|

|

Post by Midnight on Dec 15, 2022 3:39:25 GMT -5

Top Democrats In Collusion With DOJ To Stop FTX Hearing And Cover Up All Connectionsby Liza Carlisle After the request that Sam Bankman-Fried attend Tuesday’s House Financial Services Committee hearing on the stunning collapse of FTX and testify as to the particulars that brought about the demise, and his agreement to do so, it seems he has been arrested in the Bahamas and also denied bail with the magistrate overseeing the case ordering that the FTX founder should be remanded in custody until early February. Bankman-Fried agreed to testify from his location in Nassau, Bahamas, and the DOJ announced that it was charging the former FTX CEO in an “Eight Count Indictment with Fraud, Money Laundering, and Campaign finance Offenses.” Chief magistrate JoyAnn Ferguson-Pratt denied the $250,000 bond requested by Bankman-Fried’s lawyers, saying that he was a “flight risk” and has sent Bankman-Fried to the Bahamian department of corrections until February 8. Daily Beast noted that “…when the DOJ learned that SBF would testify on December 13, it set a December 12 deadline to deliver an indictment to the Bahamas’ attorney general, to avoid the optical embarrassment of SBF testifying to Congress from a mansion in a tropical paradise.” Obviously, the Democrat-run DOJ was working together with House Democrats to stop the hearing by bringing charges in the final minute so Democrats didn’t get shredded. The show went on, however, without the star witness and committee chair Rep. Maxine Waters speedily went on with the hearing, appearing to be focused on rushing to the end of the hearing, even without even letting one congressman be able to question a witness. The congresswoman from California has grown accustomed to having her own way in the Democratic-controlled Congress and attempted to have her way in the hearing and was clearly not pleased when Texas Rep. Lance Gooden, a Republican, challenged her authority. Waters tried to end the hearing before Gooden was allowed to question the witness, current FTX CEO John Ray III. As Waters delivered her closing remarks, Gooden interrupted to remind her. “Chairwoman Waters, Chairwoman Waters, I’ve not had the opportunity to testify — or [rather] to question the witness.” Waters stopped speaking as an aide whispered something into her ear, and unbelievably, she ignored Gooden and returned to her closing remarks. Raising his voice, Gooden said, “Chairwoman Waters. Parliamentary inquiry. Are all members entitled to question witnesses?” Following a brief back and forth, the obviously unhappy Waters allowed him five minutes to question Ray. “Thank you, Madam Chair.” In a sarcastic tone of voice, Waters replied, “You’re certainly welcome, sir.” This exchange raises the issue of why Waters had been so eager to end the hearing before Gooden could question the witness. Lmfao Rep. Maxine Waters tried to end the FTX hearing before Rep. @lancegooden got a chance to question the witnesses, who had to remind her that all the members of a committee are entitled to questions. pic.twitter.com/wYTxSsLVg3 — Greg Price (@greg_price11) December 13, 2022 Western Journal notes: Perhaps it was because she and many other Democrats were the beneficiaries of Bankman-Fried’s largesse. Although the lion’s share of the party’s second largest donor’s contributions went to Senate Democrats, he had directed $300,000 to members of her committee, according to The Washington Free Beacon. Last month, the Free Beacon reported, “Bankman-Fried and his co-founders at FTX contributed $300,351 to nine members of the House Financial Services Committee, according to Federal Election Commission records. Some of the largest contributions were to Democrats on the committee’s Digital Assets Working Group, which worked on regulation of the crypto industry.” This might explain her apparent fondness for the disgraced crypto king. Earlier this month, Waters praised Bankman-Fried for his willingness to speak to the media about his company’s spectacular failure. .@sbf_FTX, we appreciate that you've been candid in your discussions about what happened at #FTX. Your willingness to talk to the public will help the company's customers, investors, and others. To that end, we would welcome your participation in our hearing on the 13th. — Maxine Waters (@repmaxinewaters) December 2, 2022 linkIn the clip below, she appears to blow him a kiss. CAUGHT: Maxine Waters appears to blow a kiss at FTX’s chief fraudster Sam Bankman-Fried at a Congressional hearing while the cameras were still rolling She’s the one who’s supposed to grill SBF next month? pic.twitter.com/qxWXuNsyuK — Benny Johnson (@bennyjohnson) November 18, 2022 In a filing in Delaware Federal Bankruptcy court, Andrew Vara, a U.S. bankruptcy trustee remarked the actions of the DOJ, “just shows a level of interest and attention that they’re paying to this that should be troubling to Mr. Bankman-Fried.” Former federal prosecutor Renato Mariotti told CNBC,” It seems to me that the DOJ is trying to use the bankruptcy process as a way of getting evidence.” Water’s days as chair of the powerful committee are numbered. In a few short weeks, Democrats must hand the gavel back to the GOP and North Carolina Rep. Patrick McHenry will lead the committee. The timing of the probe with Waters at the holm is obviously intentional, given the few days until leadership changes hands. But the new leadership is planning to continue the investigation, since shortly after his appointment last month, McHenry told Fox News he intends to “get to the bottom” of the FTX collapse. Meanwhile, Investors are pulling record levels of bitcoin from crypto exchanges and the collapse of FTX stirs fears over the safety of their assets, Financial Times reports. the rush for the exit comes as the price of bitcoin has plunged 64 percent this year and is currently trading around $17,000. the outlet reported that Eric Robertson, global head of research at Asia-focused bank Standard Chartered, this week said that the pain for crypto investors will continue well into 2023. “More and more crypto firms and exchanges find themselves with insufficient liquidity leading to further bankruptcies and a collapse in investor confidence in digital assets.”

|

|

|

|

Post by schwartzie on Dec 15, 2022 19:00:45 GMT -5

FTX Bankruptcy CEO Makes $1,300 per Hour – Paid by Its CustomersALANA MASTRANGELO 15 Dec 2022 John Ray, the new CEO of the cryptocurrency exchange FTX, will reportedly be paid $1,300 per hour, plus expenses for his work on the FTX bankruptcy case, which comes to $2.6 million annually. Unlike a typical employee who works directly for a company, Ray and his top team are professional independent contractors and function more like bankers and lawyers who are working on bankruptcy affairs, according to a report by CNBC News. Due to this, Ray and his team get paid immediately, before any FTX investors receive recompense for their losses, the report added. Ray’s team has worked with him on three other bankruptcies over the last 30 years, which include restructuring Enron in the early 2000s, Nortel in 2009, and Overseas Shipbuilding Group in 2014. Now, court filings show that Ray will collect $1,300 per hour, as well as “reasonable expenses” for straightening out the collapsed crypto exchange, previously led by its disgraced founder, Sam Bankman-Fried. Assuming the new FTX CEO works the standard 40-hour work week for 50 weeks over a year, that amount comes to an annual $2.6 million. In a previous bankruptcy case, Ray reportedly billed around 156 hours in a two-month period. FTX has reportedly tracked down about $1 billion worth of assets so far, but it could be months or years before creditors are made whole, CNBC noted, adding that Enron’s restructuring took more than a decade, and Nortel’s proceedings are still going on in 2022, more than 11 years later. On Monday, Bankman-Fried was arrested in the Bahamas. The following day, the disgraced founder and former FTX CEO was hit with a host of fresh charges relating to possible financial crimes and campaign finance violations. In total Bankman-Fried was charged with eight counts, ranging from wire fraud to money laundering to conspiracy to commit fraud on the United States. The former FTX CEO, who was Democrat megadonor, was also charged with violating campaign finance laws, as Breitbart News reported. Bankman-Fried, who was once considered one of the richest people in the world, now says he is getting by on a single credit card and likely has less than $100,000 to his name. link

|

|

|

|

Post by schwartzie on Dec 16, 2022 11:25:39 GMT -5

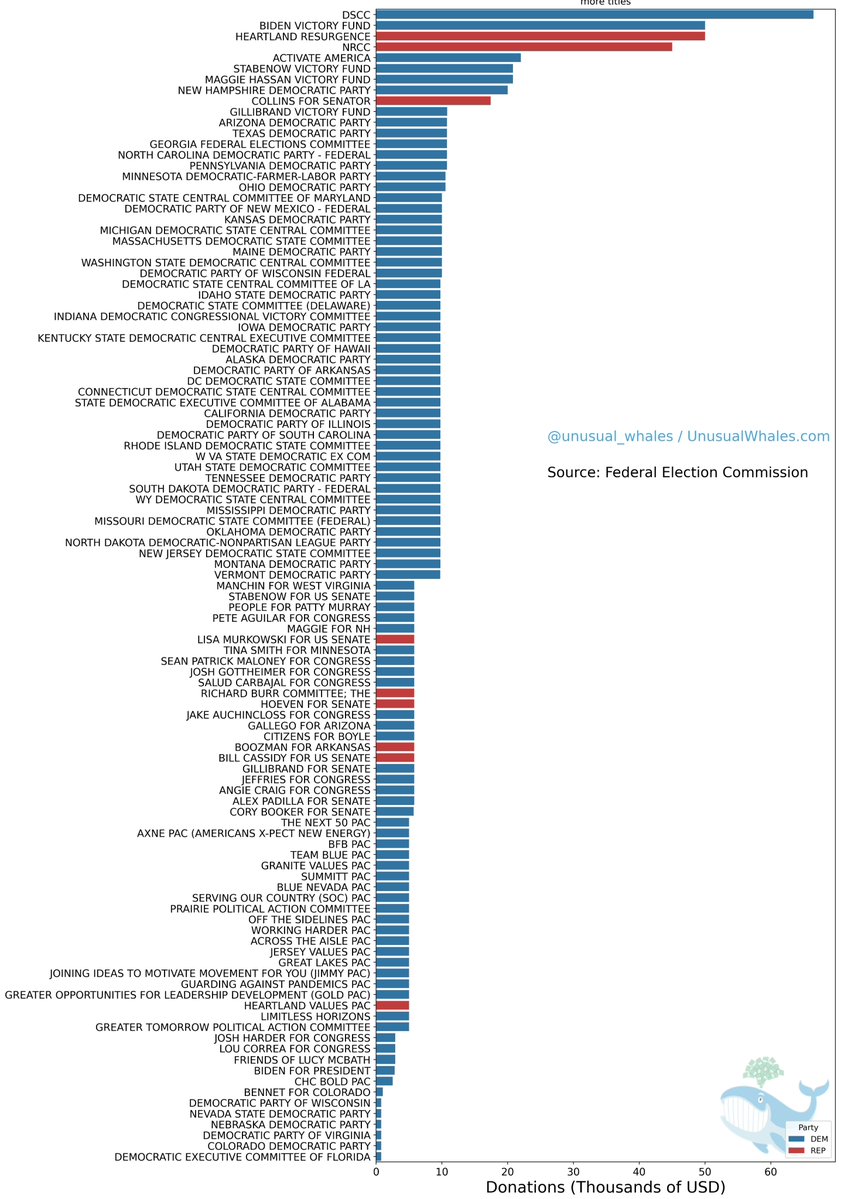

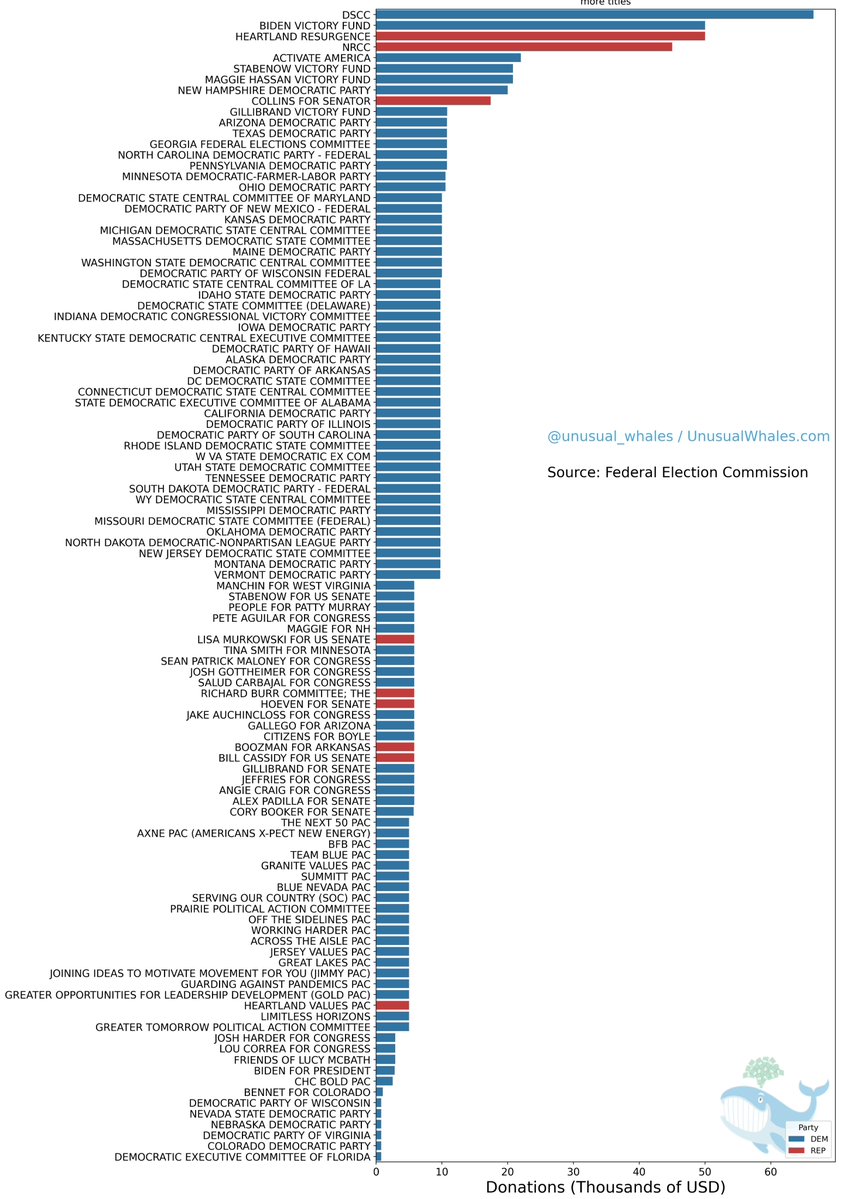

UST IN: Full List Released Of Politicians Who Took Indicted Crypto CEO’s “Illegal Political Donations” — Democrats And RINOs

By ProTrumpNews Staff Published December 16, 2022 at 10:20am FTX co-founder Sam Bankman-Fried was arrested for using customers’ funds to make illegal political donations. CNBC reported: Federal authorities on Tuesday charged FTX co-founder Sam Bankman-Fried with using what they said was tens of millions of dollars of misappropriated customer funds to make illegal political donations to both Democratic and Republican candidates. Prosecutors said one of the reasons he made those contributions was to influence the direction of policies and laws affecting the cryptocurrency industry. Bankman-Fried diverted customer assets held by FTX, a major cryptocurrency exchange, to his separate crypto hedge fund, Alameda Research, the Securities and Exchange Commission charged in a civil complaint filed in Manhattan federal court. He then used those funds to make “large political donations,” to make investments and buy “lavish real estate,” the SEC complaint alleged. We now have a list of politicians he paid. The list includes Democrats and RINO Republicans. RINOs Susan Collins, Lisa Murkowski, Bill Cassidy, Richard Burr, and John Boozman all received donations from Bankman-Fried. Both the Democrat Senatorial Campaign Committee and the Biden Victory Fund received donations from Bankman-Fried. Multiple state Democrat parties also received donations from Bankman-Fried. Full list:  Here is a chart on donations to PACs. SBF gave over$28 million to the Democrat Protect Our Future PAC. Compare this to the $150,000 he gave to the conservative American Patriots PAC.  Will the Democrats and RINOs give the money back? link

|

|

|

|

Post by Midnight on Dec 17, 2022 4:37:29 GMT -5

Lawyers Say Bankman-Fried Needs Better Defense Than 'I F*cked Up'

BY TYLER DURDEN FRIDAY, DEC 16, 2022 - 08:00 PM FTX founder and Democrat megadonor Sam Bankman-Fried's 'I'm Sorry, I fucked up', 'It wasn't me, but I'll get to the bottom of this whole mess' act needs some serious work, according to lawyers cited by Bloomberg. Bankman-Fried, who just filed a new application for bail before the Bahamian Supreme Court (set to be heard on January 17th), has been playing dumb and blaming competitors since day one. For weeks, FTX founder Sam Bankman-Fried has been previewing a possible defense to criminal charges over the cryptocurrency exchange’s collapse: I made mistakes but I didn’t mean to do it. But that’s probably not going to cut it now that he’s been arrested in the Bahamas and charged by federal prosecutors in New York, several lawyers not involved in his defense said. According to the indictment unsealed Tuesday, Bankman-Fried, 30, defrauded FTX customers and investors by using at least $1.8 billion of their money for personal expenses and risky bets by its sister trading firm, Alameda Research. -Bloomberg "I wish things worked out in the end’ is more of a (guilty) plea allocution than a defense," according to former federal prosecutor Harry Sandick. "It’s hard to see that being a triable defense. It’s hard to know what the whole thinking was in terms of those public statements, or if there was very much thinking." SBF's current posture is aimed at suggesting the FTX meltdown was unintentional, but the eight-count indictment against him clearly lays out how he lied over and over again about fund transfers. What's more, prosecutors likely have cooperating witnesses from FTX or Alameda who have flipped on SBF. "Although this is an extremely high-profile case, the indictment is a no-nonsense, no-frills document," said Jaimie Nawaday, another former federal prosecutor. "The factual statements are short and plain. The theories of fraud are very standard — lying to get money, lying about what you’re doing with the money." While the bare-bones indictment doesn't indicate what actual evidence the US government has against him, according to Nawaday, SBF's public statements may have been more than enough rope for the FTX founder to have hung himself in court. If those statements are later contradicted, it would be devastating for his defense, Sandick also notes. "There’s a saying that a false exculpatory statement is almost as good as a confession," he said. Robert Frenchman, a New York white-collar defense lawyer, said Bankman-Fried’s claims that FTX’s collapse resulted from management missteps aren’t all that convincing, even without the prosecution showing its hand. In particular, Frenchman said, the relationship between FTX and Alameda is hard to spin as innocent. -Bloomberg "There’s some very troubling facts here that don’t fit the mismanagement narrative," said Frenchman, adding "I think it’s very difficult to mount that kind of a defense when the defendant is alleged to have given secret preferential treatment to his own hedge fund. Those facts surrounding Alameda are going to be much tougher to defend. They look a lot more like fraud and deception than anything unintentional." link

|

|

|

|

Post by maybetoday on Dec 17, 2022 20:39:24 GMT -5

Prosecutors Seeking Information On FTX Donations From Top Democrats

By Margaret Flavin Published December 17, 2022 at 7:20pm The Gateway Pundit reported on the recent SEC filing regarding FTX that failed to mention the amount of donations by FTX to corrupt politicians. On Saturday, a source allegedly told The New York Times that top Democrat officials have been asked to provide information regarding donations from Sam Bankman-Fried and two former executives at disgraced cypto company. The New York Post reports: Prosecutors investigating accused crypto grifter Sam Bankman-Fried have demanded information from high-level Democrats — including the Democratic National Committee, the Democratic Congressional Campaign Committee and New York Rep. Hakeem Jeffries, the incoming House minority leader — to help prove their sprawling case, according to a report. Top Dem lawyer Marc E. Elias, who represents a long list of political campaigns and super PACs, received an email from the United States attorney’s office for the Southern District of New York asking for details about donations received from Bankman-Fried, sources told the New York Times on Saturday. Unnamed Republicans and other Democratic campaigns received similar messages, the sources said. Bankman-Fried, 30, who was arrested in the Bahamas Monday on a raft of felony charges in the wake of the November collapse of his FTX crypto exchange, allegedly siphoned off $1.8 billion dollars of customer cash, using some of it to become the Democrats’ second-largest individual donor — behind billionaire businessman George Soros — in the 2022 election cycle. link

|

|

|

|

Post by ExquisiteGerbil on Dec 18, 2022 3:38:01 GMT -5

SBF Changes Mind On Extradition To US After Four Days In Bahamian Jail

BY TYLER DURDEN SATURDAY, DEC 17, 2022 - 06:00 PM After spending just five days in a Bahamian jail cell, FTX founder Sam Bankman-Fried is backpedaling on his decision to contest extradition to the United States to face fraud charges, Reuters reports, citing a person familiar with the matter. According to the report, SBF will appear in court on Monday to formally consent to extradition - which will pave the way for him to appear in US court to face charges that he commingled customer deposits to cover expenses and debts, and to make investments through his crypto hedge fund, Alameda Research LLC. That said, legal experts tell Reuters that a trial is likely over a year away. As Fox News reported last week, the Bahamas prison where SBF was reportedly heading - Fox Hill - is "harsh" due to "overcrowding, poor nutrition [and] inadequate sanitation," along with cells that are "infested with rats, maggots, and insects." "He will be in sick bay for orientation purposes and then we will determine where best to place him," said Bahamian Commissioner of Correctional Services Doan Cleare in a statement to Reuters. A 2021 U.S. State Department report said prisoners at Fox Hill described "infrequent access to nutritious meals and long delays between daily meals." "Maximum-security cells for men measured approximately six feet by 10 feet and held up to six persons with no mattresses or toilet facilities. Inmates removed human waste by bucket. Prisoners complained of the lack of beds and bedding," according to the report. "Some inmates developed bedsores from lying on bare ground. Sanitation was a general problem, and cells were infested with rats, maggots, and insects." "Overcrowding, poor sanitation, and inadequate access to medical care were problems in the Bahamas Department of Correctional Services men’s maximum-security block," the report continued. "The facility was designed to accommodate 1,000 prisoners but was chronically overcrowded." On Thursday, Bankman-Fried sought bail from the Bahamas Supreme Court following his Dec. 12 arrest. On Tuesday he was remanded to Fox Hill Prison after Chief Magistrate JoyAnn Ferguson rejected his request to remain at home while awaiting a hearing on his extradition to the US. link

|

|

|

|

Post by schwartzie on Dec 19, 2022 15:01:58 GMT -5

Bankman-Fried's Lawyer "Shocked" That Client Did Not Waive Right To Extradition

BY TYLER DURDEN MONDAY, DEC 19, 2022 - 12:50 PM Update (1250ET): Bankman-Fried reportedly wants to see the indictment against him before agreeing to extradition to the United States, according to Reuters, citing a statement made by SBF's attorney to a court in the Bahamas on Monday. He had been expected to waive his right to an extradition hearing on Monday morning, but in court demanded to see a copy of his federal indictment. As we detailed earlier, reports over the weekend suggested that Bankman-Fried would consent to extradition, but the former crypto billionaire told a different story Monday, demanding to see a copy of his federal indictment before agreeing to return to the U.S. He will return to Fox Hill jail rather than surrendering himself to U.S. custody. CNBC reports that in open court, chaos reigned. Bankman-Fried, dressed in a blue suit and white button down, was visibly shaking. His Bahamian defense attorney told the court that he was “shocked” that Bankman-Fried was in court. “I did not request him to be here this morning,” the attorney said. Franklyn Williams KC, the Bahamian prosecutor, said that he “understood that [Bankman-Fried] intended to waive extradition,” according to an NBC News producer present in the courtroom. As Cointelegraph notes, some members of the crypto space, including the team behind YouTuber Ben Armstrong, also known as Bitboy Crypto, reported on Twitter they appeared in person at the hearing to “look SBF in the eyes.” It appears crypto-criminal Sam Bankman-Fried would rather take his chances in the relative 'luxury' of an American jail than face another night in Bahamian's corrections department, as he is expected to accept extradition as soon as this morning. After being arrested and denied bail by a Bahamas court, the 30-year-old has been held at Fox Hill Prison in Nassau. The facility has been criticized in international reports for overcrowding and lacking sanitation. Reports indicate that he shares a cell with five other individuals. The NY Times reports one former Fox Hill inmate Sean Hall, who was freed from jail last year, said: “It’s no living situation for no type of living being.” According to Hall, the width of his cell was less than the span of his stretched arms, and they slept on bare metal bunk beds infested with insects. Another source acquainted with the situation told the Wall Street Journal that Sam Bankman-Fried’s team had provided meals that matched his dietary requirements, but they were uncertain as of Friday if he had received them. According to people familiar with the matter, Sam Bankman-Fried is due in a Bahamian court on Monday where he is expected to agree to be extradited to the US to face charges of fraud. Extradition will pave the way for a protracted legal showdown in the U.S. On Tuesday, the Southern District of New York of the Justice Department unsealed a 13-page criminal indictment. Bitcoinist reports, that, according to defense attorney Zachary Margulis-Ohnuma, Bankman-Fried would likely be detained at the Metropolitan Detention Center in Brooklyn upon arriving in the U.S., although some defendants are being kept at jails just outside of New York City owing to congestion at the facility. link

|

|

|

|

Post by schwartzie on Dec 20, 2022 15:01:57 GMT -5

Michigan Democrat Received $55,000 From FTX Employees Before Sponsoring Crypto Bill In Senate

by Liza Carlisle December 19, 2022 This month has seen an unfolding drama revolving around cryptocurrency and the giant FTX. At one point, FTX claimed to be worth $32 billion before its recent collapse. Founder Sam Bankman-Fried was sought for questioning, was found to be in the Bahamas, was asked to testify in Senate hearings about the matter, and was arrested by Bahamian authorities and denied extradition back to the United States until January. FTX has collapsed and declared bankruptcy. On Tuesday, Bankman-Fried was charged with eight criminal counts: conspiracy to commit wire fraud and securities fraud, individual charges of securities fraud and wire fraud, money laundering, and conspiracy to avoid campaign finance regulations. Now the focus on Bankman-Fried is diverted for the moment, as now there is evidence that a senator was receiving donations from FTX before its collapse. U.S. Sen. Debbie Stabenow, D-MI, received at least $55,600 in donations this year from employees of FTX. The cryptocurrency exchange platform declared bankruptcy after allegedly misusing client funds. Then, Stabenow, who as Agriculture Committee Chairwoman oversees the Commodities Future Trading Commission, a cryptocurrency regulator, sponsored legislation to regulate cryptocurrency, The Washington Examiner reports. Michigan Capital Confidential first reported the story, citing Federal Election Commission records. Coindesk reported that FTX founder Sam Bankman-Fried consistently met with regulators and lawmakers and pushed for crypto regulation, including lobbying for the Digital Commodities Consumer Protection Act, Stabenow’s bill. The bill seeks to give the CFTC more authority to regulate digital commodities like FTX. Bankman-Fried backed Stabenow’s bill and paid bill cosponsor Sen. John Boozman, R-Arkansas, $8,700; cosponsor Sen. Kirsten Gillibrand, D-N.Y., $5,800, and cosponsor Sen. Cory Booker, D-N.J,. $5,700, according to FEC records. Bankman-Fried tweeted on Oct. 18, 2022, “I’m optimistic that the Stabenow-Boozman’s bill will provide customer protection on centralized crypto exchanges without endangering the existence of software, blockchains, validators, DeFi, etc. If I were convinced I was wrong about that, I would not support it.” A message left Thursday seeking comment from Stabenow’s office hasn’t been returned. It’s unclear if Stabenow still supports the bill. The Examiner continues that prior to the collapse, senators were active in advancing legislation regarding the cryptocurrency exchange. In a Nov. 10 statement after FTX collapsed, Boozman doubled down on the need for the legislation. “Chairwoman Stabenow and I remain committed to advancing a final version of the DCCPA that creates a regulatory framework that allows for international cooperation and gives consumers greater confidence that their investments are safe,” he said. At a Sept. 15 hearing, Stabenow still backed the bill to enforce “guardrails” to protect consumers. “As its name suggests, our bill is focused on consumer protection,” Stabenow said. “It will require that platforms segregate and safeguard customer assets, hold sufficient capital and abide by rigorous cybersecurity standards. It will eliminate many of the conflicts of interest in this market. And it will mandate that platforms speak truthfully about the risks of trading digital commodities and don’t engage in misleading advertising.” Eyes are on the fate of the bill, and whether it will be successful given the fate of FTX and its founder who is in court in Nassau today. Meanwhile, back in the Bahamas, the 30-year-old Bankman-Fried who originally resisted extradition after his Bahamian arrest on December 12, is appearing in court today and is expected to reverse his position and waive his extradition rights, NBC News reports, according to a source with direct knowledge of the situation. His indictment in New York on eight counts spanning wire fraud, conspiracy to commit wire fraud, and violating campaign finance laws have prosecutors alleging that Bankman-Fried ” orchestrated yearslong fraud” on investors and customers. the U.S. Securities and Exchange Commission further has charged him with defrauding investors and enriching his private crypto hedge fund Alameda. At a congressional hearing on FTX’s collapse and missteps last week, the company’s new CEO, John J. Ray III lashed out at FTX’s leadership under Bankman-Fried. “The FTX Group’s collapse appears to stem from absolute concentration of control in the hands of a small group of grossly inexperienced and unsophisticated individuals who failed to implement virtually any of the systems or controls that are necessary for a company entrusted with other people’s money or assets,” Ray told lawmakers. There are other reports that an unnamed official at the prison where Bankman-Fried is being held in the Nassau that he came off to Bahamians as “a little arrogant” and “awfully scared” after arriving at the facility, but that he seemed like a “nice guy”. In light of Bankman-Fried’s about-face on the subject of extradition, it is possible his prison stay may have had an impact on his outlook. Business Insider has previously reported that Fox Hill prison, where Bankman-Fried has been held in the Bahamas, is “known to be overcrowded and understaffed, and inmates have said they lived among rat and maggot-infestations and had to remove human waste with buckets” according to a 2021 human rights report compiled by the U.S. State Department. link

|

|

|

|

Post by PurplePuppy on Dec 22, 2022 1:29:55 GMT -5

Sam Bankman-Fried’s Ex Girlfriend Caroline Ellison is Cooperating with Prosecutors After Pleading Guilty to Charges of Fraud and Conspiracy

By Cristina Laila Published December 21, 2022 at 10:23pm Sam Bankman-Fried’s ex-girlfriend Caroline Ellison, Alameda CEO, pleaded guilty to charges of fraud and conspiracy. According to US Attorney Damian Williams, Caroline Ellison is cooperating with prosecutors in the Southern District of New York. The SDNY also charged FTX co-founder Gary Wang with fraud. In a separate complaint, the SEC charged Ellison and Wang with securities fraud. Sam Bankman-Fried is in FBI custody and is on his way from the Bahamas to New York. WATCH: TGP’s Joe Hoft previously reported on the Clinton-Ellison connection. Gary Gensler is the current SEC Chairman under the Biden regime. Gensler was Hillary Clinton’s Campaign CFO and funded the notorious Trump-Russia lie. Gensler also taught at MIT with Glenn Ellison who is the father of Caroline Ellison. FTX CEO Sam Bankman-Fried was given favorable treatment from Gary Gensler. It was Gensler who not only failed to spot the FTX crime — he appeared set to go along with a legislative strategy that would have given SBF a regulatory moat and made him king of the U.S. crypto market. link

|

|

|

|

Post by schwartzie on Dec 22, 2022 14:11:21 GMT -5

"Broke" SBF Agrees To $250 Million Bond, House Arrest In Parents' House

BY TYLER DURDEN THURSDAY, DEC 22, 2022 - 01:39 PM Update (1330ET): After spending nine days in Bahamian jail, Sam Bankman-Fried arrived in a Manhattan federal courtroom to face fraud charges over the collapse of FTX, the cryptocurrency exchange he co-founded. Shackled and dressed in a blue suit, he appeared at a bail hearing after entering a plea ahead of the bail hearing. Prosecutors say that Bankman-Fried's counsel has consented to a bail package that include a $250 Million bond, home-detention (at his parent's residence in CA), location-monitoring, and the surrender of his passport. According to prosecutors, that is the "largest-ever pre-trial bond". That could be a problem given that he claimed he only has $100,000 left to his name... Bankman-Fried's mother was also at the court hearing... Barbara Fried, a professor emerita at Stanford Law School, was seen laughing during Bankman-Fried's hearing earlier this month in the Bahamas when her son was called a "fugitive." At other times, during that hearing, she "clenched her jaw and chewed on the frames of her glasses," according to a report in the New York Times. Not laughing any more are you... as she is forced to cosign the bail agreement, placing her properties as collateral. * * * Update (1045ET): As part of the recently unsealed plea agreement with the US Attorney's Office of the Southern District of New York, CoinDesk reports that if Ellison fully cooperates with the SDNY's investigation (in throwing her boyfriend under the bus), as well as any other law enforcement agency designated by the office, she won't be further prosecuted criminally. While the deal does not guarantee that other agencies will not pursue prosecution at a later date, it appears the former Alameda exec will be spared of all major charges, which could have seen her sentenced to up to 110 years in prison. Ellison was accused of seven counts. Two accused her of committing wire fraud on customers of FTX and engaging and conspiring to do so. Another two alleged she committed wire fraud on the lenders of Alameda Research and conspired to do so. Count five charged her with conspiracy to commit commodities fraud, and count six alleged conspiracy to commit securities fraud on FTX’s equity investors. The seventh count accused her of conspiring to commit money laundering. The Attorney’s Office agreed not to prosecute Ellison on any of those seven counts in exchange for her cooperation — the complete disclosure of all the information and documents demanded by prosecutors. Ellison will be permitted bail, provided she can provide a $250,000 personal recognizance bond and restrict travel to the continental United States. She will also need to surrender any travel documents she has. Finally, CoinDesk points out one interesting side-note in that the plea deal also contains language that says if Ellison is not a US citizen, it is very likely that her removal from the US will be mandatory. While it's assumed that Ellison is a US national, it is possible she may have abandoned her nationality for a citizenship of convenience for tax reasons which is a popular trend among some crypto traders living abroad, as the US taxes non-residents. It appears Bankman-Fried's girlfriend found a way to screw him one last time. * * * Two weeks ago, when amid reports that the former CEO of Alameda Capital (which as a reminder was ground zero of the FTX implosion after it blew up $8 billion in FTX client funds on trades gone horribly wrong), Caroline Ellison, was spotted in New York just after retaining Clinton superlawyer, Jamie Gorelick of Wilmer Hale, which as readers may recall was the former No. 2 ranking member in the Clinton Justice Department, and in a recent interview, she referred to current AG Merrick Garland as her "wingman", we asked if Caroline had rolled on Sam Bankman-Fried, who was also her former lover. Fast forward to today when we just got confirmation that Caroline Ellison has fucked Bankman-Fried one final time by indeed rolling on him, and "turning states" in the criminal prosecution of the corpulent "Hairy Plotter", who commingled and stole the client money in his FTX exchange to fund a series of terrible crypto bets at his personal hedge fund Alameda, fund tens of millions in donations to democrats and buy up prestigious real estate for himself and his "altruistic" progressive lawyer parents. According to a Manhattan Federal prosecutor, two of FTX founder Sam Bankman-Fried’s closest associates have pleaded guilty to fraud and agreed to co-operate with US authorities investigating the collapse of the bankrupt cryptocurrency exchange. In other words, they took a plea deal to avoid even more prison time in exchange for serving SBF on a silver platter to the Feds. Damian Williams, the US attorney for the Southern District of New York, announced the guilty pleas and criminal charges against Caroline Ellison and Zixiao “Gary” Wang, the low profile co-founder of FTX, in a short video statement. His office had brought eight charges against Bankman-Fried last week. Ellison pleaded guilty to seven counts, including wire and securities fraud and conspiracy to commit money laundering, which carry a maximum sentence of 110 years in prison, while Wang pleaded guilty to four counts of fraud, with a maximum 50-year sentence. The documents said prosecutors would not oppose bail requests from both defendants under certain conditions, including posting a bond and handing in their travel documents, as they awaited formal sentencing. Concurrently, the Securities and Exchange Commission and the Commodity Futures Trading Commission also filed civil lawsuits against the 28-year-old Ellison and 29-year-old Wang, accusing them of fraud. “As part of their deception, we allege that Caroline Ellison and Sam Bankman-Fried schemed to manipulate the price of FTT, an exchange crypto security token that was integral to FTX, to prop up the value of their house of cards,” said SEC chair Gary Gensler. Furthermore, as CEO of the FTX trading affiliate, Ellison “used FTX’s customer assets to pay Alameda’s debts” and diverted billions of dollars of depositors’ money to the company to fill a hole caused by a crypto market crash in May, the SEC’s complaint alleges. The CFTC said Wang had a hand in creating some of the algorithms that underpinned FTX, which allowed Alameda “to maintain an essentially unlimited line of credit” on the exchange, giving it an “unfair advantage” over regular depositors. “These critical code features and structural exceptions allowed Alameda to secretly and recklessly siphon FTX customer assets from the FTX platform." Both defendants are co-operating with the SEC, the agency said. The CFTC said they were not contesting their liability. Which means that SBF is looking at a lot of prison time, unless he too can throw someone even more important and powerful under the bus... ... although if that is the case, he probably will be Epsteined within hours of arriving at MDC Brooklyn, singe MCC New York where Epstein "killed himself", has been closed since August 2021 due to deteriorating conditions. While Ellison's superlawyers have yet to make a statement, a lawyer for Wang, Ilan Graff, said: “Gary has accepted responsibility for his actions and takes seriously his obligations as a co-operating witness.” Last week, the DOJ filed charges against Bankman-Fried and accused him of orchestrating “one of the biggest financial frauds in American history” by misappropriating customer assets from FTX to Alameda Research. He was arrested in the Bahamas, where he lives. He is also facing parallel civil cases from the SEC and CFTC. Williams reiterated his call for others who worked with Bankman-Fried to come forward. “If you participated in misconduct at FTX or Alameda, now is the time to get ahead of it,” he said. “We are moving quickly and our patience is not eternal.” One of them is former Alameda CEO Sam Trabucco, best known for quietly bailing on Sam just as everyone was about to blow up and fleeing on his multi-million dollar new yacht. The announcement from Williams comes just after a plane carrying Bankman-Fried took off from the Bahamas, where he waived his right to challenge extradition to the US. He is due to appear in a Manhattan court as soon as Thursday, where his bail request will be considered, although in light of Caroline's plea, it is safe to say it won't be granted. The details in the SEC's complaint have been laid out nicely by the following twitter account... link

|

|

|

|

Post by maybetoday on Dec 23, 2022 21:28:58 GMT -5

Caroline Ellison Admits She and Sam Bankman-Fried Conspired to Mislead FTX Investors and Customers

By Cristina Laila Published December 23, 2022 at 7:20pm Sam Bankman-Fried’s ex-girlfriend Caroline Ellison, Alameda CEO, pleaded guilty to charges of fraud and conspiracy. According to US Attorney Damian Williams, Caroline Ellison is cooperating with prosecutors in the Southern District of New York. The SDNY also charged FTX co-founder Gary Wang with fraud. In a separate complaint, the SEC charged Ellison and Wang with securities fraud. Caroline Ellison admitted she and Sam Bankman-Fried conspired to mislead FTX investors and customers. Ellison said her former company Alameda had access to FTX’s cash which ultimately afforded her an unlimited line of credit with no oversight. Because of this arrangement, Alameda was able to ‘borrow’ money from FTX without having to put up any collateral or be subject to margin calls. “From 2019 through 2022, I was aware that Alameda was provided access to a borrowing facility on FTX.com, the cryptocurrency exchange run by Mr. Bankman-Fried,” Ellison said. “In practical terms, this arrangement permitted Alameda access to an unlimited line of credit without being required to post collateral, without having negative balances and without being subject to margin calls on FTX.com’s liquidation protocols.” Fox Business reported: Former Alameda Research CEO Caroline Ellison said she and FTX co-founder Sam Bankman-Fried misled lenders about how much the company was borrowing from the cryptocurrency exchange. Ellison revealed her actions in a Dec. 19 plea hearing in a Manhattan federal court, Bloomberg reported. “I am truly sorry for what I did. I knew that it was wrong,” she said, according to a transcript of the hearing in which she acknowledged the financial ties between her company and FTX. Bankman-Fried, 30, the disgraced crypto exchange founder, faces multiple charges from the Southern District of New York and the Securities and Exchange Commission. The charges include conspiracy to commit wire fraud, wire fraud, conspiracy to commit commodities fraud, conspiracy to commit securities fraud, conspiracy to commit money laundering, and conspiracy to defraud the Federal Election Commission and commit campaign finance violations. He was released Thursday on $250 million bond after his arrest in the Bahamas earlier this month. Ellison said that “if Alameda’s FTX accounts had significant negative balances in any particular currency, it meant that Alameda was borrowing funds that FTX’s customers had deposited on the exchange,” the Bloomberg report said. link

|

|

|

|

Post by schwartzie on Dec 24, 2022 17:49:10 GMT -5

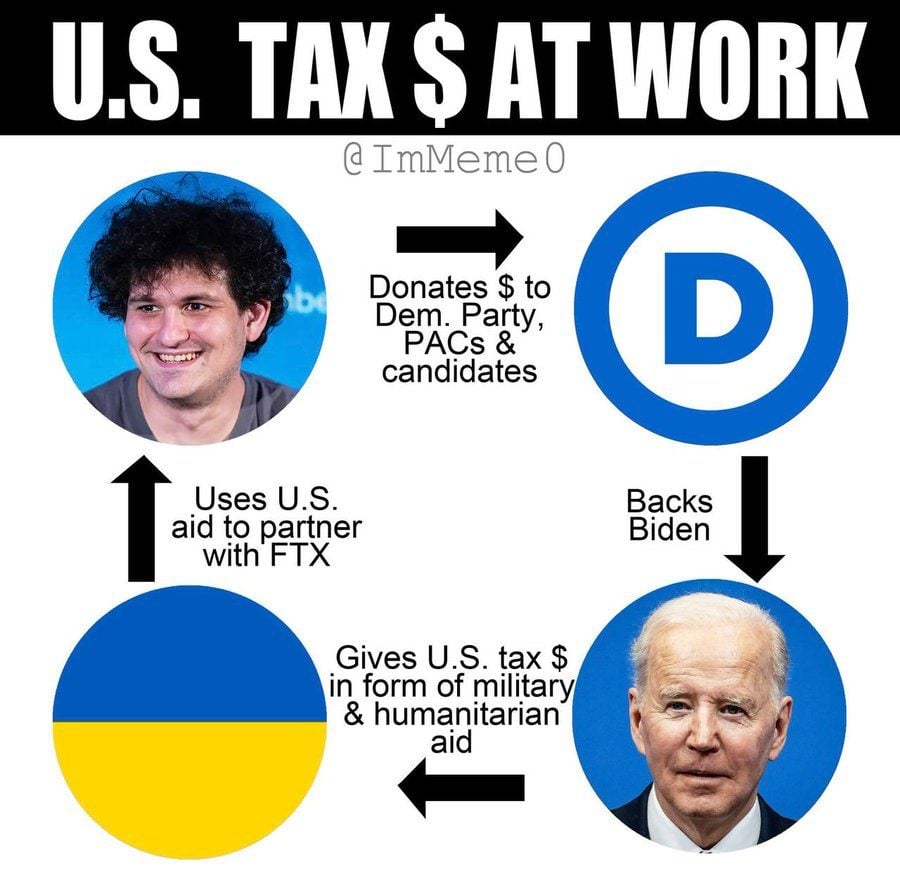

Secret Back Channel Between FTX and White House Closed the Day After FTX Filed for Bankruptcy

By Joe Hoft Published December 24, 2022 at 1:50pm A secret back channel between FTX and the Biden White House shut down the day after FTX filed for bankruptcy. In November TGP reported that billions were sent to Ukraine from the US. Ukraine took some of this money and invested it in FTX. FTX took millions of dollars and invested them in US politicians. The far-left Washington Post reported on March 3 that Ukraine was dealing in crypto. The Ukrainian government has gathered more than $42 million in cryptocurrency donations since Saturday, plus digital artwork including a limited edition worth roughly $200,000, according to blockchain analytics firm Elliptic. The challenge is how the country cashes in on these assets to fund its war needs. Amid the Russian invasion of Ukraine, the CEO of FTX, Sam Bankman Fried has come forward to help a crypto donation project. He humbly announced that FTX will be supporting the Ukrainian Ministry of Finance and other communities in collecting crypto donations for the country. The Ukrainian government has received over $60 million in crypto donations from all over the world. FTX’s CEO, Sam Bankman Fried highlighted that the war in Ukraine has been dragging on. The country is in full need of humanitarian help and access to global financial infrastructure. He also called attention to sanctions and crypto during this kind of situation. He indicated that crypto exchanges should enforce sanctions announced by the government seriously. This was all laid out in our post.  Now we’ve learned that FTX and the Biden White House participated in a back channel that was closed the day after FTX went bankrupt. This all came from a report at far-left Politico. They reported on Thursday that Democrat operative and close advisor to Bankman-Fried named Sean McElwee had a direct backchannel setup with the White House. McElwee is a well-known progressive activist who started the “Abolish ICE” movement and in 2018 founded Data for Progress, a progressive think tank with an emphasis on influencing public policy through polling. DFP quickly embedded itself into the top layers of the Democratic firmament. More recently, McElwee became a close political ally and adviser to FTX founder SAM BANKMAN-FRIED. (They were connected through Shor, according to a friend of both men.) McElwee had easy access to the White House and the press. And he made sure they had access to him. He kept an open Slack channel at DFP that became a rolling conversation between McElwee, Biden administration officials and some well-known reporters — a kind of JournoList for the early 2020s. On Nov. 12, the day after FTX filed for bankruptcy and SBF resigned as CEO, McElwee abruptly shuttered the Slack channel. Six days later, he and Data for Progress began negotiating his exit from the firm he had built. At the time, the reported reason for the rupture was that McElwee’s well-known penchant for betting on the outcomes of elections created a conflict of interest for a polling firm. A slew of 2022 DFP polls had a GOP bias, and activists on Twitter — as well as some prominent Democrats pinging reporters — asked whether McElwee was cooking DFP’s polls to affect races and cash in. Sources at DFP insist that this would have been highly unlikely, and that their polls had a GOP bias because of an oversampling of respondents via SMS. In the wake of this, DFP recently adopted a previously unreported “Gambling and Wagering Policy” that prohibits employees from betting on anything related to DFP projects or clients. The McElwee-DFP breakup was ugly, but the two sides were trying to negotiate an amicable separation agreement and a severance. Then on Dec. 13, the U.S. Attorney for the Southern District of New York unsealed an eight-count indictment against SBF. The first seven counts, which were about financial crimes, garnered the most attention. But it was the eighth count that turned heads in Washington, alleging a straw-donor scheme in which SBF funneled corporate money to candidates and committees through third parties. And SDNY alleged that SBF had help: SBF “and others known and unknown,” the indictment says, made contributions “in the names of other persons.” Bonchie at Red State shares: To say there are a lot of red flags with this situation is to understate things dramatically, and the questions surrounding the administration’s involvement become obvious with this news. What exactly was McElwee, operating as an advisor to Bankman-Fried, passing along to the White House? What exactly was the White House telling McElwee? Were they coordinating donations? Discussing messaging? Trading favors and influence? Or was there something even more sinister going on? So far, Democrats have done their best to distance themselves from the man who was their second-largest donor in 2022, but these relationships aren’t going away just because the mainstream press ignores them. Having a secret backchannel with the White House is a big deal, and people deserve to know what their government was doing coordinating with a scam artist like Bankman-Fried. We subsequently learned that over $20 billion awarded to Ukraine this past year is unaccounted for. Maybe the missing billions are not related to FTX at all. We don’t know. But we do know that Biden gave billions to Ukraine. Ukraine was involved with FTX and FTX donated millions to Democrat candidates. They may have talked about this on their back channel. More at link

|

|

|

|

Post by shalom on Dec 28, 2022 23:28:40 GMT -5

Sam Bankman-Fried to Enter Plea Deal in FTX Ponzi Scheme Case

By Cristina Laila Published December 28, 2022 at 4:20pm Sam Bankman-Fried is expected to enter a plea deal next week in the FTX Ponzi scheme case. Former FTX CEO Sam Bankman-Fried’s case was assigned to Bill Clinton-appointed District Judge Lewis Kaplan. TGP reported that after allowing SBF to return home to his parents’ house before Christmas that the judge who set him free next recused herself from the case because of her husband’s conflicts. This is good news for Sam Bankman-Fried. Judge Kaplan is part of the Deep State Democrat gang. Judge Kaplan has allowed E. Jean Carroll to sue President Trump for alleged rape. A Case President Trump has adamantly denied. Reuters reported: Sam Bankman-Fried is expected to enter a plea next week to criminal charges he defrauded investors and looted billions of dollars in customer funds at his failed FTX cryptocurrency exchange. The 30-year-old is expected to be arraigned on the afternoon of Jan. 3, 2023, before U.S. District Judge Lewis Kaplan in Manhattan federal court, court records on Wednesday showed. Kaplan was assigned to the case on Tuesday, after the original judge recused herself because her husband’s law firm had advised FTX before its collapse. Prosecutors have accused Bankman-Fried of engaging in a years-long “fraud of epic proportions,” by using customer deposits to support his Alameda Research hedge fund firm, buy real estate and make political contributions. Sam Bankman-Fried’s ex-girlfriend Caroline Ellison, Alameda CEO, pleaded guilty to charges of fraud and conspiracy last week. Sam Bankman-Fried's former girlfriend, Caroline Ellison, has agreed to cooperate with federal agents investigating the former FTX CEO. According to US Attorney Damian Williams, Caroline Ellison is cooperating with prosecutors in the Southern District of New York. The SDNY also charged FTX co-founder Gary Wang with fraud. In a separate complaint, the SEC charged Ellison and Wang with securities fraud. Caroline Ellison admitted she and Sam Bankman-Fried conspired to mislead FTX investors and customers. Ellison said her former company Alameda had access to FTX’s cash which ultimately afforded her an unlimited line of credit with no oversight. Because of this arrangement, Alameda was able to ‘borrow’ money from FTX without having to put up any collateral or be subject to margin calls. “From 2019 through 2022, I was aware that Alameda was provided access to a borrowing facility on FTX.com, the cryptocurrency exchange run by Mr. Bankman-Fried,” Ellison said. “In practical terms, this arrangement permitted Alameda access to an unlimited line of credit without being required to post collateral, without having negative balances and without being subject to margin calls on FTX.com’s liquidation protocols.” link

|

|

|

|

Post by ExquisiteGerbil on Dec 29, 2022 4:28:01 GMT -5

SBF Case Moved to Clinton Appointed Judge Lewis Kaplan Who’s Allowed Garbage Trump Rape Case to Continue and Oversaw Prince Andrew Case Too

By Joe Hoft Published December 27, 2022 at 8:20pm Here we go again. Former FTX CEO Sam Bankman-Fried’s case was assigned to Bill Clinton-appointed District Judge Lewis Kaplan. TGP reported that after allowing SBF to return home to his parents’ house before Christmas that the judge who set him free next recused herself from the case because of her husband’s conflicts. Zerohedge reported today: So fast forward to today when Sam Bankman-Fried’s criminal case was reassigned to Bill Clinton-appointed District Judge Lewis Kaplan, recently known for handling a Epstein-linked sexual abuse lawsuit against Britain’s Prince Andrew, and defamation lawsuits against Donald Trump, and is also known for presiding over a number of federal racketeering cases involving Mafia members. In April 2010, Kaplan was assigned to preside over the cases of 14 Gambino crime family members arrested on charges, among others, of racketeering, racketeering conspiracy, witness tampering (in the 1992 trial of John Gotti), and sex trafficking of a minor. This is good news for SBF. Judge Kaplan is part of the Deep State Democrat gang. Judge Kaplan has allowed E. Jean Carroll to sue President Trump for alleged rape. A Case President Trump has adamantly denied. The former president will have to sit for a deposition on 19 October and answer questions under oath, US District Judge Lewis A Kaplan ruled on Wednesday (12 October). Mr Trump’s legal team had asked for the testimony to be delayed – a request now denied by the judge. Roberta Kaplan, Ms. Carroll’s attorney, said in a statement: “We are pleased that Judge Kaplan agreed with our position not to stay discovery in this case.” Mr Trump has denied Carroll’s allegations. Alina Habba, his attorney, told The Associated Press in a statement: “We look forward to establishing on the record that this case is, and always has been, entirely without merit.” In his ruling, Judge Kaplan wrote that “the defendant should not be permitted to run the clock out on plaintiff’s attempt to gain a remedy for what allegedly was a serious wrong,” and cited the “advanced age” of the parties. MrTrump is 76 years old and Ms Carroll is 78. Carroll’s interviews on TV concerning her allegations should have been enough to throw out any case but not with Judge Kaplan. It’s against President Trump. Judge Kaplan also oversaw the sexual abuse (Jeffrey Epstein-related) case against Prince Andrew. A U.S. judge dismissed the sex abuse lawsuit against Britain’s Prince Andrew on Tuesday, three weeks after lawyers for the American woman who filed it reached a deal calling for the prince to make a substantial donation to his accuser’s charity and declare he never meant to malign her character. U.S. District Judge Lewis A. Kaplan signed court papers dismissing the August lawsuit after lawyers on both sides asked him to do so earlier in the day. The judge had given them until March 17 to complete the deal or he would set a trial date. The lawsuit cannot be refiled. The lawyers revealed three weeks ago that they had tentatively agreed to a settlement in which the prince would donate to Virginia Giuffre’s charity and make the declaration about her character. Andrew strenuously denied Giuffre’s allegations after she sued him, accusing the British royal of sexually abusing her while she traveled with financier Jeffrey Epstein in 2001 when she was 17. Kaplan has been around for some time after being appointed by Clinton. He’s the perfect judge for SBF. More at link

|

|

|

|

Post by Midnight on Dec 30, 2022 4:19:41 GMT -5

Disgraced Crypto Billionaire and Top Democrat Donor Sam Bankman-Fried Met with Biden Officials at Least 4 Times, Including in September

By Jim Hoft Published December 29, 2022 at 9:20pm  Top Democrat donor and disgraced crypto billionaire, Sam Bankman-Fried, met with Biden officials at least 4 times in 2022 including a meeting in September with White House advisor Steve Ricchetti. Sam Bankman-Fried, the CEO of FTX cryptocurrency exchange, announced in May that he would donate “north of $100 million” and up to a “soft ceiling” of $1 billionfor the Democrat candidate running against President Donald Trump in the 2024 race. Bankman-Fried donated over $40 million to Democrats in the 2022 midterm elections. FTX was laundering money from Ukraine and moving millions to donate to Democrats in the 2022 midterms. It was a nifty trick by Democrats to get some easy campaign cash Earlier this month Elon Musk said suggested that donations to Democrats were likely much larger than the $40 million declared and as high as $1 billion! The truth is likely somewhere in between the two numbers.  Ukraine funneled millions, if not billions, of international donations into FTX, Bankman-Fried’s company before it went belly-up. The Daily Mail reported: Disgraced cryptocurrency mogul Sam Bankman-Fried met with four Biden officials this year before the collapse of his FTX empire and his arrest in the Bahamas. The Democratic donor, 30, awaiting trial for what prosecutors say is one of the biggest financial frauds in U.S. history held talks with senior White House advisor Steve Ricchetti on September 8, Bloomberg reported on Thursday. He has had at least two other meetings with Ricchetti on April 22 and May 12 and another with top aide Bruce Reed. Bankman-Fried’s brother Gabriel also participated in a meeting on his own on May 13. The latest report is further evidence of the deep ties Bankman-Fried had with Washington before he was charged with swindling investors out of at least $1.8 billion. link

|

|

|

|

Post by schwartzie on Dec 30, 2022 17:11:51 GMT -5

NEW: FTX Founder Sam Bankman-Fried to Likely Plead Not Guilty to Fraud at Next Week’s Hearing: Report

By Cristina Laila Published December 30, 2022 at 2:41pm Sam Bankman-Fried will likely plead not guilty to fraud in next week’s hearing according to The Wall Street Journal. Former FTX CEO Sam Bankman-Fried’s case was assigned to Bill Clinton-appointed District Judge Lewis Kaplan. TGP reported that after allowing SBF to return home to his parents’ house before Christmas that the judge who set him free next recused herself from the case because of her husband’s conflicts. Judge Kaplan is part of the Deep State Democrat gang. Judge Kaplan has allowed E. Jean Carroll to sue President Trump for alleged rape. A Case President Trump has adamantly denied. Sam Bankman-Fried’s ex-girlfriend Caroline Ellison, Alameda CEO, pleaded guilty to charges of fraud and conspiracy last week. Sam Bankman-Fried's former girlfriend, Caroline Ellison, has agreed to cooperate with federal agents investigating the former FTX CEO. According to US Attorney Damian Williams, Caroline Ellison is cooperating with prosecutors in the Southern District of New York. The SDNY also charged FTX co-founder Gary Wang with fraud. In a separate complaint, the SEC charged Ellison and Wang with securities fraud. Caroline Ellison admitted she and Sam Bankman-Fried conspired to mislead FTX investors and customers. Ellison said her former company Alameda had access to FTX’s cash which ultimately afforded her an unlimited line of credit with no oversight. Because of this arrangement, Alameda was able to ‘borrow’ money from FTX without having to put up any collateral or be subject to margin calls. “From 2019 through 2022, I was aware that Alameda was provided access to a borrowing facility on FTX.com, the cryptocurrency exchange run by Mr. Bankman-Fried,” Ellison said. “In practical terms, this arrangement permitted Alameda access to an unlimited line of credit without being required to post collateral, without having negative balances and without being subject to margin calls on FTX.com’s liquidation protocols.” link

|

|

|

|

Post by schwartzie on Dec 31, 2022 14:24:46 GMT -5

Bahamas Says It’s Keeping $3.5 Billion of FTX Assets – FTX Says Bahamas is Holding Only $296 Million

By Joe Hoft Published December 31, 2022 at 10:30am Yesterday the Bahamas claimed that they were holding $3.5 billion in FTX assets to pay back those who lost money from the now-bankrupt company. FTX says Bahamas is holding much less. Yesterday it was reported that the Bahamas is holding $3.5 billion in FTX assets. Bahamian regulators took control of digital assets worth $3.5 billion from FTX’s local subsidiary in early November, a day after the cryptocurrency exchange filed for bankruptcy in the U.S. The Securities Commission of the Bahamas took the assets from FTX Digital Markets, citing “imminent dissipation” of the funds due to risks against the exchange, including hack attacks, the regulator said Thursday. The agency says it will temporarily retain “exclusive control” of the assets, which it’s storing in “secure digital wallets,” until the Bahamas Supreme Court directs it to return them to customers and creditors. FTX witnessed a flurry of fund movement in the hours after the company filed for Chapter 11 bankruptcy. Around that time, an unidentified hacker using the moniker “accounts drainer” stole nearly $400 million worth of tokens from the company. On Nov. 12, FTX acknowledged that an unidentified entity had “unauthorized access to certain assets,” and pledged to “secure all assets, wherever located,” according to a statement published by FTX U.S. General Counsel Ryne Miller, attributed to newly installed CEO John J. Ray III. He was appointed after CEO and founder Sam Bankman-Fried stepped down. However, later yesterday, FTX came out and said that the Bahamas is holding much less of FTX’s assets – more like $296 million rather than the $3.5 billion. FTX on Friday disputed claims by the Securities Commission of the Bahamas (SCB) that the regulator was holding $3.5 billion of the bankrupt cryptocurrency exchange’s assets. When the Commission seized the digital assets of FTX in November, they were worth just $296 million, FTX said in a statement. FTX urged the commission to “clear up any confusion” about the assets it holds and their value. The regulator began liquidation proceedings against FTX Digital Markets Ltd., the company’s Bahamas-based unit, in November. FTX said it will seek the return of any assets seized, because FTX DM is only a “local service company” which does not own the FTX.com exchange or any of the cryptocurrency seized. SCB said Thursday it had seized over $3.5 billion in cryptocurrency and was holding those funds for future repayment to FTX’s customers and other creditors. SCB did not identify the type of cryptocurrency seized or say how it was valued. FTX said Friday that most of the seized cryptocurrency was in the form of FTX’s proprietary FTT tokens. The seized FTT tokens would have plunged in value to $167 million as of Dec. 20, and the SCB may be unable to find a buyer for such a large stake even at that lowered price, FTX said. SCB did not immediately respond to a request for comment Friday. Unfortunately for the Bahamas, the investments of FTX that they are holding are in large part the garbage cryptocurrency created by FTX that was almost worthless. The SCB hasn’t commented because they are too shocked to speak about their safeguarding assets that are worthless. As TGP reported earlier, FTX is still trying to determine how much it owes and how much money it has. This is a total trainwreck. link

|

|

|

|

Post by PurplePuppy on Jan 5, 2023 1:55:52 GMT -5

THE FIX IS IN: Sam Bankman-Fried Has a Clinton Judge, Soros-Related Biden-Appointed Prosecutor, and His Case Is in the Corrupt SDNY

By Joe Hoft Published January 4, 2023 at 8:10pm Could this be a coincidence or is the fix in? Sam Bankman-Fried was arrested on multiple counts of fraud after billions of dollars went missing from his cryptocurrency exchange FTX. It’s still unknown how much money went missing. When we found that the government’s case against SBF was initiated out of the DOJ’s corrupt Southern District of New York (SDNY) we knew the fix was in. The SDNY is the same district that brought charges against innocent We Build the Wall (WBTW) figures in a political hit. The attorneys in the SDNY were certainly not going to prosecute SBF in the same manner they went after WBTW patriots. They certainly weren’t going to look into FTX’s activities in Ukraine and with the Democrats as well. We also found that the first judge over the case had conflicts of interest and still she allowed SBF to spend the holidays at his parents’ house in California, flying first class there. Then when the first judge recused herself for her conflicts with FTX, the next judge placed over the case is Bill Clinton appointed Judge Lewis Kaplan. Kaplan has allowed the unfounded rape case against President Trump to move forward. Based on her interview on CNN, the accuser appears certifiable. But this Clinton Judge allowed it to move forward. We’ve learned that in addition to being run in the SDNY and having a Clinton judge, the prosecuting attorney in SBF’s case is a Joe Biden-appointed Soros-related attorney who recently oversaw the Ghislaine Maxwell case. Damian Williams was appointed by Joe Biden to the SDNY in 2021. He’s a Democrat who worked for John Kerry’s campaign in 2004. He then attended Yale where he was supported by the Paul and Daisy Soros Fellowships for New Americans. Williams was also a law clerk for Merrick Garland. What are the odds that all these connections are overseeing the SBF case? With these bad actors, what are the odds they find the billions of dollars that are currently missing? More at link

|

|

|

|

Post by schwartzie on Jan 7, 2023 20:42:04 GMT -5

AUDACIOUS: SBF Demands Bankruptcy Court to Hand Over $450 million in Robinhood Stock to Help Him Pay His Legal Bills.

By Joe Hoft Published January 7, 2023 at 9:00am Oh, the Audacity! Sam Bankman-Fried Demands Bankruptcy Court to Hand Over $450 million in Robinhood Stock. Guest post by Bob Bishop Sam Bankman-Fried and his Stanford law professor parents, Joe Bankman and Barbara Fried are highly anxious legal fees will bankrupt the family. However, they received an unheard-of precedent by the Obama-appointed judge, Ronnie Abrams, granting a $250 million recognizant bond secured by his parents’ home valued at $4 million and a court-ordered ruling hiding two sureties. Judge Ronnie Abrams has since recused herself from the criminal case due to her husband’s firm relationship with FTX. SBF’s latest and outrageous legal maneuver demands $450 million in Robinhood stock be handed over by the bankruptcy court to pay his legal bills.  SBF’s Alameda Research purchased the 56.3 million Robinhood shares (symbol HOOD) using investor and FTX customer funds for $648 million. Accordingly, SBF and Alameda Research should have filed the required SEC 13D filing for acquiring over 5% of Robinhood’s outstanding shares. SBF then conveyed ownership to his off-shore Antigua corporation, Emergent Fidelity Technologies, secured by promissory notes to Alameda. Off-shoring is a strategy for tax avoidance, relaxed regulations, or asset protection. Emergent and SBF subsequently filed a 13D. The current market price of Robinhood has collapsed, resulting in a $189 million unrealized loss to Emergent or, in substance, FTX creditors.  What audacity to demand the release of shares to provide adequate legal defense for SBF while “the FTX creditors face only the possibility of economic loss.” “When people get used to preferential treatment, equal treatment seems like discrimination.” — Thomas Sowell link

|

|

|

|

Post by Midnight on Jan 13, 2023 3:04:31 GMT -5

FTX’s Sam Bankman-Fried Posts His Manifesto on Social Media and It’s Crazy

By Joe Hoft Published January 12, 2023 at 3:35pm Sam Bankman-Fried released a manifesto today mirroring his Substack account where he claims his innocence in FTX’s bankruptcy. Hat tip Bob Bishop SBF summarized his points – In mid November, FTX International became effectively insolvent. The FTX saga, at the end of the day, is somewhere between that of Voyager and Celsius. Three things combined together to cause the implosion: a) Over the course of 2021, Alameda’s balance sheet grew to roughly $100b of Net Asset Value, $8b of net borrowing (leverage), and $7b of liquidity on hand. b) Alameda failed to sufficiently hedge its market exposure. Over the course of 2022, a series of large broad market crashes came–in stocks and in crypto–leading to a ~80% decrease in the market value of its assets. c) In November 2022, an extreme, quick, targeted crash precipitated by the CEO of Binance made Alameda insolvent. And then Alameda’s contagion spread to FTX and other places, similarly to how Three Arrows etc. ultimately impacted Voyager, Genesis, Celsius, BlockFi, Gemini, and others. Despite this, very substantial recovery remains potentially available. FTX US remains fully solvent and should be able to return all customers’ funds. FTX International has many billions of dollars of assets, and I am dedicating nearly all of my personal assets to customers. SBF Claims FTX US is in good shape in an apparent attack on the DOJ. This post is about FTX International’s (in)solvency.It’s not about FTX US, because FTX US is fully solvent and always has been When I passed FTX US off to Mr. Ray and the Chapter 11 team, it had around +$350m net cash on hand beyond customer balances. Its funds and customers were segregated from FTX International. It’s ridiculous that FTX US users haven’t been made whole and gotten their funds back yet. Here is my record of FTX US’s balance sheet as of when I handed it off:  FTX International was a non-US exchange. It was run outside the US, regulated outside the US, incorporated outside the US, and took non-US customers. (In fact, it was primarily headquartered, run from, and incorporated in The Bahamas, as FTX Digital Markets LTD.) US customers were onboarded to the (still solvent) FTX US exchange. SBF says that he did nothing wrong and he kindly would offer up some of his funds if he could use his Robinhood money for legal expenses. I didn’t steal funds, and I certainly didn’t stash billions away. Nearly all of my assets were and still are utilizable to backstop FTX customers. I have, for instance, offered to contribute nearly all of my personal shares in Robinhood to customers–or 100%, if the Chapter 11 team would honor my D&O legal expense indemnification. TGP wrote about this Robinhood request previously. SBF goes on to say the problem was the market lost 80% of its value and he still doesn’t have access to the passwords to FTX systems. Next, SBF gets into the details and says that he received an audit report that confirmed his analysis of the firm’s financial standing. However, he doesn’t note that this was not full audit by a Big 4 accounting firm, it was something much less than that. Then SBF says that: There were billions of dollars of funding offers when Mr. Ray took over, and more than $4b that came in after. But this sounds like a Ponzi scheme. Is he saying that more funding could have been used to offset the billions lost with no attached liabilities? SBF goes on to say that he wanted to share this all in front of the Democrat House but he was unfortunately arrested the night before. I had been planning to give my first substantive account of what happened in testimony to the US House Financial Services Committee on December 13th. Unfortunately, the DOJ moved to arrest me the night before, preempting my testimony with an entirely different news cycle. For what it’s worth, a draft of the testimony I planned to give leaked out here. It’s very puzzling why SBF’s lawyers would allow him to release this message. This whole FTX case smells really bad. What is the truth? More at link

|

|

|

|

Post by schwartzie on Jan 14, 2023 22:55:58 GMT -5

Revealed: FTX Attorney Reveals Co-Founder of Company Was Ordered to Create “Secret Backdoor” for Laundering Money

By Jim Hoft Published January 14, 2023 at 4:20pm Where did this guy come from? How did he become a multi-millionaire? Was he a government asset? Was he used by the elites to funnel money to fellow elites? Was he used by the deep state to sabotage crypto currencies? How much money did he ultimately funnel to Democrats and their causes? The attorney for FTX testified in court that the co-founder of the crypto company used a secret backdoor to launder money to Alameda Research. FTX Crypto went bankrupt last year, its owner losing millions of dollars. FTX owner Sam Bankman-Fried was the second biggest donor to Democrats in the 2022 midterms. TRENDING: BREAKING: COVER UP: Lawyers Found More Classified Documents in Biden's Private Library Than Previously Known The Daily Mail reported: A bombshell testimony has revealed that the co-founder of cryptocurrency exchange FTX was ordered by Sam Bankman-Fried to create a ‘secret’ backdoor to funnel money to Alameda Research. Attorney for FTX Andrew Dietderich told the Delaware bankruptcy court on Wednesday that Gary Wang was told to create the secret line of credit of customer funds from FTX to the hedge fund. Dietderich told the court that Wang ‘created this backdoor by inserting a single number into millions of lines of code for the exchange’ creating the line of credit, which ‘customers did not consent’ to. The FTX attorney testified that the backdoor was a ‘secret way for Alameda to borrow from customers on the exchange without permission,’ Business Insider reported. link

|

|

|

|

Post by schwartzie on Jan 15, 2023 16:27:31 GMT -5

Sam Bankman-Fried (SBF) Moved at Least $10 Billion Between FTX and Alameda Research and Created a $65 Billion LOC from FTX Customers Without Their Consent or Knowledge

By Joe Hoft Published January 15, 2023 at 7:30am Sam Bankman-fried (SBF) took $65 billion from FTX accounts without the customer’s knowledge. A couple of days ago SBF released his manifesto where he claimed that he did nothing wrong that resulted in cryptocurrency exchange FTX going bankrupt. He said if he would have been able to receive more funds he could have paid off the debt that was due which sounds more like a Ponzi scheme than apparently SBF understood. One thing SBF left out in his manifesto was that he had $65 billion removed from FTX cryptocurrency accounts. The Daily Mail reported: A bombshell testimony has revealed that the co-founder of cryptocurrency exchange FTX was ordered by Sam Bankman-Fried to create a ‘secret’ backdoor to funnel money to Alameda Research. Attorney for FTX Andrew Dietderich told the Delaware bankruptcy court on Wednesday that Gary Wang was told to create the secret line of credit of customer funds from FTX to the hedge fund. Dietderich told the court that Wang ‘created this backdoor by inserting a single number into millions of lines of code for the exchange’ creating the line of credit, which ‘customers did not consent’ to. The FTX attorney testified that the backdoor was a ‘secret way for Alameda to borrow from customers on the exchange without permission,’ Business Insider reported. ‘Wang created this backdoor by inserting a single number into millions of lines of code for the exchange, creating a line of credit from FTX to Alameda, to which customers did not consent,’ Dietderich testified. ‘And we know the size of that line of credit. It was $65 billion.’ Business Insider goes on to report that at least $10 billion was moved between FTX and Alameda with another $2 billion unaccounted for. What Americans really want to know is how much money went to dirty politicians’ accounts. More at link

|

|

|

|

Post by songbird on Jan 18, 2023 20:34:48 GMT -5

FTX Detailed Recovery Plan Released – Executives Could Borrow Billions from Customers with No Collateral – $250 Million in Bahamas Property Purchased

By Joe Hoft Published January 18, 2023 at 1:05pm The FTX bankruptcy court has released a detailed recovery plan to maximize billions in customer and stakeholder recoveries. Those overseeing FTX have provided a document that they claim might materially change that lists the assets the company has in place currently. The Executive Summary shows $5.5 billion of liquid assets located.  As noted above, FTX Debtors have uncovered the mechanics behind how Alameda Research had the ability to borrow without collateral effectively unlimited amounts from customers and how a small group of individuals had the ability to remove digital assets from the exchange without being recorded on the exchange ledger. They might have used some of this to purchase around $250 million in properties in the Bahamas.  See the filing at link

|

|

|

|

Post by songbird on Jan 20, 2023 20:58:51 GMT -5

FTX Allegedly Paid Bill Clinton $250,000 Then Used Him to Dupe Investors

By Joe Hoft Published January 20, 2023 at 5:48pm If there’s a corruption scandal involving Democrats and millions of dollars you can bet the Clintons are involved somehow. The FTX scandal is in the billions of dollars. And there is much we still don’t know, like how much money was swindled from innocent participants in the scheme. The Daily Caller reported today: Disgraced crypto mogul Sam Bankman-Fried allegedly paid former President Bill Clinton roughly $250,000 to give a speech at his Crypto Bahamas Conference in April 2022, according to a Thursday report from the New York Post (NYP). Bankman-Fried’s conference featured Clinton alongside other world leaders and top crypto executives. Not long after, Bill and Hillary Clinton invited Bankman-Fried to speak at the 2022 Clinton Global Initiative (CGI) in September, the NYP reported. Zerohedge added more to this story: Bankman-Fried, or SBF, is accused of eight criminal charges, including conspiracy to commit money laundering, conspiracy to commit wire fraud on customers and lenders, conspiracy to commit commodities and security fraud, and separate wire fraud on customers and lenders. And as the NY Post reports, a close relationship with the Clintons helped SBF to dupe investors. Bill Clinton was paid north of $250,000 when he spoke at the disgraced FTX CEO’s Crypto Bahamas Conference in April, sources told The Post. At the over-the-top tropical shindig, the ex-US president along with former UK Prime Minister Tony Blair were famously photographed onstage next to Bankman-Fried, who appeared wearing shorts and a T-shirt. Shortly thereafter, Bill and Hillary Clinton invited the 30-year-old Bankman-Fried — known as “SBF” in crypto circles — to speak at their annual Clinton Global Initiative in New York — an effective endorsement of the former FTX CEO that played a pivotal role in elevating his reputation among politicians and deep-pocketed investors alike, insiders told The Post. -NY Post To promote the Clinton event, SBF’s photo was featured on the Clinton Foundation website next to notables such as Matt Damon, Gavin Newsom, Melinda French-Gates and Larry Fink. People close to the Clintons say it was a typical quid-pro-quo between the Democratic power couple and SBF; up and coming business leaders gain credibility by riding the Clinton coattails – and then the Clintons get a check. “The Clintons’ involvement gave SBF some air cover,” said one former confidante in a statement to the Post. We knew early on that the Clintons were involved with FTX and because of that we knew it was a shady operation. link

|

|

|

|

Post by maybetoday on Jan 21, 2023 1:45:14 GMT -5

The Corrupt New York Court Agrees to Keep the Identities of SBF Sureties Redacted and the Prosecutor Supported the Motion

By Joe Hoft Published January 20, 2023 at 8:40pm The corrupt court in New York agreed to a motion today from Sam Bankman-Fried’s sureties to keep their identities redacted in the case and the prosecutor supported the motion! We reported on January 3 that the Clinton judge overseeing the SBF case allowed the identities of two of the sureties backing SBF to remain anonymous. These individuals or entities were backing the release of SBF and putting down hundreds of thousands of dollars to set SBF free. Today it was reported that the SDNY District court led by Clinton Judge Lewis Kaplan has allowed the two sureties that are anonymous to remain anonymous and yet these sureties signed $500k and $200k separate surety bonds. The kicker is the prosecutor supported the motion. SDNY District Court motion to continue to redact Sam Bankman-Fried’s two non-parent sureties but disclosed they signed $500K and $200K separate appearance bonds. The prosecutor supports the motion. What a farce!@gatewaypundit #FTX #FTXbankruptcy #FTXScam pic.twitter.com/NGKBwa42XE — Bob Bishop – Forensic Investigator (@bobbish40288847) January 20, 2023 There is a possibility that the sureties who remain anonymous are entities related to Stanford University that may have some ownership in SBF’s parent’s home. Unfortunately, we cannot confirm this today. link

|

|