $40 million. Bankman-Fried, who had an estimated net worth of $16 billion last week, is now completely broke, according to calculations by Bloomberg — an incident that the outlet referred to as “one of history’s greatest-ever destructions of wealth.” link

|

|

|

|

Post by J.J.Gibbs on Nov 19, 2022 0:56:17 GMT -5

The COVID/Crypto Connection: The Grim Saga Of FTX & Sam Bankman-Fried

FRIDAY, NOV 18, 2022 - 07:40 PM Authored by Jeffrey Tucker via The Brownstone Institute, A series of revealing texts and tweets by Sam Bankman-Fried, the disgraced CEO of FTX, the once high-flying but now belly-up crypto exchange, had the following to say about his image as a do-gooder: it is a “dumb game we woke westerners play where we say all the right shibboleths and so everyone likes us.” Very interesting. He had the whole game going: a vegan worried about climate change, supports every manner of justice (racial, social, environmental) except that which is coming for him, and shells out millions to worthy charities associated with the left. He also bought plenty of access and protection in D.C., enough to make his shady company the toast of the town. As part of the mix, there is this thing called pandemic planning. We should know what that is by now: it means you can’t be in charge of your life because there are bad viruses out there. As bizarre as it seems, and for reasons that are still not entirely clear, favoring lockdowns, masks, and vaccine passports became part of the woke ideological stew. This is particularly strange because covid restrictions have been proven, over and over, to harm all the groups about whom woke ideology claims to care so deeply. That includes even animal rights: who can forget the Danish mink slaughter of 2020? Regardless, it’s just true. Masking became a symbol of being a good person, same as vaccinating, veganism, and flying into fits at the drop of a hat over climate change. None of this has much if anything to do with science or reality. It’s all tribal symbolism in the name of group political solidarity. And FTX was pretty good at it, throwing around hundreds of millions to prove the company’s loyalty to all the right causes. Among them included the pandemic-planning racket. That’s right: there were deep connections between FTX and Covid that have been cultivated for two years. Let’s have a look. Earlier this year, the New York Times trumpeted a study that showed no benefit at all to the use of Ivermectin. It was supposed to be definitive. The study was funded by FTX. Why? Why was a crypto exchange so interested in the debunking of repurposed drugs in order to drive governments and people into the use of patented pharmaceuticals, even those like Ramdesivir that didn’t actually work? Inquiring minds would like to know.  Regardless, the study and especially the conclusions turned out to be bogus. David Henderson and Charles Hooper further point out an interesting fact: “Some of the researchers involved in the TOGETHER trial had performed paid services for Pfizer, Merck, Regeneron, and AstraZeneca, all companies involved in developing COVID-19 therapeutics and vaccines that nominally compete with ivermectin.” For some reason, SBF just knew that he was supposed to oppose repurposed drugs, though he knew nothing about the subject at all. He was glad to fund a poor study to make it true and the New York Times played its assigned role in the whole performance. It was just the start. A soft-peddling Washington Post investigation found that Sam and his brother Gabe, who ran a hastily founded Covid nonprofit, “have spent at least $70 million since October 2021 on research projects, campaign donations and other initiatives intended to improve biosecurity and prevent the next pandemic.” I can do no better than to quote the Washington Post: The shock waves from FTX’s free fall have rippled across the public health world, where numerous leaders in pandemic-preparedness had received funds from FTX funders or were seeking donations. In other words, the “public health world” wanted more chances to say: “Give me money so I can keep advocating to lock more people down!” Alas, the collapse of the exchange, which reportedly holds a mere 0.001% of the assets it once claimed to have, makes that impossible. Among the organizations most affected is Guarding Against Pandemics, the advocacy group headed by Gabe that took out millions in ads to back the Biden administration’s push for $30 billion in funding. As Influence Watch notes: “Guarding Against Pandemics is a left-leaning advocacy group created in 2020 to support legislation that increases government investment in pandemic prevention plans.” Truly it gets worse: FTX-backed projects ranged from $12 million to champion a California ballot initiative to strengthen public health programs and detect emerging virus threats (amid lackluster support, the measure was punted to 2024), to investing more than $11 million on the unsuccessful congressional  campaign of an Oregon biosecurity expert, and even a $150,000 grant to help Moncef Slaoui, scientific adviser for the Trump administration’s “Operation Warp Speed” vaccine accelerator, write his memoir. Leaders of the FTX Future Fund, a spinoff foundation that committed more than $25 million to preventing bio-risks, resigned in an open letter last Thursday, acknowledging that some donations from the organization are on hold. And worse: The FTX Future Fund’s commitments included $10 million to HelixNano, a biotech start-up seeking to develop a next-generation coronavirus vaccine; $250,000 to a University of Ottawa scientist researching how to eradicate viruses from plastic surfaces; and $175,000 to support a recent law school graduate’s job at the Johns Hopkins Center for Health Security. “Overall, the Future Fund was a force for good,” said Tom Inglesby, who leads the Johns Hopkins center, lamenting the fund’s collapse. “The work they were doing was really trying to get people to think long-term … to build pandemic preparedness, to diminish the risks of biological threats.” More: Guarding Against Pandemics spent more than $1 million on lobbying Capitol Hill and the White House over the past year, hired at least 26 lobbyists to advocate for a still-pending bipartisan pandemic plan in Congress and other issues, and ran advertisements backing legislation that included pandemic-preparedness funding. Protect Our Future, a political action committee backed by the Bankman-Fried brothers, spent about $28 million this congressional cycle on Democratic candidates “who will be champions for pandemic prevention,” according to the group’s webpage. I think you get the idea. This is all a racket. FTX, founded in 2019 following Biden’s announcement of his bid for the presidency, by the son of the co-founder of a major Democrat Party political action committee called Mind the Gap, was nothing but a magic-bean Ponzi scheme. It seized on the lockdowns for political, media, and academic cover. Its economic rationale was as nonexistent as its books. The first auditor to have a look has written: “Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here. From compromised systems integrity and faulty regulatory oversight abroad, to the concentration of control in the hands of a very small group of inexperienced, unsophisticated and potentially compromised individuals, this situation is unprecedented.” Continued at link

|

|

|

|

Post by schwartzie on Nov 19, 2022 16:40:44 GMT -5

WHAT’S GOING ON? FTX Debtors File Motion to Hide the Names of FTX Creditors

By Joe Hoft Published November 19, 2022 at 2:50pm FTX, which is now in bankruptcy has numerous questionable entries in its financials. Now the company is requesting that its list of creditors be kept hidden. This past week TGP reported that FTX’s balance sheet included an investment labeled “Trump Lose”. Zerohedge reported on the financials that FTX maintained which were a travesty. The financials of FTX included the following: According to Ray, he has located “only a fraction” of the digital assets of the FTX Group that they hope recover during the Chapter 11 bankruptcy. They’ve so far secured about $740 million of cryptocurrency in offline cold wallets, a storage method designed to prevent hacks. This is just a fraction of the $10-$50 billion in liabilities the company disclosed in its bankruptcy filing. How do we know it’s a fraud: as Ray writes on page 24, although the investigation has only begun and must run its course, it is my view based on the information obtained to date, “that many of the employees of the FTX Group, including some of its senior executives, were not aware of the shortfalls or potential commingling of digital assets.” Many maybe not, but some – and certainly SBF himself – did. It gets better: Ray said that company’s audited financial statements should not be trusted, Ray said, adding that liquidators are working to rebuild balance sheets for FTX entities from the bottom up. FTX “did not maintain centralized control of its cash” and failed to keep an accurate list of bank accounts and account signatories, or pay sufficient attention to the creditworthiness of banking partners, according to Ray. Advisers don’t yet know how much cash FTX Group had when it filed for bankruptcy, but has found about $560 million attributable to various FTX entities so far. Although restructuring advisers have been in control of FTX for less than a week, they’ve seen enough to depict the crypto company as a deeply flawed enterprise. Lasting records of decision making are hard to come by: Bankman-Fried often communicated through applications that auto-deleted in short order and asked employees to do the same, according to Ray. In the US there are requirements for companies to prepare timely and accurate financial statements. Auditors confirm these results and issue reports describing their work and what is being confirmed. It is important for the financials to be accurate and timely. FTX apparently didn’t do this. In addition to all the issues with the financials, in a filing today, the debtors of FTX have requested that the names and lists of all the creditors of FTX be kept secret. link

|

|

|

|

Post by maybetoday on Nov 19, 2022 22:07:32 GMT -5

Kevin McCarthy Used FTX Funding to Sway GOP Primaries and Take Out MAGA Favorite Madison Cawthorn

By Jim Hoft Published November 19, 2022 at 5:58pm How Kevin McCarthy’s political machine worked to sway the GOP field – WaPo September 27, 2022  This is really a stunning report. House GOP Leader Kevin McCarthy used FTX funding to sway GOP primaries away from Trump supporters. The National File originally reported on this on Friday. Of course, it is widely know that the now bankrupt FTX US funded millions into Democrat campaigns through Ukraine. But at least one FTX player funded hundreds of thousands of dollars to Kevin McCarthy to take out MAGA lawmakers. The Washington Post reported: We recommend you read this entire article to understand that Kevin McCarthy is NO FRIEND of MAGA! Top allies of Kevin McCarthy, the House Republican leader, worked this spring to deny Cawthorn a second term in office, after the Donald Trump-endorsed lawmaker made controversial comments about cocaine use and sex parties in Washington that led McCarthy to announce he had “lost my trust,” according to multiple Republicans briefed on the effort, which has not been previously reported. GOP lobbyist Jeff Miller, one of McCarthy’s closest friends and biggest fundraisers, and Brian O. Walsh, a Republican strategist who works for multiple McCarthy-backed groups, were both involved in an independent effort to oppose Cawthorn as part of a broader project to create a more functioning GOP caucus next year, said the Republicans, who like others spoke on the condition of anonymity to discuss private conversations. Targeting Cawthorn was part of a larger behind-the-scenes effort by top GOP donors and senior strategists to purge the influence of Republican factions that seek disruption and grandstanding, often at the expense of their GOP colleagues. The political machine around McCarthy has spent millions of dollars this year in a sometimes secretive effort to systematically weed out GOP candidates who could either cause McCarthy trouble if he becomes House speaker or jeopardize GOP victories in districts where a more moderate candidate might have a better chance at winning. The allies close to McCarthy have sometimes taken steps to conceal their efforts, as they did in the Cawthorn case, with money passing from top GOP donors through organizations that do not disclose their donors or have limited public records, federal disclosures show… …In the weeks before his  , a group called Results for N.C. spent $1.7 million to defeat him and support his opponent. The National Association of Realtors, which gave $600,000 to CLF, gave $300,000 to the cause. A nonprofit that does not disclose its donors, Americans for a Balanced Budget, gave $830,000. Most of the rest of the money, $700,000, came from Ryan Salame, an executive at crypto currency exchange FTX U.S., a major donor both to McCarthy’s own operation and to other groups backing McCarthy’s favored candidates. West Realm Shires Services, the corporate name used by FTX U.S., gave $750,000 to CLF in August. Advisers to Salame and FTX declined to comment. The Gateway Pundit’s Cassandra Fairbanks reported earlier on McCarthy’s efforts to take out Madison Cawthorn. (At link)

|

|

|

|

Post by schwartzie on Nov 20, 2022 15:56:05 GMT -5

FTX Lost $3.7 Billion in 2021 – In Bankruptcy Filing It Hides the Names of Its Unsecured Creditors Who Are Owed $3.1 Billion

By Joe Hoft Published November 20, 2022 at 12:25pm FTX reported a $3.7 BILLION loss in its 2021 tax return. Also, its unsecured creditors are redacted in the company’s bankruptcy filing and they are owed an additional $3.1 BILLION. What’s going on? FTX, the cryptocurrency exchange that went bankrupt only a few days ago, was in financial duress for some time. In the company’s bankruptcy filing, FTX mentions that it incurred a loss of $3.7 billion as recorded in its 2021 tax returns. In addition, in the bankruptcy filing dated yesterday, the list of FTX creditors is redacted. This is a list of the 50 largest unsecured creditors. The largest five creditors are due nearly $1 billion ($226 million, $203 million, $174 million, $160 million, and $131 million). Who are they and why are they redacted? The firm filed voluntary bankruptcy for its 102 subsidiaries as well. The FTX collapse is leading to some very questionable and corrupt acts. link

|

|

|

|

Post by Shoshanna on Nov 20, 2022 20:07:09 GMT -5

Samuel Bankman Fried May Have Started the Demolition of the Deep State

By Larry Johnson Published November 20, 2022 at 7:15am I admit it. I am not a complete cynic. Like Don Quixote, I am tilting at windmills. The unfolding scandal, fraud of the collapse of FTX, is not just some minor financial disaster. This is global and is going to ensnare many seemingly smart people who mistakenly believed that if you engaged in cyber currency transactions you could hide from law enforcement. Whoops!! They apparently did not take the time to understand block chain. The security of block chain will be their undoing. I want to direct you to some articles that you should read if you want to understand the train wreck that is occurring with the bankruptcy of Bankman Fried’s crypto-currency trading platform. First up is James Howard Kunstler. He gets you blood boiling and shows how this is connected to the Ukraine disaster: Thirty-seven billion more dollars for Ukraine? (That’s thirty-seven thousand millions of dollars, by the way.) Bringing the total this year to a click-or-two over ninety billion (ninety-thousand millions), on top of whatever Sam Bankman-Fried’s FTX company funneled through that sad-sack international money laundromat — soon to be the darkest backwater of a European failed state since Field Marshal Melchior von Hatzfeldt of Westphalia left Bohemia a corpse-strewn wasteland after the Battle of Jankau (1645). It really doesn’t matter how much more money we pound down that rat-hole, you understand, because by the time various parties — the weapons-makers, Volodymyr Zelensky, sundry members of the US House of Representatives, the Biden family, the World Economic Forum — are finished creaming off their fair shares, poor Ukraine won’t have enough cash-on-hand to replace six fuse-boxes in Zaporizhzhia. Kunstler does an especially deft job of helping you understand the political and financial incest that is rampant in the United States: The Bankman-Fried extended family is the quintessence of Woke aristocracy. Dad Joe Bankman and mom Barbara Fried are both law professors at Stanford. She also acted as a money-bundler for the Democratic Party and ran two non-profit “voter registration” orgs (against the IRS laws which only permit non-partisan organized voter registration). Brother Gabe Bankman-Fried headed a non-profit named Guarding Against Pandemics (funded by Sam), which lobbies Congress to construct new platforms for medical tyranny. Aunt Linda Fried is Dean of Columbia U’s Public Health school, and is associated with Johns Hopkins, which ran the October 2019 Event 201 pandemic drill (sponsored by the Gates Foundation) months before the Covid-19 outbreak. Sam’s girlfriend, Caroline Ellison, ran the Alameda Investments arm of the FTX empire (that is, FTX’s own money laundromat). Her dad, Glenn Ellison, is chair of MIT’s Econ School. His former colleague on the MIT Econ faculty, Gary Gensler, who specialized in blockchains there, is now head of the Securities and Exchange Commission, an agency that Sam Bankman-Fried was attempting to rope into a regulation scheme to eliminate FTX’s crypto-currency competitors. Caroline’s mom, Sara Fisher Ellison, is an MIT econ prof specializing in the pharmaceutical industry (fancy that!). Caroline Ellison is currently on-the-run. The sum total of all this professional and academic accomplishment is also the quintessence of Woke-Jacobin turpitude in service to a political faction that seeks maximum moneygrubbing while acting to overthrow every norm of behavior in the conduct of elections, and perhaps in American life generally. That’s some accomplishment. It’s also a lesson in why the managerial elite of our country are no longer trustworthy. They have gotten away with crimes against the nation for years, which has only made them bolder and more reckless. As investigators unravel this web of corruption do not be surprised if Hillary and Bill Clinton, and some of their acolytes, emerge as key players in the deception and fraud. You think that Bill Clinton hanging out with Samuel Bankman Fried is just a coincidence? If you believe that, please contact me. I have a great investment opportunity for you. Just give me two million dollars and I will change the world on your behalf (legal disclaimer — I am not specifying the specific world that I will change but it is highly likely it will be mine.) Political Moonshine has been prolific in writing about the corrupt finance linking Washington political players and Ukraine. It has been going on for years. I encourage you to read two recent pieces. Warning, you are going down a rabbit hole. The Moonshine folks, in my view, would benefit from a savvy editor. The first article, The Keystone of Corruption: Ukraine and the FTX Scandal, lists what it considers to be key facts about the corrupt activities of FTX: Tens of billions of U.S. dollars have been funneled to Ukraine The money was laundered through FTX The laundered money now in the form of FTX cryptocurrency was funneled back to Democrats and the Bidens All of that money is now gone and FTX is bankrupt FTX gave at least $40 million to Democrats in advance of the 2022 midterms FTX funded congressional campaigns for members overseeing the Commodity Futures Trading Commission (CFTC), [oversees regulation of the cryptocurrency industry] FTX’s ex-CEO Sam Bankman-Fried aggressively lobbied the CFTC FTX is currently under investigation by the CFTC and the Securities and Exchange Commission (SEC) The investigation was opened after Bankman-Fried allegedly moved $10 billion in client assets at FTX to his trading firm Alameda Research A liquidity crisis at FTX caused the company to file for bankruptcy FTX is directly involved with and related to Ukraine In March, the Washington Post reported that Ukraine was dealing in cryptocurrency The Ukrainian government gathered more than $42 million in cryptocurrency donations Approximately a week after Ukraine gathered the cryptocurrency donations, FTX engaged with Ukraine Respective to the Russian invasion of Ukraine FTX/Sam Bankman-Fried formulated a cryptocurrency donation project in Ukraine Bankman-Fried announced that FTX would support the Ukrainian Ministry of Finance and other communities in collecting cryptocurrency donations for the nation The Ukrainian government has received over $60 million in cryptocurrency donations globally Bankman-Fried cited humanitarian aid and access to global financial infrastructure as causes Bankman-Fried indicated that cryptocurrency exchanges should enforce sanctions announced by the government Bankman-Fried was the #2 donor to the Democratic party; George Soros was #1 The money laundering circle was: Democrats vote to send funds to Ukraine, Ukraine invests in FTX, FTX cryptocurrency was funneled back to the same Democrats The follow up post, The Keystone of Corruption: Ukraine, the FTX Scandal, PrivatBank, the National Bank of Ukraine and Ihor Kolomoyskyi, hones in on Ihor Kolomoyskyi. Remember him? He reportedly funded the AZOV Battalion and he played a key role in putting Zelensky in the Presidential “palace” in Kiev. One final but important data point in understanding the FTX implosion, at least according to the New York Post. Mr. ChangPeng Zhao, CEO of Binance. According to the New York Post: Earlier this month, Coindesk published a report that Bankman-Fried’s investment firm Alameda Trading’s balance sheet was relying on FTX’s cryptocurrency token, known as FTT. Around this time, Zhao sold a massive trove of FTT, which ultimately triggered FTX’s bankruptcy. “It’s not a coincidence he goes to the Middle East and comes back bankrupt,” the source speculated. “The trip created the unraveling of the fraud. There’s a direct causation between that marketing junket and Bankman-Fried’s downfall.” link

|

|

|

|

Post by ExquisiteGerbil on Nov 21, 2022 2:52:23 GMT -5

FTX was HEAVY into funding vaccine research, biotech engineering and other globalist depopulation agendas through the “scientific research” community

Saturday, November 19, 2022 by: Ethan Huff Tags: badhealth, badmedicine, badscience, biotech, corruption, crypto, depopulation, engineering, fraud, FTX, genocide, globalist, junk science, research, Sam Bankman-Fried, SBF, science clowns, science grants, scientific, vaccine This article may contain statements that reflect the opinion of the author Bypass censorship by sharing this link: New citizens.news/676232.html(Natural News) The hundreds of grants and investments totaling at least $132 million that were earmarked by the FTX Foundation and its FTX Future Fund for use in developing new bioweapons, “vaccines” and other chemical and pharmaceutical products are officially null and void. And their recipients are now in a panic about it. Following the announced resignation of the entire Future Fund leadership team on November 11, one of the companies that was supposed to receive a cash grant from it, SecureBio, lamented the fact that employees at his firm will now be out of a job unless emergency backup funding is procured. “We don’t think it is right that anyone should lose their jobs over a financial calamity totally unrelated to the excellent work they are doing,” announced SecureBio co-founder Kevin Esvelt. SecureBio had initially been awarded a $1.2 million grant to develop “better pandemic defenses,” according to Coin Telegraph. Another company, a biotechnology firm called Sherlock Biosciences, was supposed to receive $2 million from the Future Fund to study infectious diseases. HelixNano, a similar firm within the same field, was supposed to receive $10 million for vaccine research. Then there is Our World in Data, which was supposed to be given $7.5 million to “track trends relevant to humanity’s long-term prospects,” whatever that is supposed to mean. FTX was also involved in research to “debunk” the merits of ivermectin as a viable remedy for the Wuhan coronavirus (COVID-19). Brighteon.TV Another entity that was supposed to be on the dole of FTX’s “philanthropic” efforts via Sam Bankman-Fried’s (SBF) “Building a Stronger Future” initiative is ProPublica, which was to receive the first tranche of a $5 million grant this year, followed by more disbursements in 2023 and 2024. Organizations that received money from FTX in the 90 days prior to its bankruptcy could be subject to a “clawback” According to Molly Kovite, a lawyer and member of the “Effective Altruism” group, all of these organizations and others that received money from an FTX entity within the 90 days prior to its bankruptcy declaration could be forced to pay it all back through a process known as a “clawback.” Two days after Kovite announced this on November 14, Open Philanthropy, the philanthropic funder that Kovite represents, announced that it is seeking applications from grantees affected by the collapse of the Future Fund. Each application will be evaluated and provided funding at the group’s discretion. Meanwhile, U.S. Senators Elizabeth Warren (D-Mass.) and Richard Durbin (D-Ill.) are requesting that SBF, the former FTX CEO, and John Jay Ray III, the current CEO, provide more information about what happened to collapse the fraudulent cryptocurrency exchange. Some 13 different requests for documents, lists and answers have been sent by these two, who are still awaiting answers on behalf of the American public. “The public is owed a complete and transparent accounting of the business practices and financial activities leading up to and following FTX’s collapse,” the two lawmakers wrote, emphasizing that there has been an “apparent lack of due diligence by venture capital and other big investment funds eager to get rich off crypto.” “These developments justify our long-standing concerns that the crypto industry ‘is built to favor scammers’ and ‘designed to reward insiders and to defraud mom-and-pop investors,'” they further added. SBF and Ray have until November 28 to provide the requested materials, which also include “complete copies of all FTX and FTX-subsidiary balance sheets, from 2019 to the present.” Warren and Durbin also want SBF to provide an explanation for his business decisions as well as strange statements he has made on Twitter that appear to be encoded for secret communication.

|

|

|

|

Post by schwartzie on Nov 21, 2022 15:18:55 GMT -5

FTX Funded $18 Million Towards Research that Claimed that Ivermectin and Hydroxychloroquine Didn’t Work Against COVID

By Joe Hoft Published November 21, 2022 at 1:30pm FTX funded garbage research that claimed that Ivermectin and Hydroxychloroquine didn’t work against COVID. FTX financed politicians in the US in recent elections. Millions were sent to these politicians as we already reported. FTX was actually the second-largest donor to the Democrat party. Now we have uncovered evidence that FTX also funded research that was used to claim that the use of Ivermectin and Hydroxychloroquine were not useful in combatting COVID. TRENDING: Sen. Josh Hawley Demands Correspondence Between Federal Officials and Dem Party Leaders Following FTX Collapse and Why the Scheme Was Only Revealed AFTER the Midterm Elections FTX funded research behind a study on Ivermectin and Hydroxychloroquine that claimed these two products didn’t work against COVID. The studies were “stopped early” for these two products due to “futility”. See the chart from the study below:  FTX released a news wire on May 16, 2022, where the now bankrupt entity bragged about funding more that $18 million to support trials that concluded that products like  The results of these studies hindered the use of these products that are inexpensive and work against COVID. FTX spent millions on these studies that are not in sync with ample evidence to the contrary. link

|

|

|

|

Post by schwartzie on Nov 21, 2022 15:29:59 GMT -5

Who Funded FTX and Why? That Is One of the Key issues

By Larry Johnson Published November 21, 2022 at 7:00am If you are familiar with the old comedy trio, the Three Stooges, I bet you can spot a resemblance between Larry Fine and Sam Bankman-Fried. Are they related?  Larry Fine  Sam Bankman-Fried One big difference — Larry Fine was funny; Bankman-Fried is not. What has many people scratching their heads is how this kid could wind up at the top of a multi-billion dollar enterprise and convince so many supposedly shrewd Wall Street financiers to throw money at him? Which brings me to the following tweet. This is your chance to drill down and help try to unravel how this whole scam got started. I asked the question earlier today, who bankrolled this start-up. A wise and good friend sent me this.  I hope that the appropriate governing authorities are conducting a full-scale investigation. In the meantime, what do you know about any of these companies/organizations and the people who helped get FTX up and running? I am flattered to have such an urbane, smart group of people from around the world who take the time to read and comment on my articles. I am betting that some of you have some insights on some of these companies and can help shed light on whether there were some nefarious intents at the beginning or if people who should have known better failed to do their due diligence. What do you think? link

|

|

|

|

Post by ExquisiteGerbil on Nov 21, 2022 19:12:12 GMT -5

CEO Of Ukrainian Crypto Firm Denies FTX–Ukraine Money-Laundering Allegations

BY TYLER DURDEN MONDAY, NOV 21, 2022 - 06:20 PM Authored by Andrew Moran via The Epoch Times, Everstake, a Ukraine-based cryptocurrency firm, has been caught in the crosshairs of a controversial relationship involving Kyiv, Democrats, and the beleaguered FTX exchange that has captured the attention of Washington officials. As part of efforts to generate more funds for the war effort, the Ukrainian government launched “Aid for Ukraine,” a website that accepted cryptocurrency donations that would be converted into fiat money and then deposited at the National Bank of Ukraine. The contributions would be used to purchase a wide range of essential items, from medical supplies to military clothing. The Ministry of Digital Transformation partnered with FTX, Ukraine’s Kuna exchange, and Everstake to help facilitate crypto-denominated donations, which have totaled between $60 million and $100 million. Because of former FTX CEO Sam Bankman-Fried’s immense donations to Democrat lawmakers and the timing between the creation of the fund and President Joe Biden’s billions in financial and military assistance to Kyiv, there has been speculation of wrongdoing. Critics allege that Ukraine invested in FTX to funnel money to the Democratic Party. According to Everstake CEO Sergey Vasylchuk, it is a ridiculous assertion to think that the Ukrainian government would invest in private companies at a time of war and utilize critical resources for political payoffs, noting that Kyiv is “investing in the needs of families” with the aid it receives. “Technically, the Ministry of Digital Transformation mostly supported the information point of view,” he told The Epoch Times, adding that it was chaotic in the early days of the war, requiring the use of backups to receive funds. “It was messed up at the time,” the head of the staking service platform noted. “I never felt this was like a wonderful cheat. For me, when they say Ukraine invests in companies, I just ignore it.” Vasylchuk confirmed that he was never in contact with Bankman-Fried during the process, explaining that FTX maintained only a small role in the fundraising effort. “We have six people who were part of the compliance legal team” who helped get the Aid for Ukraine project off the ground, Vasylchuk averred. Crypto has turned into a vital tool in the military conflict in Eastern Europe. In recent months, pro-Russia organizations have been accepting donations through cryptocurrency exchanges, raising millions of dollars in digital currencies that are then used to support Moscow’s military campaign. In the aftermath of the FTX collapse, there have been widespread concerns this would trigger a contagion effect. Cryptocurrency prices have plummeted, crypto-related firms have tumbled, and many parties that have been exposed to Bankman-Fried’s empire have experienced financial pressures. But Vasylchuk says that Everstake is weathering the storm because it maintains diversified assets and, depending on a treasure trove of web reports, the company uses various wallets to ensure the safety and security of its holdings. ‘UNITED24’ Ukraine officials have also addressed the recent allegations, including Deputy Minister of Digital Transformation Oleksandr Bornyakov, who described the latest rumors as “nonsense.” “A fundraising crypto foundation @_AidForUkraine used @ftx_Official to convert crypto donations into fiat in March. Ukraine’s gov never invested any funds into FTX. The whole narrative that Ukraine allegedly invested in FTX, who donated money to Democrats is nonsense, frankly,” he wrote in a tweet last week. Aid for Ukraine was recently taken down and replaced with “UNITED24.” “UNITED24 was launched by the president of Ukraine, Volodymyr Zelensky, as the main venue for collecting charitable donations in support of Ukraine. Funds will be transferred to the official accounts of the National Bank of Ukraine and allocated by assigned ministries to cover the most pressing needs,” the new website states. The website also informed visitors that “we are looking for companies or enterprises that can help Ukraine with specific needs.” Ukrainian President Volodymyr Zelensky during a meeting with the U.S. secretary of state in Kyiv on Sept. 8, 2022. (Genya Savilov/POOL/AFP via Getty Images) Washington Probing FTX-Ukraine Connections A growing number of U.S. officials are not convinced by these explanations. In a letter to Secretary of State Antony Blinken, several House Republicans, led by Rep. Troy Nehls (R-Texas), wrote that it had recently come to their “attention that billions of taxpayer dollars sent to Ukraine to assist with their war efforts were potentially invested in a crypto exchange that then made massive donations to Democrats” during the 2022 midterm election campaign. “While this partnership was touted as a way to assist Ukraine in cashing out crypto donations for ammunition and humanitarian aid, we have serious concerns that the Ukrainian government may have invested portions of the nearly $66 billion of U.S. economic assistance into FTX to keep Democrats in power—and keep the money coming in,” the lawmakers explained in a letter (pdf) exclusively obtained by FOX Business. “We sincerely hope the  driver behind the billions in congressional assistance to Ukraine was not Democrats attempting to keep themselves in power, and that none of the missing funds were used as a passthrough to avoid campaign finance laws or end up in Democrat pockets.” A State Department spokesperson told the business news network that there is “no reason to believe that these reports are anything but pure falsehoods and misinformation.” The House Financial Services Committee, led by Reps. Patrick McHenry (R-N.C.) and Maxine Waters (D-Calif.), announced a bipartisan hearing into the FTX debacle and what it could mean for the digital asset economy. The committee plans to hear from Bankman-Fried and individuals involved in Alameda Research, Binance, and FTX. link

|

|

|

|

Post by ExquisiteGerbil on Nov 21, 2022 19:15:01 GMT -5

"You're An Absolute Fraud": CME CEO Terry Duffy Recalls First Meeting Sam Bankman-Fried In March 2022

BY TYLER DURDEN MONDAY, NOV 21, 2022 - 01:40 PM CME Chairman and Chief Executive Officer Terry Duffy has been the talk of social media today, after a podcast appearance with CNBC's Guy Adami and Dan Nathan began making its rounds on Monday morning. Among other topics discussed on the podcast was Duffy recalling his first meeting with Sam Bankman-Fried, which took place in March 2022. Ole' Terry's senses from days of being in the pit are still sharp as can be. He pegged FTX for a fraud before the company blew up - and told Bankman-Fried as much to his face, as he called on the podcast. Duffy says he was approached by SBF at a conference who told him he wanted to compete with CME in crypto. Instead, Duffy says he offered to give SBF his crypto franchises in exchange for working together. "Let me be your risk manager. I'll clear it so that I know it's done properly," Duffy says he told SBF. When SBF asked if Duffy would deploy his model, Duffy told him "Your model is crap. Why would I deploy a model that introduces risk into the system? Of course I'm not going to deploy your model!" From there, SBF "flat out turned me down", Duffy said. "Right away I said to him 'You're a fraud. you're an absolute fraud'," Duffy recants telling SBF. "You're supposedly worth $26 billion and are altruistic? How come there's not a $10 billion donation going to someone right this moment in time?" "My net worth doesn't start with any B's and I'll give you 3-to-1 that I have more money than you," Duffy said to SBF. "I'll give you 4-to-1 that I have more money in my right pocket than your net worth." And the recollection of events gels with media at the time. Later on in the spring, Duffy took to Congress and specifically made claims that "FTX [had] set aside insufficient financial resources to back its proposed direct clearing model for crypto derivatives". "I got berated" at Congress when blowing the whistle on FTX, Duffy says. You can watch the whole congressional hearing below, but we've cued it up to a heated exchange with Congressman Ro Khanna (pointed out by @ardalyonovich on Twitter) who vehemently defends FTX after Duffy claimed that FTX had "zero capital requirements for participants". "I think that's, on its face, a false statement," Khanna barks at Duffy. Khanna then continues to try and lecture Duffy: "Sir I want you to, after this, submit something that is accurate recognizing you're testimony to Congress, you don't know much about cryptocurrencies, you're opining about cryptocurrencies and you're giving false statements to Congress," he continues. Penn professor and forensic accounting expert Francine McKenna summed it up perfectly when she commented on Twitter: "Duffy went to Congress and told them FTX was a bankrupt business model and he was ignored just like he was ignored when he said Corzine knew he had used customer funds and knew where the missing $1.6 bullion was. link

|

|

|

|

Post by OmegaMan on Nov 21, 2022 22:03:16 GMT -5

Globalist operative: Sam Bankman-Fried and his FTX cryptocurrency exchange SCAM heavily promoted by World Economic Forum as example of “effective altruism” and “stakeholder capitalism”