|

|

Post by maybetoday on Nov 21, 2022 22:19:42 GMT -5

Sen. Josh Hawley Demands Correspondence Between Federal Officials and Dem Party Leaders Following FTX Collapse and Why the Scheme Was Only Revealed AFTER the Midterm Elections

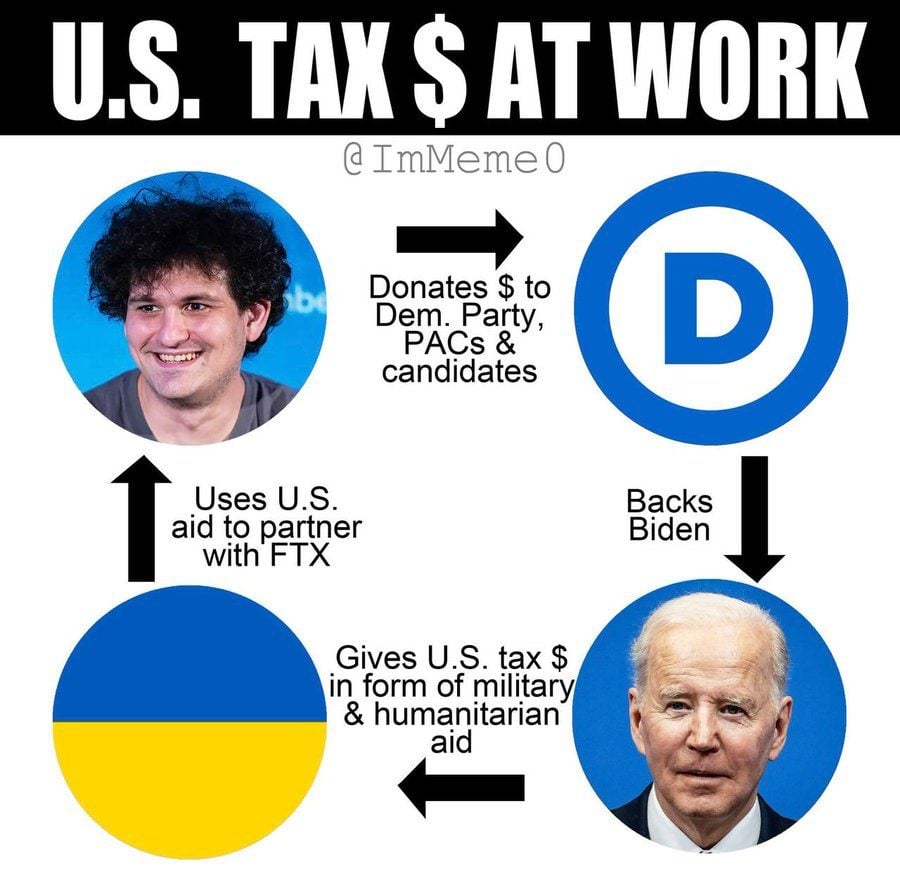

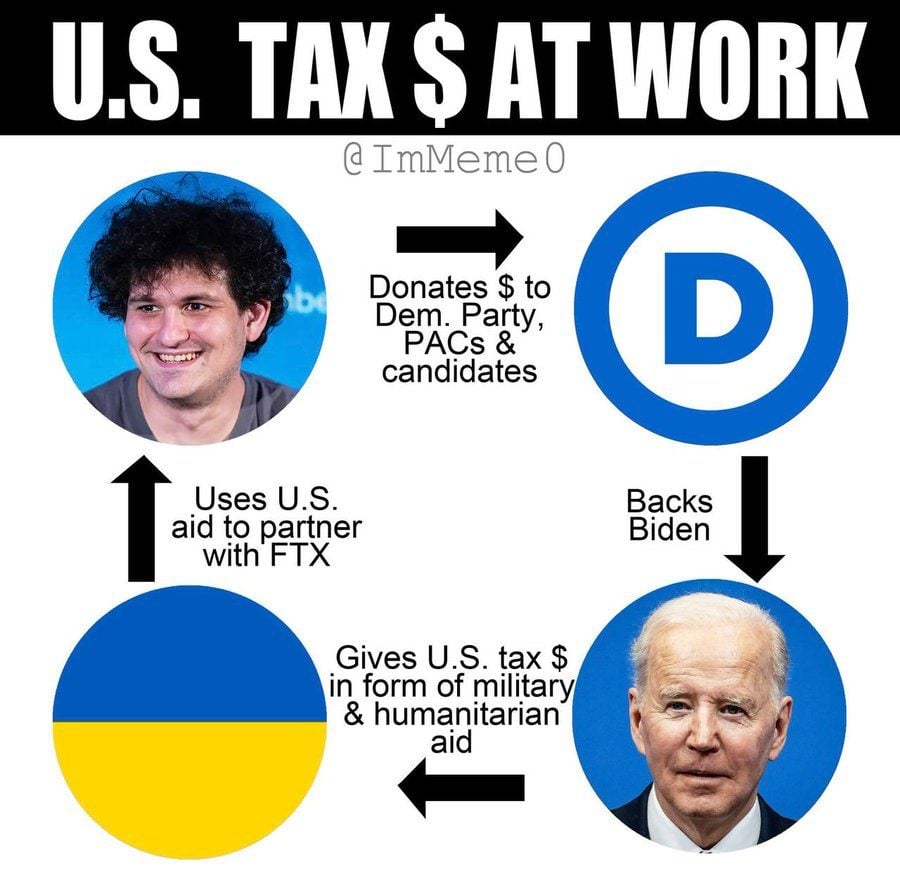

By Jim Hoft Published November 21, 2022 at 8:00am Senator Josh Hawley (R-MO) sent a letter to top Biden administration officials Friday morning, demanding information and correspondence regarding the collapse of cryptocurrency exchange FTX. Hawley wants to know why the illegal scheme was announced AFTER the midterm elections. FTX owner Sam Bankman-Fried was the second largest donor to Democrats in the 2022 midterms behind only George Soros. Senator Hawley wants communications between Bankman-Fried and AG Merrick Garland, Securities and Exchange (SEC) Commission Chairman Gary Gensler and Commodity Futures Trading Commission (CFTC) Chairman Rostin Behnam. As the Gateway Pundit reported earlier, Gary Gensler taught at MIT with Bankman-Fried’s girlfriends father. Senator Hawley requested the following actions by Friday November 25th, the day after Thanksgiving: 1. Prior to the public revelation of Mr. Bankman-Fried’s scheme to withdraw customer deposits from FTX to offset losses incurred by Alameda, had your respective agencies initiated an investigation into allegations of fraud perpetuated by FTX, Alameda, and their executives? If so, when were the investigations initiated and when were they expected to conclude? 2. Have FTX, Almeda, or any of the executives associated with these companies previously entered into confidential settlements or deferred prosecution agreements with your respective agencies? If so, please provide all materials associated with these settlements and agreements. 3. Please provide all correspondence between your agencies, the Biden Administration, the Democratic National Committee, the Democratic Congressional Campaign Committee, and the Democratic Senatorial Campaign Committee regarding FTX, Alameda, and its executives, including Mr. Bankman-Fried, Caroline Ellison, and Gary Wang. FOX Business reported: Hawley, a member of the Senate Judiciary Committee, penned the letter to Attorney General Merrick Garland, Securities and Exchange (SEC) Commission Chairman Gary Gensler and Commodity Futures Trading Commission (CFTC) Chairman Rostin Behnam. He demanded the three officials disclose whether they had investigated FTX or its sister firm, Alameda Research, and if their respective agencies had entered into settlements with the two companies. The Missouri Republican also asked whether the Department of Justice, SEC or CFTC had communicated with the Democratic Party apparatus regarding FTX and its founder Sam Bankman-Fried. Bankman-Fried was a prolific donor to Democratic candidates during the midterm election cycle, wiring nearly $40 million to Democratic coffers throughout 2021 and 2022. He also donated about $10 million to help President Biden get elected in 2020. More at link

|

|

|

|

Post by schwartzie on Nov 22, 2022 16:07:31 GMT -5

Highlights From First FTX Bankruptcy Hearing: "Substantial Amount" Of FTX Assets Stolen, "Dueling" Bahamas Liquidation Comes To A Head

BY TYLER DURDEN TUESDAY, NOV 22, 2022 - 01:42 PM Today at 11am ET, the first FTX bankruptcy court hearing finally took place in Delaware bankruptcy court before Judge John Dorsey, the official start of what will be a long, complex and unprecedented chapter 11 case; this is what we have learned so far (courtesy of the WSJ and Bloomberg). A “substantial amount” of failed crypto exchange FTX’s assets is missing and may have been stolen as a run on customer deposits and a liquidity crunch precipitated a crisis of leadership and led the firm to collapse, FTX lawyer James Bromely said in court “FTX was in the control of inexperienced and unsophisticated individuals, and some or all of them were compromised individuals,” said James Bromley, counsel to FTX’s new management, at its debut appearance at the Delaware bankruptcy court after the failed exchange filed for the largest-ever crypto bankruptcy case earlier this month. FTX’s rapid downfall triggered an "unprecedented" bankruptcy, causing many standard procedures, such as this hearing, to be delayed. Information about FTX’s biggest creditors will remain redacted for now. The dueling liquidation proceedings will move to Delaware, where the Chapter 11 case is being heard. Judge Dorsey said he will sign an order formally moving a Chapter 15 bankruptcy case filed by Bahamian liquidators from New York to Delaware. FTX expanded the number of affected customers and creditors from a "million" to millions." Some more details from Bromley's initial disclosures: In his initial comments, Bromley recounted some of the events leading up to the company’s sudden collapse, alleging major failures against its former leadership under co-founder Sam Bankman-Fried. “What we have here is a worldwide, international organization, but which was run as a personal fiefdom of Sam Bankman-Fried.” Mr. Bromley said. FTX’s new management and advisers are implementing market-standard controls for the firm’s accounting, audit, cash management, human resources, risk management and data management systems, Bromley said. He described the fall of FTX as “one of the most abrupt and difficult collapses in the history of corporate America and the history of corporate entities around the world. ” FTX is also “suffering from cyber attacks” that have occurred on the day the firm filed bankruptcy, the days following the chapter 11 filing, and still continue, Bromley said. FTX is in “constant communication” with the Justice Department and the cybercrimes unit of the (Democrat controlled) US attorneys office in New York, which has opened a criminal investigation (whatever happened to the previously reported probe that was launched by the Democrat-controlled AG of SDNY months ago - did it get bogged down in too many donations?). In response, Judge Dorsey said he would grant a number of requested motions filed by FTX to help the company manage its bankruptcy, including the to redact for now the identities of customers with funds frozen on the exchange. FTX management has said it may need until January to compile a complete balance sheet detailing the company’s total assets and liabilities, but some business divisions appear to be solvent. The firm has located approximately $1.4 billion in cash that it says belongs to the business, more than double the figure given in a report to the court last week. Most of that cash - $1.24 billion - is located in the Alameda subsidiary. Investment bank Perella Weinberg has been hired to explore selling any salvageable units out of bankruptcy (earlier there were reports that Tron network founder Justin Sun was eyeing some FTX assets). FTX's lawyer also said it has received requests from both the U.S. House and Senate to have Mr. Ray appear before Congress in December. In an especially interesting twist, one which potentially involves SBF's strategy on how to keep stolen assets close by at hand, Judge Dorsey says he will sign an order formally moving a Chapter 15 bankruptcy case filed by Bahamian liquidators from New York to Delaware. In response, Chris Shore who is representing the dueling Chapter 15 liquidators in the Bahamas, said “we’re going to try to work this out” with the Chapter 11 debtors. As a reminder, court-appointed liquidators in the Bahamas previously said the local subsidiary controls private keys needed to transfer crypto in and out of the entire FTX complex, once estimated to hold around $16 billion in assets. As such, some have speculated that the Bahamas govt may be in cahoots with SBF himself to keep much of the stolen assets on the Bahamas. While this has been unconfirmed, it is notable just a few days ago, Bankman-Fried liked a Tweet in which it was suggested that the Bahamanian Securities Commission was corrupt and would help SBF keep the stolen funds. Here is how the WSJ explains this tension: "some FTX assets are tied up in the Bahamas, where the firm relocated last year as the country sought to become a destination for digital currency firms worldwide. Public officials there seized the digital assets of FTX’s local operations earlier this month, which the new management has characterized as an unauthorized transfer. The Securities Commission of the Bahamas, the lead local authority investigating FTX’s collapse, has confirmed that asset transfer, but said it moved the coins “for safekeeping” in accordance with local laws." Court-appointed liquidators in the Bahamas have said the local subsidiary controls private keys needed to transfer crypto in and out of the entire FTX complex, once estimated to hold around $16 billion in assets. That explains why Chris Shore hinted that there "could" be conflict between the liquidators in the Bahamas and the FTX bankruptcy lawyers. “There is a tension that is going on right now,” Shore says, referring to bankruptcy rules in the US and efforts by the Bahamas liquidators to get control of assets and information about FTX’s collapse. It is understandable why both regulators want control over the Bahamanian subs - that's where most of the remaining money can be found, and if SBF is indeed working on collusion with local corrupt authorities, he may walk out of all this a billionaire. In any event, how Judge Dorsey rules on the treatment of the Bahamas sub may have the biggest consequence for the outcome of this bankruptcy case. Elsewhere in the hearing, FTX has said that it will need months to sort through claims from customers as it sifts through the bad bets at its affiliated trading firm Alameda Research, which tipped FTX into bankruptcy. It hasn’t detailed how much it owes to more than one million estimated customers. Lawyers representing FTX are also seeking court approval to keep paying the remaining employees on the payroll, protect the money remaining inside FTX’s bank accounts and pay vendors that it deems critical to the business. link

|

|

|

|

Post by OmegaMan on Nov 22, 2022 20:56:26 GMT -5

FINANCIAL FRAUD: Alameda was front-running trades against customers, amassing illicit crypto gains prior to FTX implosion

Tuesday, November 22, 2022 by: Ethan Huff Tags: Alameda, Bubble, computing, conspiracy, corruption, crypto, cryptocurrency, deception, deep state, finance, fraud, frontrunning, FTX, market crash, money supply, risk, Sam Bankman-Fried, scam, trading This article may contain statements that reflect the opinion of the author (Natural News) It has been revealed that the trading firm Alameda Research captured large amounts of cryptocurrency tokens ahead of their listing on the now-defunct FTX exchange, a scheme also known as frontrunning. Reports indicate that between the start of 2021, around the time of heavily shorted GameStop’s meteoric rise, Alameda had begun acquiring about $60 million worth of crypto tokens across 18 listings tied to the Ethereum blockchain, according to an analysis of public blockchain from Argus, a blockchain analytics firm. Frontrunning is a common occurrence in the crypto world, as well as in the stock world among market makers, but what has been uncovered about Alameda is “much, much greater” than what Argus co-founder Owen Rapaport has ever seen in all his years of work. Alameda, by the way, is a crypto trading firm founded by Sam Bankman-Fried, who also owned the FTX crypto exchange. The guy belongs in jail based on what has occurred in the past several weeks, but as of this writing he is still a free man. (Related: FTX was also involved in funneling investor cash to deep state “research” aimed at discrediting ivermectin as a remedy for the Wuhan coronavirus [Covid-19].) Among the 18 assets that Alameda appears to have been frontrunning since the beginning of 2021 include IndiGG, Guild of Guardians, Render Token, Boba Token, Gala, Gods Unchained, Spell Token, BitDAO, Eden Network, Sandbox, LooksRare Token, RAMP DEFI, Orbs, DOD bird, Convergence, SAND, Linear Token, BaoToken, and Immutable X. Alameda and FTX were sharing insider information, despite Bankman-Fried claiming they were two completely separate entities To figure all this out, Rapaport’s team compared Alameda’s on-chain trading of ERC-20 tokens on the Ethereum network to FTX listing announcements that were made between February 2021 and March 2022. Brighteon.TV All that time, Bankman-Fried claims that Alameda and FTX remained as two completely separate entities. However, the bank run that ultimately forced FTX’s hand in suspending all withdrawals last week, which then resulted in the company filing for bankruptcy, tell a much different story. It turns out that a sizeable portion of Alameda’s balance sheet was comprised of FTT, one of the tokens on the FTX exchange. We also now know, thanks to Argus, that Alameda and FTX were sharing information with each other in order to front-run token listings. Argus, by the way, provides anti-insider trading and employee compliance software services. Simply put, Argus exists to fight against the kind of fraud that Bankman-Fried was overseeing with his two corrupt businesses, Alameda and FTX. Keep in mind that Bankman-Fried told The Wall Street Journal (WSJ) back in February of this year that Alameda did not have access to insider information about FTX’s token listing plans. It turns out that he was lying. “Compared to the cases that we’ve seen so far, filed by the federal government, definitely the scale at which Alameda has been front running FTX listings over multiple months, is much, much greater, which reflects that they’re a larger player in the ecosystem and just had a lot more capital to deploy in order to make money here,” Rapaport is quoted as saying. The hope is that law enforcement will take action against Bankman-Fried and others at Alameda and FTX who appear to have committed the crime of insider trading, among potentially other crimes. Precedent for this was already established earlier this year when the Department of Justice (DoJ) brought charges against former OpenSea product manager Nate Chastain and former Coinbase product manager Ishan Wahi for trading non-fungible tokens (NFTs) and other tokens using insider knowledge. link

|

|

|

|

Post by maybetoday on Nov 22, 2022 21:56:24 GMT -5

Joe Bankman, Father of Former FTX CEO Sam Bankman-Fried, Was the Legal Mastermind Behind FTX

By Joe Hoft Published November 22, 2022 at 8:20pm The financial collapse of multibillion-dollar FTX is sending waves through the cryptocurrency industry. As the list of people responsible grows, one individual on the list should be the former CEO’s father, Joe Bankman. FTX is now in bankruptcy and its top 50 creditors alone are owed over $3 billion from the entity. We’ve reported on the peculiar circumstances surrounding these creditors and the court’s efforts to date to hide the identities of these creditors. As the list of creditors increases, there is much blame to throw around. One individual whose name should be on the list is Joe Bankman, the father of the former CEO of FTX, Sam Bankman-Fried. In an interview online, Joe Bankman, the father of FTX’s CEO, brags about being the legal mastermind of sorts behind FTX. link

|

|

|

|

Post by maybetoday on Nov 24, 2022 0:37:47 GMT -5

FTX Funded $18 Million Towards Research that Claimed that Ivermectin and Hydroxychloroquine Didn’t Work Against COVID

By Joe Hoft Published November 21, 2022 at 1:30pm FTX funded garbage research that claimed that Ivermectin and Hydroxychloroquine didn’t work against COVID. FTX financed politicians in the US in recent elections. Millions were sent to these politicians as we already reported. FTX was actually the second-largest donor to the Democrat party. Now we have uncovered evidence that FTX also funded research that was used to claim that the use of Ivermectin and Hydroxychloroquine were not useful in combatting COVID. FTX funded research behind a study on Ivermectin and Hydroxychloroquine that claimed these two products didn’t work against COVID. The studies were “stopped early” for these two products due to “futility”. See the chart from the study below:  FTX released a news wire on May 16, 2022, where the now bankrupt entity bragged about funding more that $18 million to support trials that concluded that products like  The results of these studies hindered the use of these products that are inexpensive and work against COVID. FTX spent millions on these studies that are not in sync with ample evidence to the contrary. link

|

|

|

|

Post by Midnight on Nov 24, 2022 3:50:37 GMT -5

NPR Covers for FTX’s Massive Left-Wing Corporate Fraud and Embezzlement

BEN WETMORE on November 24, 2022 at 2:36 am Collapse of major cryptocurrency exchange FTX is blamed by NPR on lack of regulation Major conflicts of interest and close relations by FTX CEO with regulators is ignored FTX connection to major left-wing donors and funders also ignored in story NPR is subtly trying to reinforce a narrative frame around the FTX collapse that the cryptocurrency markets are unregulated, therefore the lack of regulations led to the current collapse. But that narrative fundamentally misrepresents the known facts in the story and dodges some of the central reasons why the story is so important: politically-connected elites embezzled billions of dollars from FTX. Embezzlement can topple any company no matter how well-run. Instead, NPR wants to advocate for regulations so they push that narrative while downplaying the actual crimes involved. It’s dishonest. Major Violations: Missing Context Ignoring the Central Issue Creating False Connections On November 11, 2022 FTX declared bankruptcy. FTX is a cryptocurrency exchange. [1] An exchange, put simply, is where retail customers can transfer cash to cryptocurrency, where they can exchange their cash for tokens or coins of various cryptocurrencies. Cryptocurrency operates by issuing ‘coins’ or ‘tokens’ that are branded with various trade names. Bitcoin is, by far, the most famous ‘coin’ though it is not properly considered a ‘crypto’ because its transactions are not secret. Earlier this year, FTX was estimated to be worth $32 billion. In less than a month, financial investigators have discovered widespread financial problems at the company, including a missing $10 billion from user accounts. Those funds were used to cover losses at a related company, Alameda Research. [2] The founder and now-former CEO was Sam Bankman-Fried, known in the media by his initials as “SBF.” Bankman-Fried had his girlfriend Caroline Ellison running Alameda Research. [3] The scheme so far seems to involve taking the billions in cash deposited by users into FTX, and then transferring those liquid assets into a coin owned and operated by Bankman-Fried. His coin is known as FTT. [4] Bankman-Fried then loaned billions of dollars of user funds to Alameda Research to separately invest in and speculate in other cryptocurrencies. [5] His first major mistake was taking investor deposits and putting them into a coin he held a stake in, and then his second major mistake was taking those deposited funds and using them to capitalize an investment company on the side. To make a comparison to a retail bank, it would be as though Wells Fargo took consumer deposits and transferred all of the dollar deposits into the currency of Iceland, the Krona, because he owned Iceland. And then, on top of that, if Wells borrowed from consumer deposits without asking to start and run his own investment company in other currencies using depositor funds. This missing context is absent from NPR’s reporting. Unsurprisingly there are a wide variety of laws against doing these exact kind of schemes. So here’s how NPR covers for this massive fraud and embezzlement of customer funds in their opening sentence: “Lawyers for the once-mighty crypto-exchange FTX described a company riddled with dysfunction and mismanagement…” It’s not actually a ‘dysfunction’ or ‘mismanagement’ when the company runs exactly as it was intended: it invested in an unstable token they had a self-interest in, and then siphoned off funds to invest in speculative markets. The company might be poorly managed, but it’s core problems came from a well-functioning and well-managed criminal scheme. Instead NPR makes it sound like rascally teens running a late-night Dairy Queen. This is ignoring the central issue by NPR. The issue is not the lack of regulation in cryptocurrency markets, it’s that this company was being run by a fraudster con man and was being propped up by well-connected elites who were also steering major donations to the political left. NPR just leans into the complexity of cryptocurrency without even trying to explain it to its readers. They use some key phrases to make it seem super complicated and hard-to-understand. Here are a few of the phrasings that work to create that image in just the first four paragraphs of the story: “…sprawling empire…” “…one of the most abrupt and difficult collapses in the history of corporate America…” “…part of a large and complex bankruptcy filing.” “…And its new management team, brought in right before the exchange filed for Chapter 11, is just beginning to understand the magnitude of the mess they inherited.” “Here’s what we learned…” It’s not hard to notice what they’re doing here: they’re saying it’s so complex we’ll never really know what happened. They’re saying, “don’t look too closely here or it’ll just make your brain hurt” as if most corporate frauds are really that complex. Financial crimes are much like any other crime: they exist when someone who doesn’t deserve something takes the thing. Something of value gets taken from someone who owns it, and goes to someone else via fraud. If a bank steals from depositors, that issue isn’t complicated. If a company executive embezzles funds, it’s not complicated. That person might have excuses, they might have their reasons, but the illegality of what they’ve done isn’t complicated. It’s not complicated here. The available mainstream reporting makes pretty basic claims. Those claims could be wrong, they could be #fakenews, but so far Bankman-Fried has largely been admitting to everything that’s being claimed in the papers. Billions of dollars lost to millions of customers and NPR can only focus on hackers and whether there was a run on the bank causing the collapse. NPR also engages in missing necessary context when it talks about the investors into FTX. Here is the offending paragraph: “FTX’s legal team outlined how much money the company has gotten from investors since it was founded in 2019, and in its most recent funding round, it raised an additional $400 million for its U.S. business, and $500 million for its larger international operations.” NPR completely ignores the controversial original funders of FTX, including notorious investment firm BlackRock. [6] It then also ignores the redactions in bankruptcy filings of the creditors owed funds from FTX. [7] What would the motivation be to keep the creditors secret? If anything, other investors should be warned about the potential exposure to an FTX bankruptcy that might wipe out accounts for other businesses or investment groups. But this all matches the weak reporting on FTX and the avoidance of their massive political donations to Democrats. The media largely ignores the massive political donations, over $40 million, made by FTX to Democrats [8] and hard-left causes such as Transgenderism. [9] That would generate too many questions about whether the reporting on the topic is too biased and prejudiced in favor of the elites connected to the company, and against the many investors in that space who have done nothing wrong but who are now suffering political pressure to have the government regulate away their financial sector. A significant unreported part of the story is that the original investors in FTX are the major banks who stand to lose the most from widespread adoption of cryptocurrency. The crypto market, in many ways, is a grassroots rejection of conventional banking and state-driven monetary policy. Banks tried to kill crypto as their first choice, but failed. [10] Governments hate crypto because they allow dissidents and vulnerable populations the freedom and power to be economically independent of state coercion. [11] That aspect of the story is missing from this NPR story, and from almost every other story on FTX’s collapse. Those who funded FTX in the first place are entities who wanted to see cryptocurrencies fail. That’s potentially enormously ironic or one hell of a coincidence. There are also reports that FTX was used to launder money through Ukraine back into U.S. domestic politics. [12] These donations were illegal even by Biden’s orders. [13] FTX donations were even used by the GOP leadership to take out America First politicians like Madison Cawthorn. [14] Those issues might seem fantastic at first, but examining those close to and around FTX begins to make some of those issues obviously relevant to any fair reporting about the topic. To their credit, the New York Times covers this aspect of the scandal by pointing out the extensive political and social network that Bankman-Fried used to build his company. [15] But as one example, the media typically completely ignores the involvement of Bankman-Fried’s Stanford Law Professor father Joe Bankman. [16] Also ignored is that Bankman-Fried’s girlfriend, Catherine Ellison, is the daughter of Glenn Ellison [17] of the college, Massachusetts Institute of Technology, known more often as “MIT.” Ellison previously worked with and allegedly oversaw Gary Gensler. [18] Gensler is now head of the government’s regulatory arm overseeing the misconduct at FTX and Alameda Research, the Securities and Exchange Commission. [19] Many in the crypto world are rightfully pointing out that this appears to be a significant conflict of interest. [20] Some in Congress are making this same point. [21] Notably SEC head Gensler held a 45 minute Zoom meeting with Bankman-Fried months prior to the FTX collapse where Bankman-Fried proposed an SEC-sanctioned crypto trading platform. [22] Earlier this year the SEC under Gensler hired 50 additional ‘crypto cops’ to police the cryptocurrency space, [23] and yet they managed to completely miss the ongoing fraud and mismanagement at FTX. Zero of this context appears in the NPR reporting on the topic. The biased and prejudiced NPR reporting is also evidence in how it contrasts with other financial frauds. You can see it in the way that NPR covers a similar case of founder misdeeds in the Elizabeth Holmes case, published on the same day as the FTX article. [24] In the second paragraph NPR says: “When U.S. District Judge Edward Davila ordered prison time for the former CEO last week, one thing was pivotal: How much money investors had lost because of her crimes.” NPR isn’t focusing on the complexity of biology or blood testing, they aren’t losing readers in the briar patch of finances, securities, investments, venture capital, they are focusing on the central issue: investors lost money because of a criminal act. That sums up the story: a company founder committed a crime in order to take money that wasn’t rightfully theirs. In Holmes’ case she took investments from millionaires for a testing device that wasn’t ready and possibly would never be ready. In Bankman-Fried’s case he took investments from the masses for a currency exchange that he secretly denominated in his own coin, and then siphoned off client funds to run his own separate investment company for his own personal benefit. The story really isn’t that complex or complicated. When talking about Holmes, NPR talks about the investors who were involved since many were Republicans. Holmes was leading Theranos, hoping to create a blood testing service that would conduct a wide variety of tests with only a small amount of blood sample from users. Holmes’ vision was practically extremely difficult, if not impossible, to achieve and as her company expanded she met deadlines by faking results. Yet NPR focuses greatly on her criminal activity even though, for the most part, it involved defrauding investors while likely seeking to get more time to achieve her result. In the case of Bankman-Fried, if the various news accounts are accurate, he was misappropriating user funds in the first place by converting them into a coin/token that he held personally, the FTT coin. He was then embezzling those funds in order to separately invest them with Alameda Research run by his girlfriend. Holmes’ actions are somewhat understandable, while still unethical and illegal, because she appears to have been buying time to try and make her blood testing device work. Bankman-Fried’s actions are not at all defensible or understandable, because he was breaching his fiduciary duties to his customers from the start, and then taking those funds for personal gain on top of it. Bankman-Fried, again to the extent that the news accounts are accurate, was not just commiting fraud he was also converting those assets into his own personal gain. He was enriching himself and widely donating funds to personal causes using funds that were not his own. That is larceny, embezzlement, misappropriation of funds, theft, crimes that are very clear cut and very obvious. On top of it all, Bankman-Fried told the media that ethics were a “dumb game we woke westerners play.” [25] This reveals his state of mind, which is one of a remorseless sociopath criminal. This is what NPR considers the five main takeaways from the FTX collapse story: 1) Customers’ money is M.I.A. 2) FTX has bad data and intentionally destroyed internal messages 3) Estimates that FTX was worth $32 billion may be too low 4) It wasn’t just a “run on the bank” that led to FTX’s collapse 5) Everyone is worried about hackers, and there are major disputes brewing about how to handle customer data This is such a dishonest rendering of the story and the ‘major revelations’ of the story that it’s hard to write about it dispassionately. NPR isn’t just missing this story, they are purposefully covering up the major revelations in the story because it doesn’t fit their obvious ideological imperatives. There are many other major revelations about this story that NPR is covering up, it’s a major disservice to their readers that they are so grossly negligent while reporting this topic. link

|

|

|

|

Post by schwartzie on Nov 24, 2022 18:14:31 GMT -5

FTX Former CEO “SBF” CONFIRMS He Will Still Speak With New York Times On November 30th

By Anthony Scott Published November 24, 2022 at 2:00pm The founder of disgraced cryptocurrency exchange FTX has just confirmed on Twitter that he will still speak at the New York Times’s Deal Book summit on November 30th. Many FTX users who had their crypto assets taken from them overnight, thought SBF would be in handcuffs by now but instead, he is being offered a keynote speaker spot by the New York Times. Other speakers alongside SBF are Ukrainian President Vladimir Zelensky, Democrat Mayor of NYC Eric Adams, Mark Zuckerberg, Mike Pence, and more. Previously, the New York Times wrote a 2,200 worded puff piece about SBF which mentioned fraud or Democrats zero times. Just after SBF tweeted his confirmation he would be attending the New York Times event the liberal news outlet would write another article about SBF titled “Inside Sam Bankman-Fried’s Quest to Win Friends and Influence People”. Which was an even bigger puff piece than they wrote about him initially. SBF had several media outlets in his pocket and reportedly sent large donations to Vox, ProPublica, The Intercept, Semafor, and the Law and Justice Journalism Project. CEO of Twitter Elon Musk has even chimed in about SBF’s ability to “bribe” media outlets and stated, “If SBF was as good at running a crypto exchange as he was at bribing media, FTX would still be solvent!” link

|

|

|

|

Post by schwartzie on Nov 26, 2022 17:25:46 GMT -5

Revealed: FTX Was Funding Biological Weapons Shelters

By Jim Hoft Published November 26, 2022 at 2:40pm FTX was funding biological weapons shelters while laundering money from the Ukrainian government via crypto meant for their war efforts. Millions ended up with the Democrat Party before the 2022 midterm election. An interesting tip dropped on 4chan/pol website this weekend. Specifically, post boards.4chan.org/pol/thread/405764991Apparently, Samual Bankman-Fried’s charitable organization was funding shelters for bioweapon attacks. This was while he was laundering money with help from the National bank of Ukraine. SBF launched the Future Fund charitable organization. SBF launched a charity called the Future Fund and sat on the board with his former girlfriend Caroline Ellison. The Future Fund was funding the construction and design of bioweapons shelters. It appears that the links lead to legitimate websites tied to SBF. They’re advertising/soliciting activities related to shelters from bioweapons. And they were doing this while funneling money to Ukraine meant for their war efforts. As TGP reported earlier, there were several US-funded biolabs sprinkled across Ukraine for some reason.  Russian Defence Ministry briefing showing US-sponsored biolabs on Ukraininan territory. Photo : Russian Ministry of Defence “There are 25+ US-funded biolabs in Ukraine which if breached would release and spread deadly pathogens to US/world.” Gabbard said back in March 2022. “We must take action now to prevent disaster. US/Russia/Ukraine/NATO/UN/EU must implement a ceasefire now around these labs until they’re secured and pathogens destroyed,” she added. VIDEO: Tulsi Gabbard made her statement based on testimony from the Undersecretary of State for Political Affairs in Eurasia, Victoria Nuland. Victoria Nuland admitted during testimony before a US Senate committee the existence of biological research labs in Ukraine. Less than 24 hours later, White House Press Secretary Jen Psaki said that reports of biolabs in Ukraine were fake news propagated by Russia. The Democrat-fake news-media complex then attacked anyone who brought up the biolabs in Ukraine. Then this happened– Russia released alleged captured documents from Ukraine exposing evidence of US Military Biolabs in Ukraine. Russia made the accusations in front of the United Nations General Assembly. This forced the Pentagon to finally admitted in a public statement that there are 46 US-funded biolabs in Ukraine. More at link

|

|

|

|

Post by ExquisiteGerbil on Nov 29, 2022 18:50:45 GMT -5

Bahamas AG Says FTX 'Debacle' Not Their Fault

TUESDAY, NOV 29, 2022 - 06:45 PM Authored by Kevin Stocklin via The Epoch Times Bahamas Attorney General Ryan Pinder took to the podium Sunday night to defend his country’s securities regulators against “inaccurate allegations” by the U.S.-based legal team, led by veteran work-out attorney John Ray III, that has taken over management of FTX in bankruptcy, following the cryptocurrency exchange’s abrupt collapse in early November. “It is possible that the prospect of multimillion-dollar legal and consultancy fees is driving both their legal strategy and their intemperate statements,” Pinder alleged, adding that “any attempt to lay the entirety of this debacle at the feet of the Bahamas because FTX is headquartered here would be a gross oversimplification of reality.” Illustration by The Epoch Times. (Craig Barritt/Getty Images) Ray is reportedly earning $1,300 per hour, with a $200,000 retainer, to lead the work-out effort. Other attorneys are reported to earn $975 per hour, with other technical and investigative consultants earning $50,000 per month. In addition, many of the original 350 FTX employees are being kept on the payroll in order to try to preserve for investors whatever value of the company remains, but according to Ray, even figuring out who all these employees are has been challenging. Ray states in his bankruptcy declaration of Nov. 17 that because of poor record keeping by the company’s human resources department, bankruptcy attorneys “have been unable to prepare a complete list of who worked for the FTX Group as of the petition date or the terms of their employment. Repeated attempts to locate certain presumed employees to confirm their status have been unsuccessful to date.” Founded by Sam Bankman-Fried in 2019, FTX was valued at $32 billion by 2021 and was the third-largest exchange for cryptocurrency in the world, with more than a million investors trading its version of digital currency, known as FTT. Bankman-Fried’s net worth at the height of the crypto market was believed to be $16 billion. The crypto market has had a difficult year across the board, falling from a total global market capitalization of $3 trillion a year ago to around $800 billion today, with other crypto companies facing bankruptcy. But FTX had specific problems beyond the general market decline. On Nov. 6, Binance, a rival exchange to FTX, abruptly sold off its $2 trillion holdings of FTT, which it acquired in connection with a prior stake in FTX. Binance CEO Changpeng Zhao noted in a tweet: “Due to recent revelations that have came to light, we have decided to liquidate any remaining FTT on our books.” Caroline Ellison, CEO of Alameda Research at the time, responded by tweet to Binance: “If you’re looking to minimize the market impact of your FTT sales, Alameda will happily buy it all from you today at $22!” But Alameda was unable to make good on this pledge, and the massive unloading of FTT sparked other investors to rush to sell the digital coin as its value collapsed, sparking a liquidity crisis at FTX. According to Pinder, “FTX was experiencing the equivalent of a run on a bank, when customers are all rushing to withdraw all of their assets simultaneously.” Binance then offered to step in and acquire FTX, but quickly withdrew its offer once it got a look at FTX’s books, which Ray subsequently described as “a complete failure of corporate controls and a complete absence of trustworthy financial information.” Liquidity issues, it now appears, were only the tip of the iceberg. To date, the investigation of FTX’s books indicates that money that investors put up to buy FTT crypto on the exchange was being passed from their exchange accounts to an affiliated hedge fund called Alameda Research. It was also being lent out to owners, used to buy houses in the Bahamas and elsewhere, donated to various progressive causes that Bankman-Fried supported, or paid out as political donations. But the blame for regulators failing to notice any of this should not be placed solely on the Bahamas, Pinder said. Of the more than 100 subsidiaries and affiliates of FTX’s crypto empire, FTX Digital Markets is the only entity regulated in the Bahamas, according to Pinder. Alameda Research, the hedge fund affiliate of FTX, is registered in Delaware. According to Ray’s bankruptcy filing, however, other Alameda affiliate companies are registered in the Bahamas, as well as in Korea, Japan, the British Virgin Islands, Antigua, Hong Kong, Singapore, the Seychelles, the Cayman Islands, Australia, Panama, Turkey, and Nigeria. ‘Next Warren Buffet’ Numerous FTX subsidiaries are registered with the Securities and Exchange Commission (SEC), with some operating with licenses from the U.S. Commodity Futures Trading Commission (CFTC)—both U.S. regulators who were established to protect small investors and appear to have had no concerns about illicit activity at FTX prior to the bankruptcy filing. At the height of his success, Bankman-Fried was lauded on the cover of Forbes and Fortune Magazine, which referred to him as the “next Warren Buffet.” In an aerial view, the FTX Arena, which the Miami Heat call home, on Nov. 18, 2022, in Miami, Florida. Miami-Dade County and the Miami Heat are ending their arena naming rights deal with the company. (Joe Raedle/Getty Images) He was praised for his support of progressive causes, which ranged from climate change to pandemic policy. Sam’s brother, Gabe Bankman-Fried, ran the advocacy group Guarding Against Pandemics, which sought to increase government efforts for pandemic prevention and to which Bankman-Fried donated millions. Bankman-Fried had relationships and took meetings with prominent politicians and regulators, including SEC Chairman Gary Gensler, who seemingly also failed to notice anything amiss at FTX during a 45-minute phone call with Bankman-Fried. Bankman-Fried was the second-largest donor to the Democratic Party, after billionaire hedge-fund manager George Soros, and donated $10 million to Joe Biden’s presidential campaign. Of the tens of millions of dollars Bankman-Fried donated to political campaigns, $262,200 went to Republican candidates, while $40 million went to Democrats. Pinder took no questions after his speech and did not address other open issues, including whether FTX founder and ex-CEO Sam Bankman-Fried would be extradited to the United States to face criminal charges or whether the global assets of the FTX empire would be consolidated from the various jurisdictions around the globe into the United States, as the bankruptcy team is attempting to do. Bankman-Fried remains a headline speaker at the upcoming New York Times’ DealBook Summit, which also features BlackRock CEO Larry Fink, Secretary of the Treasury Janet Yellen, Meta CEO Mark Zuckerberg, actor Ben Affleck, and Ukrainian President Volodymyr Zelensky, among others. BlackRock was reportedly one of the investors in FTX. A recent tweet from Bankman-Fried stated, “I’ll be speaking with [New York Times business columnist] Andrew Sorkin at the dealbook summit next Wednesday (11/30).” The Times’ summit, billed as a gathering of “today’s most vital minds on a single stage,” identifies Bankman-Fried as “a 29-year-old American investor, entrepreneur, and philanthropist.” “At this time, we expect Mr. Bankman-Fried will be participating in the interview from the Bahamas,” a spokesperson for the New York Times told The Epoch Times. Bankman-Fried’s parents, both professors at Stanford University, are prominent supporters of the Democratic Party. His mother, Barbara Fried, is the founder of “Mind the Gap,” a secretive Silicon Valley fundraising organization for Democrat candidates. Mind the Gap has reportedly raised approximately $20 million from tech investors to support left-wing political campaigns. ‘A Very Complex Investigation’ In defense of Bahamian regulators, Pinder said that authorities in the Bahamas were the first in the world to act when trouble at FTX became apparent, and that there were “a number of protective measures” that were taken by the Bahamian Securities Commission on Nov. 10, including freezing FTX’s accounts, seizing FTX’s assets and putting FTX into provisional liquidation the day after rival crypto exchange Binance abruptly pulled out of a deal to acquire FTX. link

|

|

|

|

Post by ExquisiteGerbil on Nov 30, 2022 22:50:04 GMT -5

Sam Bankman-Fried on the Collapse of FTX

|

|

|

|

Post by PurplePuppy on Dec 1, 2022 2:19:10 GMT -5

FTX’s “SBF” Tells All Sorts of Stories About His Actions – Plays The “I Didn’t Know” Excuse

By Joe Hoft Published November 30, 2022 at 7:45pm Sam Bankman-Fried (SBF) couldn’t tell the truth if he wanted. His claims now appear dishonest at best but what do you expect from someone who stole $4 billion from his own company? Zerohedge shared this morning on a recent interview with SBF. Bankman-Fried started the interview by saying he’s deeply sorry about what happened. “I didn’t ever try to commit fraud on anyone,” Bankman-Fried (SBF) said. He claims he was shocked by what happened this month. “I have limited access to data,” Bankman-Fried said about his attempt to reconstruct what happened over the past month. Which makes us wonder – if he didn’t have the data, who did? When pressed by Sorkin, Bankman-Fried said “I didn’t knowingly commingle funds”. Which we note is not a denial, and as NYT notes, on the commingling of funds, there appears to be ample evidence suggests that Alameda and FTX shared an account at their U.S. banking partner Silvergate. Here is the interview: Later in the day Zerohedge shared another interview with SBF. Reminder, this guy cannot be trusted. At the very least he swindled millions of users of his platform. We also know that SBF accepted donations for Ukraine. Also, Ukraine reported that they sent money from the US to FTX to invest in crypto currencies. We also know that SBF and the top individuals at FTX gave $70 million to the Democrats. These people were some of the top donors to the Democrats in the 2022 election. SBF now claims that he also gave money to the GOP but this was dark money so there is no way to confirm and he makes claims about Ukraine too. SBF shared the following per Zerohedge: Speaking about his political activities, SBF said, “I donated about the same to both parties. […] All of my Republican donations were dark.” He addressed rumors about money laundering of Ukrainian donations: “The Ukraine one? I wish I could have pulled that off. I wish. I didn’t fully understand the goal of it. I was helping Ukraine launder funds for the Democratic Party? I don’t know why Ukraine is laundering funds for the Democratic Party. I don’t know how they would or why they would.” I call BS. This doesn’t sound too convincing. Now we know that Biden can’t account for $20 billion in money to Ukraine. Here is the second interview on Zerohedge today: More at link

|

|

|

|

Post by Berean on Dec 1, 2022 19:16:21 GMT -5

Going by the looks of this place, I wouldn't even trust them with $10! 😲 Photos: Here’s Why FTX Poured Nearly $12 million Into This Tiny Bank With 3 Employees In Middle-Of-Nowhere Washington State

By Ann Stossel - November 27, 2022  Following the signing of FTX’s chapter 11 bankruptcy, the failed crypto mogul Sam Bankman-Fried has been going around town to explain his side and attempt restore his reputation. But, documents never lie. In the bankruptcy proceedings, one of the assets revealed to be owned by FTX is the curiousity-inducing small bank in the state of Washington. How small? The Farmington State Bank has a single location and only three staff as of this year. It didn’t even have online banking or a credit card. In March, FTX’s sister hedge fun Alameda Research spent $11.5 million on Farmington State Bank’s parent company, FBH. According to the Federal Deposit Insurance Corporation, the bank’s net worth was $5.7 million; it was the 26th-smallest bank in the country out of 4,800 at the time of the investment. But it is not only the peculiar stake that raised some questions. Back in 2020, Farmington State Bank was acquired by FBH whose chairman was Jean Chalopin. He is also the chairman of Deltec Bank, which, like FTX, is based in the Bahamas–but its most well-known client is a $65-billion crypto firm called Tether. Photos from the bank below:    There’s even more weird crypto drama swirling around all of this, but before you learn more about it, just a gentle reminder that it’s all centered on one tiny bank in this town:  Alameda bought a US bank (Farmington State) connected with Deltec and Tether, and then transferred it to FTX. There’s no way that the regulatory approval of a Bahamian HF buying a US bank was legit. No way. FTX was a criminal enterprise from the start. Here’s the letter from SF Fed prez Mary Daly approving Fed Reserve System membership (SWIFT and wires) for the bank that SBF bought. That’s Deltec Chairman Jean Chalopin on the Board, as is Gemini Chief Compliance/Operating Officer Noah Perlman. Photo below:  I think we found out why they bought this bank! Farmington’s deposits had remained stable at around $10 million for a decade prior to the acquisition. However, the bank’s deposits increased about 600% to $84 million in the third quarter of this year, presumably after the Alameda investment. According to FDIC records, nearly all of that increase, $71 million, came from just four new accounts. The bank is currently known as Moonstone Bank online and its website makes no mention of Bitcoin or other digital currency, except to claim a desire to help “the evolution of next-generation finance.” So to summarize: we have a bank that was bought illegally so that people involved in this scheme can launder their money without problems! link |

|

|

|

Post by maybetoday on Dec 1, 2022 20:45:51 GMT -5

Former FTX CEO – Sam Bankman-Fried – Admits FTX Didn’t Buy Bitcoin for Clients – Just Took Their Money (VIDEO)

By Joe Hoft Published December 1, 2022 at 6:25pm Former FTX CEO Sam Bankman-Fried (SBF) let it all hang out. The former head of bankrupt FTX admitted on video what the company did with the money people gave to the company to invest in cryptocurrencies like bitcoin. We reported on the bankruptcy of FTX weeks ago. The firm suddenly crashed and along with it the second-largest donor to the Democrat Party was finished. Billions of dollars were shared with FTX with the belief that FTX was in turn investing the money in cryptocurrencies requested by the purchaser. However, SBF shared what we now all know already. FTX didn’t take customers’ money and invest in Bitcoin, it just took the money. See the video in the tweet below. It’s a wonder that SBF hasn’t been arrested already and thrown in jail. link

|

|

|

|

Post by schwartzie on Dec 4, 2022 13:55:18 GMT -5

Democrat Rep. Maxine Waters Praises FTX Founder In New Tweet

By Anthony Scott Published December 3, 2022 at 9:30pm Representative Maxine Waters has nothing but nice things to say about disgraced FTX owner Sam Bankman-Fried who is responsible for millions of people losing their crypto investments overnight. In a recent tweet, Waters was quoted saying “SBF we appreciate that you’ve been candid in your discussions about what happened at #FTX. Your willingness to talk to the public will help the company’s customers, investors, and others.” She would continue “We would welcome your participation in our hearing on the 13th.” It sounds as if Waters is inviting SBF to a casual dinner party and not a House Financial Services Committee Hearing. Read her tweet here: Previously The Gateway Pundit reported Maxine Waters blew a kiss toward SBF after a cryptocurrency exchange hearing last year. WATCH: It’s very clear SBF will not face any tough questions in the upcoming House Financial Services Committee Hearing but rather be giving softball questions. In his most recent interview with the New York Times SBF nervously claimed he committed no fraud whatsoever, but invetsiors who have lost millions disagree SBF is acting in a “candid” manner. Following his big New York Times interview he would proceed to participate in Twiiter space where he confessed he never used clients funds to buy Bitcoin but rather used the funds elsewhere. link

|

|

|

|

Post by PurplePuppy on Dec 4, 2022 21:48:45 GMT -5

Sam Bankman-Fried Dodges on Call to Testify at Maxine Waters’ Request on FTX Collapse

SEAN MORAN 4 Dec 2022 Sam Bankman-Fried, the disgraced former CEO of FTX, on Sunday dodged House Financial Services Committee Chair Maxine Waters’ (D-CA) call to testify. “@sbf_FTX, we appreciate that you’ve been candid in your discussions about what happened at #FTX. Your willingness to talk to the public will help the company’s customers, investors, and others. To that end, we would welcome your participation in our hearing on the 13th,” Waters wrote, inviting Bankman-Fried to testify before the committee’s planned December 13 hearing. In response, two days later, Bankman-Fried claimed he is still “learning and reviewing” what led to FTX’s collapse and thus cannot testify before the committee. The disgraced former tech CEO wrote, “Rep. Waters, and the House Committee on Financial Services: Once I have finished learning and reviewing what happened, I would feel like it was my duty to appear before the committee and explain. I’m not sure that will happen by the 13th. But when it does, I will testify.” The collapse of digital currency exchange FTX, as well as its sister organization hedge fund Alameda Research, rocked the cryptocurrency industry. As lawmakers and public officials try to figure out what happened, the Department of Justice (DOJ) has requested an independent inquiry into FTX regarding fraud allegations. Breitbart News reported that Bankman-Fried and his cofounders donated over $300,000 to nine lawmakers who are now investigating the company for wrongdoing. DOJ Trustee Andrew R. Vara said in the agency’s filing: “An examiner could – and should – investigate the substantial and serious allegations of fraud, dishonesty, incompetence, misconduct and mismanagement by the Debtors.” Breitbart News technology reporter Lucas Nolan explained: The filing described the collapse of FTX as the “fastest big corporate failure in American history.” According to Vara, there is a strong reason to believe that Bankman-Fried, the former CEO, and other managers, “mismanaged” the company “or engaged in fraudulent conduct.” Bankman-Fried has been replaced as CEO by John Jay Ray III who famously oversaw the bankruptcy of Enron. Vara added that the court should approve the appointment of an independent examiner to investigate the matter further. After FTX quickly collapsed, lawyers started to wonder if the exchange had engaged in fraudulent activity by misusing customer funds. In court filings, new FTX CEO John Jay Ray III stated that the company had hidden the misappropriation of corporate funds, including the purchase of a property in the Bahamas for employees. “Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here,” Ray said in the filing. The U.S. Attorney’s Office for the Southern District of New York and attorneys for the Securities and Exchange Commission (SEC) have sent requests for information to cryptocurrency investors and trading firms that have worked with FTX. link

|

|

|

|

Post by PurplePuppy on Dec 4, 2022 21:56:26 GMT -5

Elon Musk Alleges FTX CEO Sam Bankman-Fried Donated over $1 Billion to Democrats

By Jim Hoft Published December 4, 2022 at 7:04pm Sam Bankman-Fried, the CEO of FTX cryptocurrency exchange, announced in May that he would donate “north of $100 million” and up to a “soft ceiling” of $1 billionfor the Democrat candidate running against President Donald Trump in the 2024 race. Bankman-Fried donated over $40 million to Democrats in the 2022 midterm elections. FTX was laundering money from Ukraine and moving millions to donate to Democrats in the 2022 midterms. It was a nifty trick by Democrats to get some easy campaign cash. Elon Musk this week suggested that donations to Democrats were likely much larger than the $40 million declared and as high as $1 billion! The truth is likely somewhere in between the two numbers.  The Daily Mail reported: Elon Musk has suggested that disgraced crypto exchange billionaire Sam Bankman-Fried donated more than $1 billion to Democrats before FTX’s collapse. Musk’s allegation, if true, would mean SBF donated significantly more than the initially reported $40 million figure to Democratic politicians, ahead of his business’s total meltdown. On Friday, healthcare tech startup CEO Will Mandis tweeted: ‘SBF donating $40m to not go to jail for stealing $10b+ is one of the highest ROI trades of all time,’ referring to the known number in donations to Democratic politicians. Prior to the implosion of FTX late last month – which is largely being blamed on the questionable sharing of funds between FTX and crypto trading firm Alameda Research – SBF had a close relationship with the party in power in Washington, DC. He has testified before Congress, met with lawmakers and regulators and donated heavily to left-of-center media operations, which has led to the observation by some that his alleged crimes have been handled more gently than is appropriate by the mainstream media. Prior to the undoing of his company, SBF pledged to give $1billion to political candidates. It has also emerged that SBF was one of the largest Democratic donors in recent cycles, spending a reported $36 million during the last midterm election primarily via the Protect Our Future Pac. Bankman-Fried claims he donated to both major political parties, though that his donations to the Republicans were dark, meaning publicly untraceable. link

|

|

|

|

Post by schwartzie on Dec 7, 2022 17:10:00 GMT -5

Peter Schiff: The FTX Debacle Was Ultimately The Fed's Fault

BY TYLER DURDEN WEDNESDAY, DEC 07, 2022 - 02:00 PM Via SchiffGold.com, Beyond allegations of mismanagement and outright fraud, the collapse of the FTX cryptocurrency exchange reveals a more fundamental problem — the power of speculative manias fueled by central-bank easy money. Peter Schiff recently appeared on NTD Capital Report to talk about the collapse of FTX, saying ultimately it was the Federal Reserve’s fault. And it is a warning sign for the broader economy. When FTX filed for bankruptcy, it sent shockwaves through the crypto world. As Mises Institute senior editor Ryan McMaken put it, “FTX’s collapse has exposed just how little due diligence is actually taking place among investors who are apparently willing to put large amounts of cash in whatever place looks like the hottest new thing and promises—without convincing evidence—big-time returns.” Peter said he wished he had taken a deeper look into Sam Bankman-Fried earlier because he thinks he would have been able to ferret out the fraud pretty quickly. Peter pointed out that he called out Alex Mashinsky (CEO of the crypto lending and staking platform Celcius) for running a Ponzi scheme in a debate. Celcius filed for bankruptcy back in July. SchiffGold analyst Tony called Celcius the “canary in the coal mine” and said FTX was the coal mine — and it just collapsed. Peter pointed out that Celcius was paying yield on cryptocurrency, as was FTX. How could you do that? Cryptos don’t generate yield. The only way to generate yield is to take tremendous risk, which is exactly what [Mashinsky] did, except the people who were depositing their crypto didn’t appreciate the risk that was being taken. Of course, they were taking a lot of risks themselves just owning crypto because all of these currencies are basically worthless. They’re not even really currencies. They’re collectible tokens. But pretty soon, nobody is going to want a bitcoin collection, or any of these collections, and the prices are going to implode.” Some people have expressed sympathy for Bankman-Fried, saying his naivete got him in trouble, and that he wasn’t intentionally trying to defraud people. Peter said he doesn’t know whether Bankman-Fried’s actions were criminal or just the result of gross incompetence and negligence. But you would think some of these hedge fund managers who invested with him would have done a little bit of due diligence. But this just shows you the way investors will act when they’re drunk on cheap money. So, I would blame the Federal Reserve for a lot of people acting as foolishly as they did. Because maybe he was a kid, but there were a lot of grownups who were giving him money.” McMaken wrote that the FTX collapse was a canary in the coal mine for the broader economy and that it could foreshadow the fate of other segments in the economy that have been pumped up by the easy money policies of the Federal Reserve over the last decade-plus. Peter also talked about the overall state of the US economy during his interview, calling it “an absolute disaster.” Thanks to Fed policy over the last decade or so, we have a gigantic bubble. We never had a real recovery. We just had a financial bubble. And we dug ourselves into a much deeper hole than the one the Fed put us in back in 2008 following the financial crisis that they also created with the same type of monetary policy that is creating the crisis that we are heading for, which is going to be far worse than what we experienced in 2008. Not only is inflation going to get much worse than it already is, but we’re going to have a worse financial crisis than the one we had in 2008. This is going to be the worst recession that the US has ever experienced. It may even be worse than the Great Depression. It will certainly feel worse for most people because in the Depression, people at least got the relief of falling prices. This time, consumers are going to feel the sting of dramatically higher prices.” So why did we have solid GDP growth in the third quarter? Peter said it was just a function of the big improvement in the trade deficit. While the trade deficit was still huge, it wasn’t as big as it was in the previous quarters. That was thanks to two factors. One – the strong dollar, which is now reversing. The dollar just had its worse month in 12 years. … So, that’s going to push the trade deficit up. In fact, the trade deficit in November swelled by 10%. It was a huge jump. But the other factor that helped bring down the trade deficit was all the oil that Biden released from the Strategic Petroleum Reserve. Oil companies were able to buy that oil and then export it, and so, that artificially boosted our exports, which improved GDP. But pretty soon, we’re going to run out of the oil in this strategic reserve. There won’t be a reserve left, so we won’t be able to rely on that crutch.” Peter pointed out that the economic data that came out last week was horrific. I think we’re going to have a big negative number for Q4 GDP. So, we’re going to end the year on a low note. And I think we’re going to have another negative quarter in Q1 of 2023.” The host asked Peter what he thought about the big jump in retail sales. Doesn’t that bode well for the economy? Peter said they’re not really up. Prices are up. So, if you factor in inflation, retail sales are down.” Video at link

|

|

|

|

Post by Midnight on Dec 8, 2022 3:30:59 GMT -5

Maxine Waters Doesn’t Plan to Subpoena Former FTX CEO Sam Bankman-Fried to Testify at Hearing on Crypto Ponzi Scheme

By Cristina Laila Published December 7, 2022 at 6:40pm Financial Services Chairwoman Maxine Waters (D-CA) does not plan to subpoena Sam Bankman-Fried to compel testimony at next week’s hearing on the FTX collapse. Sam Bankman-Fried, a 30-year-old Democrat darling, spent more than $40 million to fund the midterms with his Ponzi scheme through the crypto exchange he founded (FTX). Up to $2 billion is ‘missing’ after FTX collapsed last month. Sam Bankman-Fried is Biden’s second biggest donor and he was funneling money through Ukraine – and that money sent to Ukraine was in turn used to fund the Democrats. Bankman-Fried still hasn’t been arrested even though he publicly admitted he didn’t buy bitcoin for clients – he just took their money. Maxine Waters nicely asked Sam Bankman-Fried to appear before the committee voluntarily next week. Bankman-Fried has NOT yet agreed to testify and Maxine Waters isn’t even threatening to issue a subpoena! CNBC reported: House Financial Services Committee Chair Maxine Waters told Democrats she doesn’t plan to subpoena former FTX CEO Sam Bankman-Fried to testify at Tuesday’s hearing about the crypto exchange’s rapid demise, according to people with direct knowledge of the conversation. Waters informed committee members of her decision at a private meeting Tuesday with Securities and Exchange Commission Chair Gary Gensler on Capitol Hill, these people said, declining to be named in order to speak freely about private conversations. Those at the meeting say Waters said she wants committee staff try to convince Bankman-Fried to voluntarily testify, those with knowledge of the meeting said. As of late Wednesday, Bankman-Fried has yet to agree to voluntarily testify to the House committee, two of the people explained. Waters, who will lose the chair title when Republicans take control of the House on Jan. 3, could end up deferring to Rep. Patrick McHenry, R-N.C., the panel’s top Republican and likely next chair, to decide whether to subpoena Bankman-Fried in the next congressional session if the FTX founder declines to voluntarily testify under oath next week. link

|

|

|

|

Post by Midnight on Dec 11, 2022 4:12:21 GMT -5

UNBELIEVABLE: Multi-Billion Dollar FTX Used QuickBooks for Its Accounting Software

By Joe Hoft Published December 10, 2022 at 9:00pm  This is really unbelievably related to FTX. The firm that was involved in money transfers with Ukraine and millions in donations to the Democrat Party used basic accounting software to keep its records. For any corporate accountant, this is simply stunning. QuickBooks is a great tool for a small company or startup but it’s not suitable for a billion-dollar company. An auditor would see this as a major issue with a company the size of FTX. Former auditor Bob Bishop reports: It’s very likely that FTX was involved in all types of transactions involving dark money. Some believe FTX was involved in millions if not billions in transactions with the Democrats. It would be difficult to manage this on QuickBooks. link

|

|

|

|

Post by schwartzie on Dec 12, 2022 13:52:54 GMT -5

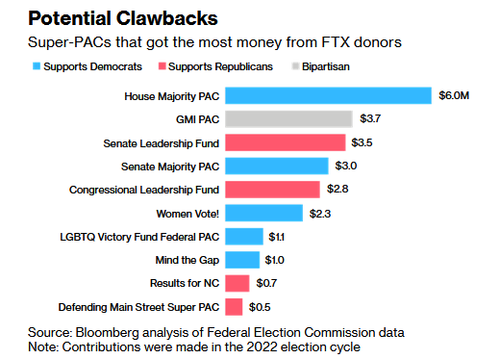

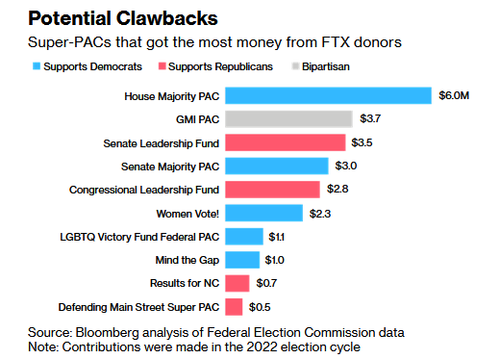

FTX Bankruptcy Puts $73 Million In Political Donations At Risk Of Clawbacks

BY TYLER DURDEN MONDAY, DEC 12, 2022 - 12:06 PM At least $73 million in political donations tied to Sam Bankman-Fried's FTX , showered mostly on high-ranking Democratic politicians, may be at risk of being clawed back through the crypto empire's bankruptcy, as lawyers search for assets to repay creditors. Hilariously, Bloomberg attempts top frame the contributions as bipartisan and "wide-ranging," despite Bankman-Fried, who's never met President Biden, being heralded as "one of the people most responsible" for Biden's 2020 win. SBF also donated to Democratic Rep. Ritchie Torres of New York, who just months ago was one of 8 members of Congress who lobbied against regulating crypto (and is now totally calling for an SEC investigation).  "Nobody ends up looking great in this," says University of Rochester political science professor, David Primo. While there’s precedent for forcing political entities to return contributions in cases of fraud, recovery prospects are unclear in FTX’s case. Recouping campaign funds as part of the bankruptcy proceedings is a complicated and lengthy process, and the scope of the total funds eligible for clawback depends on myriad federal and state laws. It is also subject to the bankruptcy lawyers’ judgment on what money, which may be long spent by the time the FTX trustees try to go after it, is worth the effort. Bankman-Fried is facing additional scrutiny for recently saying he gave equally to Republicans and Democrats, but funded conservatives through “dark money” groups that don’t identify donors. The claim is almost impossible to verify unless the recipients voluntarily disclose they received money from him. -Bloomberg One factor noted in the debate over clawbacks is whether the bankruptcy court determines there was fraud or fraudulent intent involved in the collapse of FTX, according to Ilan Nieuchowicz, a litigator for law firm Carlton Fields. If that's the case, nearly all donations tied to FTX could be a recovery target. If not, then only those made within the 90-day period prior to FTX's insolvency, or around $8.1 million, would potentially be subject to recapture. Some lawmakers are being proactive - with Michigan Democrat Debbie Stabenow announcing that she will donate $20,800 receive from SBF to a charity in her state. Republican Jophn Hoeven (see, bipartisan!), says he will give $11,600 received from SBF to the Salvation Army. That said, donating the money to charity won't necessarily keep the victims of fraud from attempting clawbacks - as the bankruptcy trustee could still ask that the donations made by those who received FTX money still return the funds. Of the $73 million Bankman-Fried, Salame, Singh and FTX corporate entities donated, $45.5 million, or 63% of that total, went to their own personal super-PACs, including Bankman-Fried’s Protect Our Future and Salame’s American Dream Federal Action. Salame backed Republicans, while Bankman-Fried and Nishad largely supported Democrats. Most of the money from those entities has already been spent, paid to a long list of vendors to support various office seekers. Bankman-Fried’s PAC only had $384,588 cash on hand as of late November, the last time the entity was required to publicly report its finances. -Bloomberg Meanwhile, $26.6 million of FTX-linked contributions went directly to large super PACs, including those who gave money to House and Senate leadership of both parties (and of course, the proportion isn't mentioned). "It’s a lot easier to return a symbolic $1,000 contribution than it is $1 million to a super PAC," said Charles Spies, who practices political law at Dickinson Wright. This wouldn't be the first time campaign donations were clawed back by bankruptcy trustees. In 2011, a district court judge ordered five party committees - including the DNC and its Republican counterpart, to return $1.6 million in donations from Allen Stanford, one of his top lieutenants, and his Stanford Financial Group, made between 2000 and 2008, before his Ponzi scheme collapsed in 2009. According to attorney Kevin Sadler, "With contributions in the millions, the trustee has to pursue it." link

|

|

|

|

Post by schwartzie on Dec 12, 2022 13:55:35 GMT -5

Sam Bankman-Fried Launching New Business after FTX Collapse

Nick R. HamiltonDecember 12, 2022 - 10:06 am FTX founder Sam Bankman-Fried has revealed his plans to launch a new business venture just weeks after the historic collapse of his cryptocurrency exchange. Bankman-Fried is currently facing a number of civil lawsuits brought against both him and his failed company. In an interview with the BBC published on Saturday, the 30-year-old said he would “give anything” to be able to set up a new business. He insists that his new business is an effort to pay back investors. When FTX collapsed, billions of dollars went missing, leaving investors and users who lost millions. “I would give anything to be able to do that,” Bankman-Fried said when asked if he planned to launch a new company to recoup the losses by FTX. “And I’m going to try if I can. “I’m going to be thinking about how we can help the world and if users haven’t gotten much back, I’m going to be thinking about what I can do for them,” he said. “And I think at the very least, I have a duty to FTX users to do right by them as best as I can.” FTX was once valued at $32 billion after raising $400 million from investors before it collapsed in November. Slay the latest News for free! Email Address * We don’t spam! Read our privacy policy for more info. The collapse came amid a liquidity crisis which was worsened further by larger rival Binance deciding to pull out of a potential rescue deal. Traders soon pulled billions from the platform and the company ultimately filed for Chapter 11 bankruptcy on November 11. Millions of FTX users have been left unable to access their crypto wallets. Questions have been raised regarding the roughly $1 billion of customer funds that appear to have vanished from the failed crypto exchange. Meanwhile, Bankman-Fried claims to have just $100,000 left in his bank account and denies having “hidden funds” anywhere. On Friday, Bankman-Fried confirmed that he will testify before the U.S. Senate Banking Committee on Tuesday amid multiple probes into FTX’s collapse as well as that of its sister hedge fund, Alameda Research. However, the former billionaire claimed he does not have access to much of his professional or personal data, and therefore “there is a limit to what I will be able to say, and I won’t be as helpful as I’d like.” Speaking to the BBC from a luxury apartment in the Bahamas owned by FTX, Bankman-Fried was asked whether he was prepared for the possibility of being arrested. “There’s some time at night ruminating, yes, but when I get up during the day, I try and focus, be as productive as I can and ignore things that are out of my control,” he replied. However, the crypto firm founder doubled down on comments he made during the New York Times DealBook Summit on November 30, in which he denied having committed any fraud at FTX. Financial regulators and authorities in both the United States and the Bahamas are currently investigating the collapse of the company. link

|

|

|

|

Post by ExquisiteGerbil on Dec 12, 2022 23:15:39 GMT -5

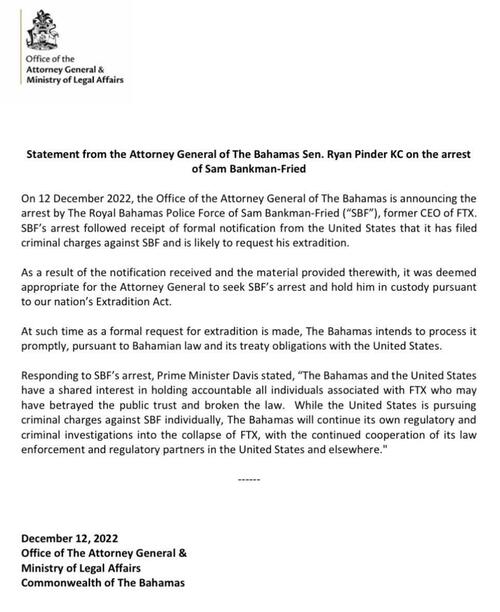

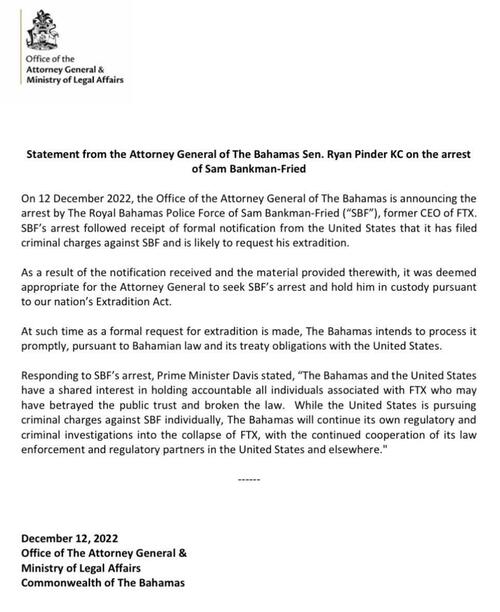

Sam Bankman-Fried Arrested In The Bahamas, Charged With Wire/Securities Fraud And Money Laundering

BY TYLER DURDEN MONDAY, DEC 12, 2022 - 06:44 PM Update (8:35pm ET): According to the NYT, the charges against SBF which in an indictment which will be unsealed on Tuesday included wire fraud, wire fraud conspiracy, securities fraud, securities fraud conspiracy and money laundering. Of course, SBF should also be charged for talking too damn much and adding 15 years to his sentence by being a megalomaniac sociopath, but we'd take attempted bribery of the entire Democratic Party instead. A lawyer chimes in, pointing out that according to federal sentencing guidelines, SBF could be looking at approximately 612,000 years in prison. While more than half a million years in prison may seem excessive, life in prison for the disgraced democrat donor sounds about right. And since SBF was the only person charged in the indictment, it appears that we were right when we said that his co-worker (and former lover) Caroline Ellison would roll on him (see "Alameda's Caroline Ellison Spotted In NY Amid Speculation She Is About To Roll On SBF After Hiring Iconic Clinton Lawyer"). * * * Just hours after refusing to attend a Senate hearing on his role in the collapse of FTX, Sam Bankman-Fried has been arrested by The Royal Bahamian Police Force, according to a statement from the Attorney General of The Bahamas Sen. Ryan Pinder KC. The arrest came after the U.S. filed criminal charges against Bankman-Fried. US prosecutors say they’ll unseal an indictment on Tuesday... It does make one wonder at the timing, as this happened just a week after Carline Ellison - the former CEO of Alameda Capital - was spotted in NY (not in custody) and had sought council, represented by DC law firm, WilmerHale. Did his girlfriend throw him under the bus pre-emptively as she saw the 'Simple Jack' defense gaining ground? Furthermore, the statement said that the nation expects the U.S. to request The Bahamas extradite Bankman-Fried in short order. "As a result of the notification received and the material provided therewith, it was deemed appropriate for the Attorney General to seek SBF's arrest and hold him in custody pursuant to our nation's Extradition Act. At such time as a formal request for extradition is made, The Bahamas intends to process it promptly, pursuant to Bahamian law and its treaty obligations with the United States." This should not have come as a total surprise after John Ray, the current FTX CEO, wrote in prepared remarks that FTX had 'commingled' funds... Responding to SBF's arrest, Prime Minister Davis stated: "The Bahamas and the United States have a shared interest in holding accountable all individuals associated with FTX who may have betrayed the public trust and broken the law. While the United States is pursuing criminal charges against SBF individually, The Bahamas will continue its own regulatory and criminal investigations into the collapse of FTX, with the continued cooperation of its law enforcement and regulatory partners in the United States and elsewhere." Presumably this means he will not be attending tomorrow's Congressional hearing with Maxine Waters... which is a shame because we would have liked to hear some answers... In his prepared remarks for that hearing, Bankman-Fried offered a blunt assessment of his plight. “I would like to start by formally stating under oath: I f*cked up,” he said in the remarks obtained by Bloomberg News. Indeed you did young man... * * * Official Statement below:  link link

|

|

|

|

Post by Midnight on Dec 13, 2022 4:40:21 GMT -5